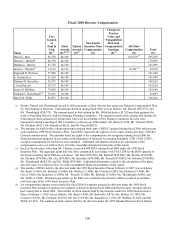

Dollar General 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.designated by the plan upon a director’ s resignation or termination from the Board. However, we

make the payment in a lump sum if the director’ s account balance does not exceed $25,000 or if

the director dies or becomes disabled. In addition, a director may request to receive an

“unforeseeable emergency hardship” in-service lump sum distribution of amounts credited to his

account in accordance with the plan’ s terms. All deferred compensation pursuant to the DDCP is

immediately due and payable upon a change-in-control of Dollar General. For purposes of the

DDCP, a change-in-control generally is deemed to occur in the same circumstances as those

described under “Equity Compensation” above with respect to the 1998 Stock Incentive Plan.

Effective January 1, 2005, account balances deemed to be invested in the Mutual Fund Options

are payable in cash and account balances deemed to be invested in the Common Stock Option

are payable in shares of our common stock and cash in lieu of fractional shares. Prior to

January 1, 2005, all account balances were payable in cash. For more information regarding the

DDCP, please see Note 9 of the consolidated financial statements in Item II, Part 8 above.

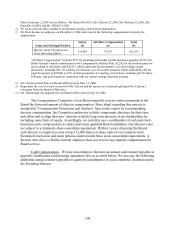

(b) Executive Compensation.

Compensation Discussion and Analysis

Who oversees the compensation of Dollar General’s Named Executive Officers?

Throughout this document, we refer to the individuals who served as our Chief Executive

Officer and Chief Financial Officer during 2006, as well as the other individuals included in the

Summary Compensation Table, as our “named executive officers” (or “NEOs”). Our Board of

Directors has a standing Compensation Committee which is responsible for, among other things,

assisting the Board in discharging its responsibilities relating to the compensation of directors

and executive officers (including the NEOs). The Committee operates pursuant to a written

Charter adopted by the Board, a current copy of which is available on the “Investing – Corporate

Governance” portion of our web site located at www.dollargeneral.com and is available in print

to any shareholder who requests it.

The Committee is responsible for recommending to the independent directors of our

Board the compensation of our Chief Executive Officer. The independent directors retain the

sole authority to approve or ratify the CEO’ s compensation. The Committee has the authority to

approve the compensation of all other executive officers (including all NEOs other than the

CEO).

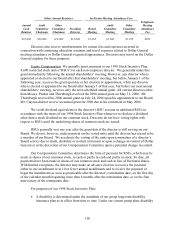

Who are the Committee members and how are they selected?

The Compensation Committee Charter provides that the Committee shall be composed of

at least three directors, all of whom shall be independent directors (as defined in our Corporate

Governance Principles). Our Board of Directors appoints the Committee members considering

the recommendation of the Nominating and Corporate Governance Committee. In addition to

being independent directors, our Corporate Governance Principles require that each Committee

member be a “non-employee director” within the meaning of Rule 16b-3 under the Exchange

Act and an “outside director” within the meaning of Section 162(m)(4)(C) of the Internal

Revenue Code of 1986, as amended.

107