Dollar General 2006 Annual Report Download - page 142

Download and view the complete annual report

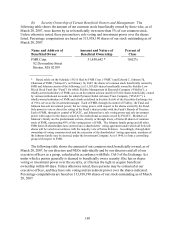

Please find page 142 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.after the end of the agreement’ s term (unless we enter into a mutually acceptable severance

arrangement or, in the case of an NEO other than Mr. Perdue, the resignation is a result of the

NEO’ s voluntary retirement or termination or, in the case of Mr. Perdue, the resignation is the

result of his voluntary retirement at or after age 62), in addition to the items identified under

“Payments Regardless of Manner of Termination” above:

• With respect to each NEO other than Mr. Perdue, all unvested equity grants will be

forfeited, vested stock options generally may be exercised for 3 months from the

service termination date unless the options expire earlier, and vested RSUs will settle

in due course.

• With respect to Mr. Perdue, the vesting of all equity grants will accelerate if he

executes a release of certain claims against us and our affiliates in the form attached

to his employment agreement, vested stock options may be exercised for 3 months

from the service termination date unless the options expire earlier, and vested RSUs

will settle in due course.

• The NEO (other than Mr. Perdue) will receive, subject to any 6-month delay in

payment required for tax law compliance, the following upon the execution of a

release of certain claims against us and our affiliates in the form attached to the

NEO’ s employment agreement:

√ Continuation of base salary for 24 months payable in accordance with our

normal payroll cycle and procedures.

√ A lump sum payment equal to 2 times the NEO’ s target incentive bonus

and 2 times our annual contribution for the NEO’ s participation in our

medical, dental and vision benefits program.

√ Outplacement services, at our expense, for 1 year or, if earlier, until other

employment is secured.

Subject to any applicable prohibition on acceleration of payment under Section 409A

of the Internal Revenue Code, we may, at any time and in our sole discretion, elect to

make a lump-sum payment of all these amounts, or all remaining amounts, due as a

result of this type of termination.

• Mr. Perdue will receive the following, subject to any 6-month delay in payment

required for tax law compliance, if he executes a release of certain claims against us

and our affiliates in the form attached to his employment agreement:

√ An amount, payable ratably over a 24 month period in accordance with our

normal payroll cycle and procedures, equal to 2.5 times the sum of his annual

base salary and the greater of his actual annual incentive bonus earned in the

fiscal year immediately prior to his service termination date or his target

incentive bonus for the fiscal year in which his employment terminated.

Subject to any applicable prohibition on payment acceleration under Section

409A of the Internal Revenue Code, we may, at any time and in our sole

140