Dollar General 2006 Annual Report Download - page 137

Download and view the complete annual report

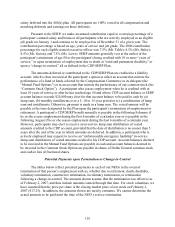

Please find page 137 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.salary deferred into the 401(k) plan. All participants are 100% vested in all compensation and

matching deferrals and earnings on those deferrals.

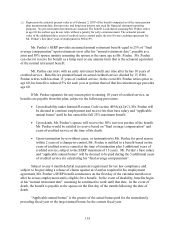

Pursuant to the SERP, we make an annual contribution equal to a certain percentage of a

participant’ s annual salary and bonus to all participants who are actively employed in an eligible

job grade on January 1 and continue to be employed as of December 31 of a given year. The

contribution percentage is based on age, years of service and job grade. The 2006 contribution

percentage for each eligible named executive officer was 7.5% (Mr. Tehle); 4.5% (Mr. Buley);

4.5% (Ms. Guion); and 7.5% (Ms. Lowe). SERP amounts generally vest at the earlier of the

participant’ s attainment of age 50 or the participant’ s being credited with 10 or more “years of

service,” or upon termination of employment due to death or “total and permanent disability” or

upon a “change-in-control,” all as defined in the CDP/SERP Plan.

The amounts deferred or contributed to the CDP/SERP Plan are credited to a liability

account, which is then invested at the participant’s option in either an account that mirrors the

performance of a fund or funds selected by the Compensation Committee or its delegate (the

“Mutual Fund Options”) or in an account that mirrors the performance of our common stock (the

“Common Stock Option”). A participant who ceases employment when he is credited with at

least 10 years of service or after he has reached age 50 and whose CDP account balance or SERP

account balance exceeds $25,000 may elect for that account balance to be paid in cash by (a)

lump sum, (b) monthly installments over a 5, 10 or 15-year period or (c) a combination of lump

sum and installments. Otherwise, payment is made in a lump sum. The vested amount will be

payable at the time designated by the Plan upon the participant’ s termination of employment or

retirement. A participant’ s CDP/SERP benefit normally is payable in the following February if

he or she ceases employment during the first 6 months of a calendar year or is payable in the

following August if he or she ceases employment during the last 6 months of a calendar year.

However, participants may elect to receive an in-service lump sum distribution of vested

amounts credited to the CDP account, provided that the date of distribution is no sooner than 5

years after the end of the year in which amounts are deferred. In addition, a participant who is

actively employed may request to receive an “unforeseeable emergency hardship” in-service

lump sum distribution of vested amounts credited to his CDP account. Account balances deemed

to be invested in the Mutual Fund Options are payable in cash and account balances deemed to

be invested in the Common Stock Option are payable in shares of Dollar General common stock

and cash in lieu of fractional shares.

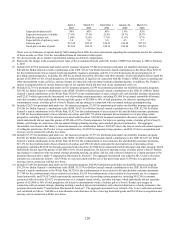

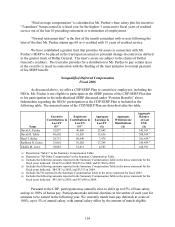

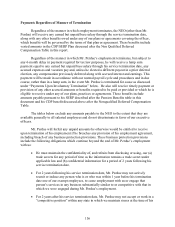

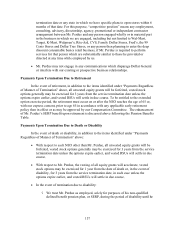

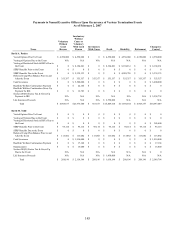

Potential Payments upon Termination or Change-in-Control

The tables below reflect potential payments to each of our NEOs in the event of

termination of that person’ s employment with us, whether due to retirement, death, disability,

voluntary termination, constructive termination, involuntary termination, or termination

following a change-in-control. The amounts shown assume that the termination was effective as

of February 2, 2007, and thus include amounts earned through that time. For stock valuations, we

have assumed that the price per share is the closing market price of our stock on February 2,

2007 ($17.23). In addition, the amounts shown are merely estimates. We cannot determine the

actual amounts to be paid until the time of the NEO’ s service termination.

135