Dollar General 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

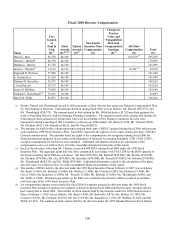

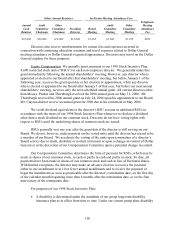

Other Annual Retainers In-Person Meeting Attendance Fees

Annual

Cash

Retainer

Audit

Committee

Chairman

Other

Committee

Chairman Presiding

Director Board

Meeting

Audit

Committee

Meeting

Other

Committee

Meeting

Directors also receive reimbursement for certain fees and expenses incurred in

connection with continuing education seminars and travel expenses related to Dollar General

meeting attendance or Dollar General-requested appearances. Directors may travel on the Dollar

General airplane for those purposes.

Equity Compensation. We annually grant, pursuant to our 1998 Stock Incentive Plan,

4,600 restricted stock units (“RSUs”) to each non-employee director. We generally make this

grant immediately following the annual shareholders’ meeting. However, any director who is

appointed or elected to our Board after that shareholders’ meeting, but before January 1 of the

following year, receives the grant upon his or her election or appointment, while any director

who is elected or appointed to our Board after January 1 of that year, but before our next annual

shareholders’ meeting, receives only the next scheduled annual grant. All current directors other

than Messrs. Perdue and Thornburgh received the 2006 annual grant on May 31, 2006. Mr.

Thornburgh received his 2006 annual grant on July 24, 2006 upon his appointment to our Board.

Mr. Clayton did not receive an annual grant for 2006 due to his retirement in May 2006.

We credit dividend equivalents to the director’ s RSU account as additional RSUs in

accordance with the terms of our 1998 Stock Incentive Plan whenever we declare a dividend

other than a stock dividend on our common stock. Directors do not have voting rights with

respect to RSUs until the underlying shares of common stock are issued.

RSUs generally vest one year after the grant date if the director is still serving on our

Board. We do not, however, make payment on the vested units until the director has ceased to be

a member of our Board. We accelerate the vesting of the units upon termination of a director’ s

Board service due to death, disability or normal retirement or upon a change-in-control of Dollar

General or in the discretion of our Compensation Committee upon a potential change-in-control.

Our Compensation Committee determines the form of payment for RSUs, which may be

made in shares of our common stock, in cash or partly in cash and partly in stock. To date, all

payments have been made in shares of our common stock and cash in lieu of fractional shares.

With limited exceptions, the director may make an advance election to receive the payment

either in one installment or in 10 or fewer annual installments and to receive the payment or

begin the installments as soon as practicable after the director’s termination date, on the first day

of the calendar month beginning more than 6 months after the termination date, or on the first

anniversary of the termination date.

For purposes of our 1998 Stock Incentive Plan:

• A disability is determined under the standards of our group long-term disability

insurance plan as in effect from time to time. Under our current group plan, disability

Telephonic

Meeting

Attendance

Fee

$35,000 $20,000 $10,000 $15,000 $1,250 $1,500 $1,250 $625

105