Dollar General 2006 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

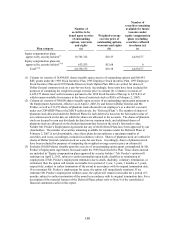

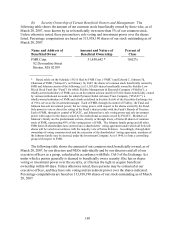

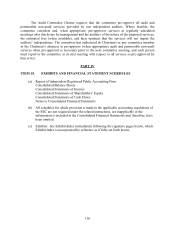

Plan category

Number of

securities to be

issued upon exercise

of outstanding

options, warrants

and rights

(a)

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

Number of

securities remaining

available for future

issuance under

equity compensation

plans (excluding

securities reflected

in column (a))

(c)

Equity compensation plans

approved by security holders(1) 19,705,322 $18.53 6,439,277

Equity compensation plans not

approved by security holders(2)(3) 633,253 $12.68 0

Total(1)(2) 20,338,575 $18.38 6,439,277

(1) Column (a) consists of 18,898,881 shares issuable upon exercise of outstanding options and 806,441

RSU grants under the 1998 Stock Incentive Plan, 1995 Employee Stock Incentive Plan, 1993 Employee

Stock Incentive Plan and 1995 Outside Directors Stock Option Plan. RSUs are settled for shares of

Dollar General common stock on a one-for-one basis. Accordingly, those units have been excluded for

purposes of computing the weighted-average exercise price in column (b). Column (c) consists of

6,439,277 shares reserved for issuance pursuant to the 1998 Stock Incentive Plan (up to 2,976,831 of

which remain available for issuance in the form of restricted stock or RSUs at February 2, 2007).

(2) Column (a) consists of 500,000 shares issuable upon exercise of an outstanding option grant pursuant to

the Employment Agreement, effective as of April 2, 2003, by and between Dollar General and Mr.

Perdue, as well as 133,253 shares of phantom stock allocated to an employee’ s or a director’s account

under our CDP/SERP Plan or the DDCP (collectively, the “Deferred Plans”). The number of shares of

phantom stock allocated under the Deferred Plans for each deferral is based on the fair market value of

our common stock on the date on which the shares are allocated to the accounts. The shares of phantom

stock are deemed to earn any dividends declared on our common stock, and additional shares of

phantom stock are allocated on the dividend payment date based on the stock’s fair market value.

Neither Mr. Perdue’ s Employment Agreement nor any of the Deferred Plans have been approved by our

shareholders. The number of securities remaining available for issuance under the Deferred Plans at

February 2, 2007 is not determinable, since those plans do not authorize a maximum number of

securities, and is not, accordingly, included in column (c) above. Shares of phantom stock are settled for

shares of Dollar General common stock on a one-for-one basis. Accordingly, shares of phantom stock

have been excluded for purposes of computing the weighted-average exercise price in column (b).

(3) Excludes 500,000 shares issuable upon the exercise of an outstanding option grant contemplated by Mr.

Perdue’ s Employment Agreement, but made under the 1998 Stock Incentive Plan. Those shares instead

are included in “Equity compensation plans approved by security holders.” Mr. Perdue’ s option will

terminate on April 2, 2013, subject to earlier termination upon death, disability or termination of

employment. If Mr. Perdue’ s employment terminates due to death, disability, voluntary termination, or

retirement, then the option will remain exercisable for a period of 1 year, 3 years, 3 months or 3 years,

respectively, subject to earlier termination of the award in accordance with its original termination date.

If we terminate Mr. Perdue’ s employment for cause, the option will immediately terminate. If we

terminate Mr. Perdue’ s employment without cause, the option will remain exercisable for a period of 3

months, subject to earlier termination of the award in accordance with its original termination date. For a

description of the material features of the Deferred Plans, please refer to Note 9 of the consolidated

financial statements earlier in this report.

148