Dollar General 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

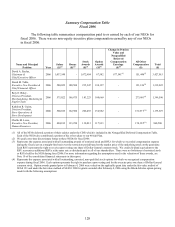

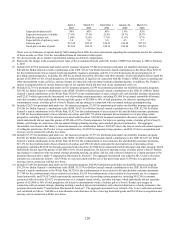

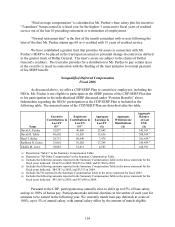

April 2,

2003

March 15,

2005

September 1,

2005

January 24,

2006

March 16,

2006

Expected dividend yield .90% .85% .85% 1.0% .82%

Expected stock price volatility 37.6% 27.4% 25.9% 24.7% 28.7%

Risk-free interest rate 2.04% 4.25% 3.71% 4.31% 4.7%

Expected life of options (years) 3.0 5.0 5.0 4.5 5.7

Exercise price $12.68 $22.35 $18.51 $16.94 $17.54

Stock price on date of grant $12.68 $22.35 $18.51 $16.94 $17.54

There were no forfeitures of options held by NEOs during fiscal 2006. For more information regarding the assumptions used in the valuation

of these awards, see Note 10 of the consolidated financial statements in this report.

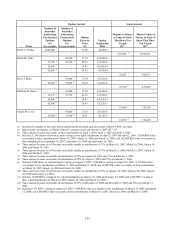

(5) We do not provide above market or preferential earnings on deferred compensation.

(6) Represents the change in the actuarial present value of the accumulated benefit under Mr. Perdue’s SERP from February 4, 2006 to February

2, 2007.

(7) Includes $31,429 for premiums paid under our life insurance program, $7,406 for premiums paid under our disability insurance programs,

$40,460 for Dollar General’ s match contributions to the CDP, $11,417 for Dollar General’ s match contributions to the 401(k) Plan, $29,575

for the reimbursement of taxes related to life and disability insurance premiums, and $31,161 which represents the incremental cost of

providing certain perquisites, including $21,000 for an annual automobile allowance and other amounts, which individually did not equal the

greater of $25,000 or 10% of total perquisites, for reimbursement of legal fees in connection with Mr. Perdue’s SERP, tickets to sporting and

other entertainment events, golf fees, and spa charges in connection with our annual strategic planning meeting. In addition, Mr. Perdue’s

spouse accompanied him on various business trips on our airplane which did not result in any incremental cost to us.

(8) Includes $12,716 for premiums paid under our life insurance program, $2,699 for premiums paid under our disability insurance programs,

$43,502 for Dollar General’ s contributions to the SERP, $18,001 for Dollar General’ s match contributions to the CDP, $11,000 for Dollar

General’ s match contributions to the 401(k) Plan, $10,587 for the reimbursement of taxes related to life and disability insurance premiums,

and $22,621 which represents the incremental cost of providing certain perquisites, including $21,000 for an annual automobile allowance

and other amounts, which individually did not equal the greater of $25,000 or 10% of total perquisites, for tickets to sporting and other

entertainment events, a holiday gift of a Sony E-Reader, and spa charges in connection with our annual strategic planning meeting.

(9) Includes $2,033 for premiums paid under our life insurance program, $1,507 for premiums paid under our disability insurance programs,

$34,285 for Dollar General’ s contributions to the SERP, $26,355 for Dollar General’ s match contributions to the CDP, $2,396 for Dollar

General’ s match contributions to the 401(k) Plan, $1,423 for the reimbursement of taxes related to life and disability insurance premiums,

$17,083 for the reimbursement of taxes related to relocation, and $188,719 which represents the incremental cost of providing certain

perquisites, including $165,715 for amounts associated with relocation, $21,000 for an annual automobile allowance, and other amounts,

which individually did not equal the greater of $25,000 or 10% of total perquisites, for tickets to sporting events, a holiday gift of a Sony E-

Reader, golf charges in connection with our annual strategic planning meeting, and a medical physical examination. The aggregate

incremental cost related to Mr. Buley’ s relocation amounts was calculated as follows: $102,075 due to the loss on resale and related expenses

of selling his prior home, $6,536 due to lease cancellation fees, $14,985 for temporary living expenses, and $42,119 due to acquisition and

moving costs in connection with his new home.

(10) Includes $7,175 for premiums paid under our life insurance program, $3,333 for premiums paid under our disability insurance program,

$22,501 for Dollar General’ s contributions to the SERP, $14,001 for Dollar General’ s match contributions to the CDP, $10,833 for Dollar

General’ s match contributions to the 401(k) Plan, $8,810 for the reimbursement of taxes related to life and disability insurance premiums,

$15,172 for the reimbursement of taxes related to relocation, and $70,146 which represents the incremental cost of providing certain

perquisites, including $42,188 for amounts associated with relocation, $21,000 for an annual automobile allowance and other amounts, which

individually did not equal the greater of $25,000 or 10% of total perquisites, for tickets to sporting events, a holiday gift of a Sony E-Reader,

spa charges in connection with our annual strategic planning meeting, an airline club fee, and a directed donation to a charity pursuant to the

program discussed above under “Compensation Discussion & Analysis”. The aggregate incremental cost related to Ms. Guion’ s relocation

amounts was calculated as follows: $28,798 due to costs associated with the sale of her prior home and $13,390 due to acquisition and

moving costs in connection with her new home.

(11) Includes $1,449 for premiums paid under our life insurance program, $4,289 for premiums paid under our disability insurance program,

$39,236 for Dollar General’ s contributions to the SERP, $13,376 for Dollar General’ s match contributions to the CDP, $6,834 for Dollar

General’ s match contributions to the 401(k) Plan, $6,728 for the reimbursement of taxes related to life and disability insurance premiums,

$17,704 for the reimbursement of taxes related to relocation, $5,519 for reimbursement of taxes related to the personal use of a company-

leased automobile, and $79,187 which represents the incremental cost of providing certain perquisites, including $49,230 for amounts

associated with relocation, $23,072 for personal use of a company-leased vehicle, and other amounts, which individually did not equal the

greater of $25,000 or 10% of total perquisites, for tickets to entertainment events, a holiday gift of a Sony E-Reader, spa charges in

connection with our annual strategic planning meeting, a medical physical examination, and a directed donation to a charity pursuant to the

program discussed under “Compensation Discussion & Analysis”. The aggregate incremental cost related to Ms. Lowe’ s relocation amounts

was calculated as follows: $40,000 as a miscellaneous cash allowance in lieu of moving household goods and $9,230 due to acquisition and

moving costs in connection with her new home.

129