Dollar General 2006 Annual Report Download - page 122

Download and view the complete annual report

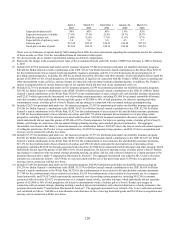

Please find page 122 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the merger, all shares of Dollar General restricted stock and RSUs will, unless otherwise agreed

by the holder and Parent, vest and be converted into the right to receive the merger consideration

of $22.00 per share of Dollar General common stock. All options to acquire shares of Dollar

General common stock will vest immediately prior to the effective time of the merger and

holders of such options will, unless otherwise agreed by the holder and Parent, be entitled to

receive an amount in cash equal to the excess, if any, of the merger consideration of $22.00 per

share of Dollar General common stock over the exercise price per share of Dollar General

common stock subject to the option.

What long-term incentives were awarded to NEOs in fiscal 2006?

As a result of the competitive data provided by Hewitt in fiscal 2006 and in the past, the

Committee has been aware that our prior long-term incentive economic values have been well

below those of the competitive market. While considering what long-term incentive awards to

grant in fiscal 2006, the Committee decided that these values should be increased to be closer to

the market in order to help retain our NEOs, many of whom are relatively new.

In considering ways to increase these values, the Committee considered granting

performance-based RSUs in addition to the time-vested stock options and RSUs which have

recently comprised the long-term component of NEO compensation. After studying this

approach, however, the Committee decided not to incorporate performance-based RSUs into the

2006 long-term incentive component due to the difficulty inherent in setting goals three years

into the future for a company undergoing transformation and implementing significant strategic

change. In making this decision, the Committee was able to draw upon its specific observations

of other companies that implemented performance-based plans and the resulting demotivating

impact caused by goals set three years into the future that could not be adjusted to recognize

significant changes in the business or in the external environment without losing the tax

deductibility of the incentive payments.

At its March 2006 meeting, the Committee instead decided to increase the long-term

compensation value for NEOs by approximately 20-25% by increasing the economic value

delivered by time-vested stock options and RSUs. Even with this increase in value, long-term

compensation for our NEOs continues to be below the comparative market median.

At the same time, the Committee also decided to change the allocation from the previous

80%/20% (stock options/RSUs) to 70%/30% (stock options/RSUs), which, according to Hewitt,

more closely aligns with market practice.

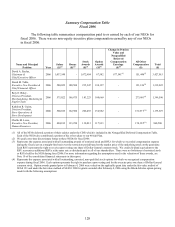

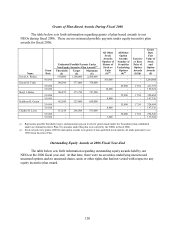

The actual grant date fair value of the 2006 stock option and RSU awards and the number

of options and shares awarded during 2006 to NEOs, are presented in the Grants of Plan-Based

Awards Table set forth in this report.

At its January 2007 meeting, the Committee decided to further adjust the relationship of

options and RSUs to reflect a 50%/50% allocation of the economic value for long-term incentive

grants made in fiscal 2007. This decision was based in part on the limited availability of shares

for use as options under the current shareholder-approved option program and in part to position

us for transitioning to a new compensation strategy that will be more effective in retaining key

employees.

120