Dollar General 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$3.6 million, a reduction in net income of $2.2 million, and a reduction in basic and diluted

earnings per share of approximately $0.01.

SFAS 123(R) also requires the benefits of tax deductions in excess of recognized

compensation cost to be reported as a financing cash flow, rather than as an operating cash flow

as required prior to the adoption of SFAS 123(R). For the year ended February 2, 2007, the $2.5

million excess tax benefit classified as a financing cash inflow would have been classified as an

operating cash inflow if the Company had not adopted SFAS 123(R). The impact of the adoption

of SFAS 123(R) on future results will depend on, among other things, levels of share-based

payments granted in the future, actual forfeiture rates and the timing of option exercises.

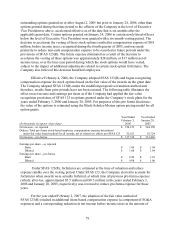

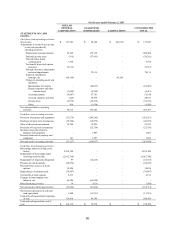

The fair value of each option grant is separately estimated by applying the Black-

Scholes-Merton option pricing valuation model. The weighted average for key assumptions used

in determining the fair value of options granted in the years ended February 2, 2007, February 3,

2006 and January 28, 2005, and a summary of the methodology applied to develop each

assumption, are as follows:

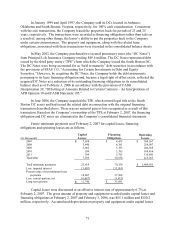

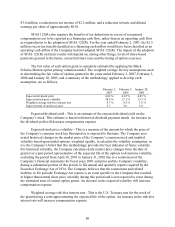

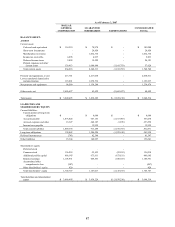

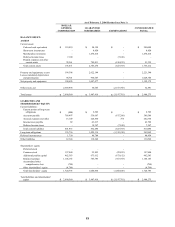

February 2,

2007

February 3,

2006

January 28,

2005

Expected dividend yield 0.82 % 0.85 % 0.85 %

Expected stock price volatility 28.8 % 27.1 % 35.5 %

Weighted average risk-free interest rate 4.7 % 4.2 % 3.5 %

Expected term of options (years) 5.7 5.0 5.0

Expected dividend yield - This is an estimate of the expected dividend yield on the

Company’ s stock. This estimate is based on historical dividend payment trends. An increase in

the dividend yield will decrease compensation expense.

Expected stock price volatility - This is a measure of the amount by which the price of

the Company’ s common stock has fluctuated or is expected to fluctuate. The Company uses

actual historical changes in the market price of the Company’ s common stock and implied

volatility based upon traded options, weighted equally, to calculate the volatility assumption, as

it is the Company’ s belief that this methodology provides the best indicator of future volatility.

For historical volatility, the Company calculates daily market price changes from the date of

grant over a past period representative of the expected life of the options to determine volatility,

excluding the period from April 30, 2001 to January 31, 2002 due to a restatement of the

Company’ s financial statements for fiscal years 2001 and prior and the Company’ s inability,

during a substantial portion of this period, to file annual and quarterly reports required by the

Securities Exchange Act of 1934. The Company believes that the restatement and related

inability to file periodic Exchange Act reports is an event specific to the Company that resulted

in higher than normal share price volatility during this period and is not expected to recur during

the estimated term of current option grants. An increase in the expected volatility will increase

compensation expense.

Weighted average risk-free interest rate - This is the U.S. Treasury rate for the week of

the grant having a term approximating the expected life of the option. An increase in the risk-free

interest rate will increase compensation expense.

80