Dollar General 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recommended and the Board of Directors approved a plan to focus on upgrading our existing

store base in order to enhance the store experience for customers. As part of this plan, we

announced our intention to close, by the end of fiscal 2007, approximately 400 stores that do not

meet our real estate criteria, to remodel or relocate approximately 300 stores in fiscal 2007, and

to decelerate new store openings, with an expectation of opening 300 new stores in fiscal 2007.

In fiscal 2006, we opened 537 new stores and closed 237 stores, including 128 store closings

identified in this strategic review. We will continue to apply rigorous criteria to new and existing

stores and will look for other enhancements to optimize our real estate strategy for profitable

growth.

In connection with the accelerated implementation of our new inventory merchandising

strategies to virtually eliminate packaway inventories and to sell through merchandise in the

closing stores, we incurred substantially higher markdowns on inventory. While we believe these

initiatives had a positive impact on sales, they had a negative impact on our gross profit rate in

2006. In total, our gross profit rate declined by 289 basis points to 25.8% in 2006 compared to

28.7% in 2005. Significantly impacting our gross profit rate, as a result of the related effect on

cost of goods sold, were total markdowns of $279.1 million at cost taken during 2006, compared

with total markdowns of $106.5 million at cost taken in 2005. The 2006 markdowns reflect

$179.9 million at cost taken during the fourth quarter of 2006 compared to $39.0 million of

markdowns at cost taken during the fourth quarter of 2005. Markdowns which were expected to

reduce inventory below cost were considered in our lower of cost or market estimate and

recorded at such time as the utility of the underlying inventory was deemed to be impaired.

During the third quarter of fiscal 2006, we recorded a lower of cost or market inventory

impairment estimate related to the initiatives discussed above, and this estimate was revised

slightly in the fourth quarter such that the impact for fiscal 2006 was $70.2 million, which

reduced 2006 gross profit by a corresponding amount. Markdowns which are not below cost

impact our gross profit in the period in which such markdowns are taken. A portion of the total

markdowns taken during the fourth quarter were related to the inventory included in our lower of

cost or market estimate, thereby reducing our estimate of such inventory as of the end of fiscal

2006 to $49.2 million. This inventory is expected to be sold during 2007.

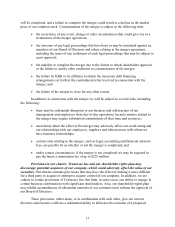

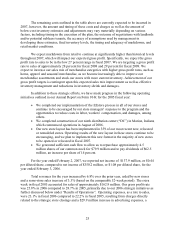

In addition, we currently estimate that we will recognize total pre-tax SG&A charges

associated with these inventory and real estate initiatives of approximately $104.6 million. Of

this total, approximately $33.4 million is reflected in our results of operations during 2006, as

follows (in millions):

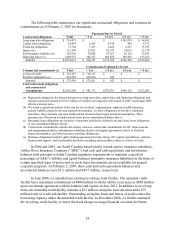

Estimated

Total

Incurred in

2006 Remaining

Lease contract termination costs $ 38.1 $ 5.7 $ 32.4

One-time employee termination benefits 1.4 0.3 1.1

Other associated store closing costs 9.0 0.2 8.8

Inventory liquidation fees 5.0 1.6 3.4

Asset impairment & accelerated depreciation 9.0 8.3 0.7

Other costs (a) 42.1 17.3 24.8

$ 104.6 $ 33.4 $ 71.2

(a) Includes incremental store labor, advertising and other costs.

24