Dollar General 2006 Annual Report Download - page 71

Download and view the complete annual report

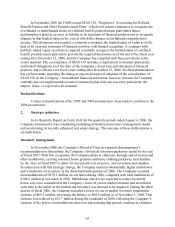

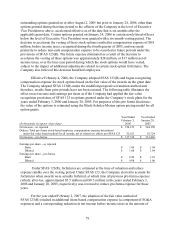

Please find page 71 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2006, the Company amended its revolving credit facility to increase the

maximum commitment to $400 million and to extend the expiration date to June 2011. The

amended credit facility contains provisions that would allow the maximum commitment to be

increased to up to $500 million upon mutual agreement of the Company and its lenders. The

amended credit facility is unsecured. The Company has two interest rate options: base rate

(which is usually equal to prime rate) or LIBOR. The Company pays interest on funds borrowed

under the LIBOR option at rates that are subject to change based upon the ratio of the

Company’ s debt to EBITDA (as defined in the amended credit facility). Under the amended

credit facility, the facility fees can range from 10 to 20 basis points; the all-in drawn margin

under the LIBOR option can range from LIBOR plus 55 to 125 basis points; and the all-in drawn

margin under the base rate option can range from the base rate plus 10 to 20 basis points.

The amended credit facility contains financial covenants, which include limits on certain

debt to cash flow ratios, a fixed charge coverage test, and minimum allowable consolidated net

worth ($1.45 billion at February 2, 2007). In December 2006, the Company amended the

revolving credit facility to lower the fixed charge coverage test for future periods through fiscal

2008 to take into account the impact that the initiatives discussed in Note 2 related to

merchandising and real estate strategies may have on the ratio in those periods. As of February 2,

2007, the Company was in compliance with all of these covenants. During 2006 and 2005, the

Company had peak borrowings of $253.4 million and $100.3 million, respectively, under the

amended credit facility. As of February 2, 2007, the Company had no outstanding borrowings or

letters of credit outstanding under the amended credit facility.

In 2000, the Company issued $200 million principal amount of 8 5/8% Notes due June

2010 (the “Notes”). The Notes require semi-annual interest payments in June and December of

each year through June 15, 2010, at which time the entire balance becomes due and payable.

The Notes contain certain restrictive covenants. At February 2, 2007, the Company was in

compliance with all such covenants.

In July 2005, as an inducement for the Company to select Marion, Indiana as the site for

construction of a new DC, the Economic Development Board of Marion approved a tax

increment financing in the amount of $14.5 million. The principal amounts on this financing are

due to be repaid during fiscal years 2015 to 2035. Pursuant to this financing, proceeds from the

issuance of certain revenue bonds were loaned to the Company in connection with the

construction of this DC. The variable interest rate on this loan is based on the weekly

remarketing of the bonds, which are supported by a bank letter of credit, and ranged from 4.60%

to 5.43% in 2006 and from 3.52% to 4.60% in 2005.

At February 2, 2007 and February 3, 2006, the Company had commercial letter of credit

facilities totaling $200.0 million and $195.0 million, respectively, of which $116.1 million and

$85.1 million, respectively, were outstanding for the funding of imported merchandise

purchases. This merchandise is subject to lien until it is paid for by the Company.

69