Dollar General 2006 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• the director is not a current partner or employee and an immediate family member is

not a current partner of that firm;

• an immediate family member is not a current employee of that firm who participates

in the audit, assurance or tax compliance (but not tax planning) practice; and

• the director or immediate family member was not within the last 3 years a partner or

employee of that firm who personally worked on our audit within that time.

Certain Compensatory Relationships. A director’ s independence is not impaired by our

employment of any of the director’ s immediate family members in a capacity other than

executive officer if the amount of compensation does not exceed $120,000 during our fiscal

year.

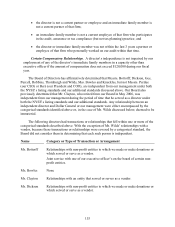

The Board of Directors has affirmatively determined that Messrs. Bottorff, Dickson, Gee,

Purcell, Robbins, Thornburgh and Wilds, Mss. Bowles and Knuckles, but not Messrs. Perdue

(our CEO) or Beré (our President and COO), are independent from our management under both

the NYSE’ s listing standards and our additional standards discussed above. Our Board also

previously determined that Mr. Clayton, who retired from our Board in May 2006, was

independent from our management during the period of time that he served as a director under

both the NYSE’ s listing standards and our additional standards. Any relationship between an

independent director and Dollar General or our management were either encompassed by the

categorical standards identified above or, in the case of Mr. Wilds discussed below, deemed to be

immaterial.

The following directors had transactions or relationships that fell within one or more of the

categorical standards described above. With the exception of Mr. Wilds’ relationships with a

vendor, because these transactions or relationships were covered by a categorical standard, the

Board did not consider them in determining that each such person is independent.

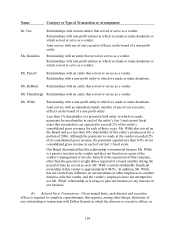

Name Category or Type of Transaction or Arrangement

Mr. Bottorff Relationships with non-profit entities to which we made or make donations or

which served or serve as a vendor.

Joint service with one of our executive officer’ s on the board of certain non-

profit entities.

Ms. Bowles None

Mr. Clayton Relationships with an entity that served or serves as a vendor.

Mr. Dickson Relationships with non-profit entities to which we made or make donations or

which served or serve as a vendor.

153