Dollar General 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

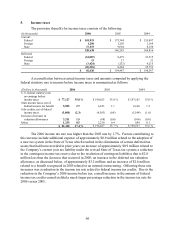

While the 2005 and 2004 rates were similar overall, the rates contained offsetting

differences. Factors causing the 2005 tax rate to increase when compared to the 2004 tax rate

include a reduction in federal jobs credits of approximately $1.0 million, additional net foreign

income tax expense of approximately $0.8 million and a decrease in the contingent income tax

reserve due to resolution of contingent liabilities that was $3.6 million less than the decrease that

occurred in 2004. Factors causing the 2005 tax rate to decrease when compared to the 2004 tax

rate include the recognition of state tax credits of approximately $2.3 million related to the

Company’ s construction of a DC in Indiana and a benefit of approximately $2.6 million related

to an internal restructuring that was completed during 2005.

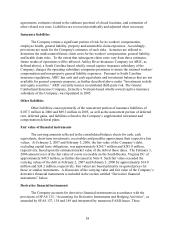

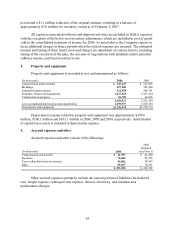

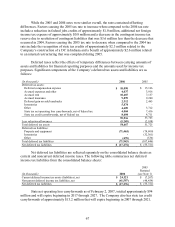

Deferred taxes reflect the effects of temporary differences between carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax

purposes. Significant components of the Company’ s deferred tax assets and liabilities are as

follows:

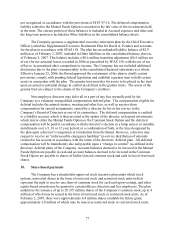

(In thousands) 2006 2005

Deferred tax assets:

Deferred compensation expense $ 10,090 $ 15,166

Accrued expenses and other 4,037 3,916

Accrued rent 10,487 7,137

Accrued insurance 9,899 9,240

Deferred gain on sale/leasebacks 2,312 2,465

Inventories 5,874 -

Other 4,609 3,712

State tax net operating loss carryforwards, net of federal tax 4,004 7,416

State tax credit carryforwards, net of federal tax 8,604 4,711

59,916 53,763

Less valuation allowances (5,249) (2,038)

Total deferred tax assets 54,667 51,725

Deferred tax liabilities:

Property and equipment (71,465) (74,609)

Inventories - (32,301)

Other (478) (536)

Total deferred tax liabilities (71,943) (107,446)

Net deferred tax liabilities $(17,276) $(55,721)

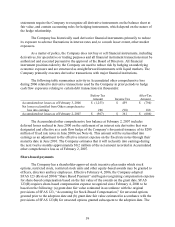

Net deferred tax liabilities are reflected separately on the consolidated balance sheets as

current and noncurrent deferred income taxes. The following table summarizes net deferred

income tax liabilities from the consolidated balance sheets:

(In thousands) 2006

2005

Restated

(see Note 1)

Current deferred income tax assets (liabilities), net $ 24,321 $ (7,267)

Noncurrent deferred income tax liabilities, net (41,597) (48,454)

Net deferred tax liabilities $(17,276) $(55,721)

State net operating loss carryforwards as of February 2, 2007, totaled approximately $94

million and will expire beginning in 2017 through 2027. The Company also has state tax credit

carryforwards of approximately $13.2 million that will expire beginning in 2007 through 2021.

67