Dollar General 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

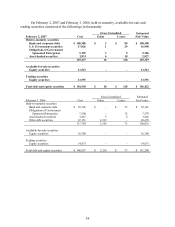

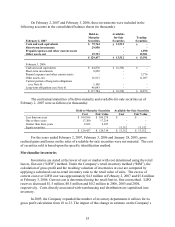

The following is a summary of consolidated balance sheet line items impacted by the

classification adjustments:

As Previously

Reported Adjustments As Restated

Prepaid expenses and other current assets $ 67,140 $ (15,801) $ 51,339

Deferred income tax asset – current 11,912 (11,912) -

Total current assets 1,762,925 (27,713) 1,735,212

Other assets, net 37,090 15,801 52,891

Accrued expenses and other 372,920 (130,566) 242,354

Deferred income tax liability – current - 7,267 7,267

Total current liabilities 933,797 (123,299) 810,498

Deferred income tax liability – noncurrent 67,633 (19,179) 48,454

Other liabilities - 130,566 130,566

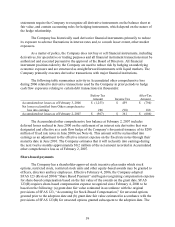

Cash and cash equivalents

Cash and cash equivalents include highly liquid investments with insignificant interest

rate risk and original maturities of three months or less when purchased. Such investments

primarily consist of money market funds, certificates of deposit and commercial paper. The

carrying amounts of these items are a reasonable estimate of their fair value due to the short

maturity of these investments.

Payments due from banks for third-party credit card, debit card and electronic benefit

transactions classified as cash and cash equivalents totaled approximately $11.6 million and $7.8

million at February 2, 2007 and February 3, 2006, respectively.

The Company’ s cash management system provides for daily investment of available

balances and the funding of outstanding checks when presented for payment. Outstanding but

unpresented checks totaling approximately $122.3 million and $124.2 million at February 2,

2007 and February 3, 2006, respectively, have been included in Accounts payable in the

consolidated balance sheets. Upon presentation for payment, these checks are funded through

available cash balances or the Company’ s existing credit facility.

The Company has certain cash and cash equivalents balances that, along with certain

other assets, are being held as required by certain regulatory requirements and are therefore not

available for general corporate purposes, as further described below under “Investments in debt

and equity securities.”

Investments in debt and equity securities

The Company accounts for its investment in debt and marketable equity securities in

accordance with SFAS 115, “Accounting for Certain Investments in Debt and Equity Securities,”

and accordingly, classifies them as held-to-maturity, available-for-sale, or trading. Debt

securities categorized as held-to-maturity are stated at amortized cost. Debt and equity securities

categorized as available-for-sale are stated at fair value, with any unrealized gains and losses, net

of deferred income taxes, reported as a component of Accumulated other comprehensive loss.

Trading securities (primarily mutual funds held pursuant to deferred compensation and

supplemental retirement plans, as further discussed in Note 9) are stated at fair value, with

52