Dollar General 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

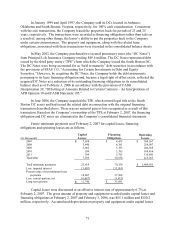

In January 1999 and April 1997, the Company sold its DCs located in Ardmore,

Oklahoma and South Boston, Virginia, respectively, for 100% cash consideration. Concurrent

with the sale transactions, the Company leased the properties back for periods of 23 and 25

years, respectively. The transactions were recorded as financing obligations rather than sales as

a result of, among other things, the lessor’ s ability to put the properties back to the Company

under certain circumstances. The property and equipment, along with the related lease

obligations, associated with these transactions were recorded in the consolidated balance sheets.

In May 2003, the Company purchased two secured promissory notes (the “DC Notes”)

from Principal Life Insurance Company totaling $49.6 million. The DC Notes represented debt

issued by the third party entity (“TPE”) from which the Company leased the South Boston DC.

The DC Notes were being accounted for as “held to maturity” debt securities in accordance with

the provisions of SFAS 115, “Accounting for Certain Investments in Debt and Equity

Securities.” However, by acquiring the DC Notes, the Company holds the debt instruments

pertaining to its lease financing obligation and, because a legal right of offset exists, reflected the

acquired DC Notes as a reduction of its outstanding financing obligations in its consolidated

balance sheet as of February 3, 2006 in accordance with the provisions of FASB

Interpretation 39, “Offsetting of Amounts Related to Certain Contracts – An Interpretation of

APB Opinion 10 and FASB Statement 105.”

In June 2006, the Company acquired the TPE, which owned legal title to the South

Boston DC assets and had issued the related debt in connection with the original financing

transaction described above. There was no material gain or loss recognized as a result of this

transaction. Based on the Company’ s ownership of the TPE at February 2, 2007, the financing

obligation and DC notes are eliminated in the Company’ s consolidated financial statements.

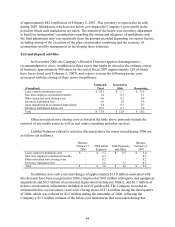

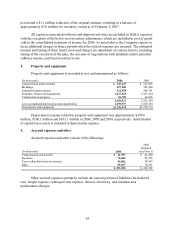

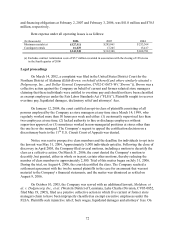

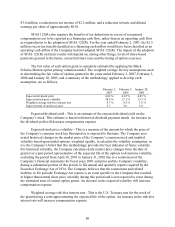

Future minimum payments as of February 2, 2007 for capital leases, financing

obligations and operating leases are as follows:

(In thousands) Capital

Leases

Financing

Obligations

Operating

Leases

2007 $ 7,658 $ 4,435 $ 304,567

2008 5,440 4,381 254,087

2009 2,082 3,785 206,369

2010 599 3,785 169,454

2011 599 3,785 139,841

Thereafter 7,036 50,188 415,263

Total minimum payments 23,414 70,359 $ 1,489,581

Less: imputed interest (5,007) (33,055)

Present value of net minimum lease

payments 18,407 37,304

Less: current portion, net (6,667) (1,413)

Long-term portion $ 11,740 $ 35,891

Capital leases were discounted at an effective interest rate of approximately 6.7% at

February 2, 2007. The gross amount of property and equipment recorded under capital leases and

financing obligations at February 2, 2007 and February 3, 2006, was $85.1 million and $150.2

million, respectively. Accumulated depreciation on property and equipment under capital leases

71