Dollar General 2006 Annual Report Download - page 154

Download and view the complete annual report

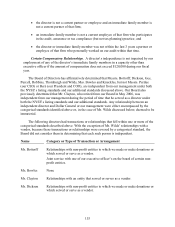

Please find page 154 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• the director is a current employee, or an immediate family member is a current

executive officer, of a lender if the highest amount of our aggregate indebtedness to

the lender outstanding during our fiscal year does not exceed the greater of $1 million

or 2% of the lender’ s total consolidated assets as of its last completed fiscal year; or

• the director or an immediate family member directly or indirectly owns less than 10%

of any class of securities of a vendor if:

√ the amount we pay to the vendor or that the vendor pays to us in any of the

vendor’ s last 3 fiscal years does not exceed the greater of $1 million or 2%

of the vendor’ s consolidated gross revenues; and

√ in the case of a lender, the highest amount of our aggregate indebtedness

to the lender outstanding during our fiscal year does not exceed the greater

of $1 million or 2% of the lender’ s total consolidated assets as of its last

completed fiscal year;

provided, however, that these transaction limits do not apply in the case of ownership

of less than 1% of a publicly held vendor, which in all cases is deemed immaterial.

Certain Relationships with Non-Profit Entities. A director’ s independence is not

impaired by the existence of any of the relationships listed below:

• the director is a current employee, or an immediate family member is a current

executive officer, of a tax-exempt entity to which we make donations if the amount

donated in the entity’ s last fiscal year does not exceed the lesser of $120,000 or 2% of

the entity’ s consolidated gross revenues;

• an immediate family member is employed in a capacity other than an executive

officer by a tax-exempt entity to which we make donations if the amount donated in

the entity’ s last fiscal year does not exceed the greater of $1 million or 2% of the

entity’ s consolidated gross revenues; or

• the director or an immediate family member serves as a director or trustee of a tax-

exempt entity to which we make donations if the amount donated in the entity’ s last

fiscal year does not exceed the greater of $1 million or 2% of the entity’ s

consolidated gross revenues. In addition, simultaneous service by a director or an

immediate family member and a member of our management team or an immediate

family member on the board of a tax-exempt entity will not preclude a director’s

independence.

Certain Relationships with Auditors. A director’ s independence is not impaired by the

existence of a prior relationship with our independent auditing firm or a current relationship

between an immediate family member and that auditing firm as long as:

152