Dollar General 2006 Annual Report Download - page 79

Download and view the complete annual report

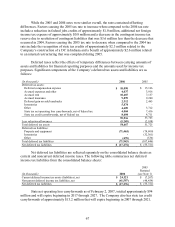

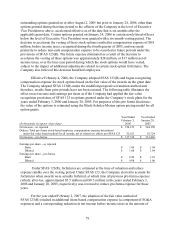

Please find page 79 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.not recognized, in accordance with the provisions of EITF 97-14. The deferred compensation

liability related to the Mutual Funds Option is recorded at the fair value of the investments held

in the trust. The current portion of these balances is included in Accrued expenses and other and

the long term portion is included in Other liabilities in the consolidated balance sheets.

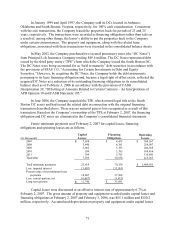

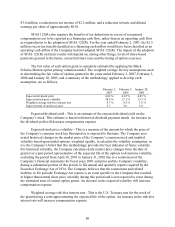

The Company sponsors a supplemental executive retirement plan for the Chief Executive

Officer (called the Supplemental Executive Retirement Plan for David A. Perdue) and accounts

for the plan in accordance with SFAS 158. The plan has an unfunded liability balance of $2.9

million as of February 2, 2007, included in Other liabilities in the consolidated balance sheet as

of February 2, 2007. This balance includes a $0.6 million transition adjustment ($0.4 million net

of tax) for net actuarial losses recorded in 2006 as prescribed by SFAS 158, with the net of tax

offset to Accumulated other comprehensive income. The Company has not included additional

disclosures due to the plan’ s immateriality to the consolidated financial statements as a whole.

Effective January 25, 2006, the Board approved the restatement of the plan to clarify certain

provisions, comply with pending federal legislation and establish a grantor trust to hold certain

assets in connection with the plan. The grantor trust provides for assets to be placed in the trust

upon an actual or potential change in control (as defined in the grantor trust). The assets of the

grantor trust are subject to the claims of the Company’ s creditors.

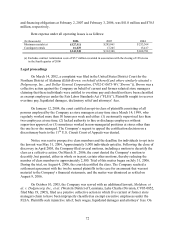

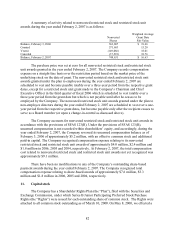

Non-employee directors may defer all or a part of any fees normally paid by the

Company to a voluntary nonqualified compensation deferral plan. The compensation eligible for

deferral includes the annual retainer, meeting and other fees, as well as any per diem

compensation for special assignments, earned by a director for his or her service to the

Company’ s Board of Directors or one of its committees. The deferred compensation is credited

to a liability account, which is then invested at the option of the director, in deemed investments

which mirror either the Mutual Funds Option or the Common Stock Option and the deferred

compensation will be paid in accordance with the director’ s election in a lump sum or in monthly

installments over a 5, 10 or 15 year period, or a combination of both, at the time designated by

the plan upon a director’ s resignation or termination from the Board. However, a director may

request to receive an “unforeseeable emergency hardship” in-service distribution of amounts

credited to his account in accordance with the terms of the directors’ deferral plan. All deferred

compensation will be immediately due and payable upon a “change in control” (as defined in the

directors’ deferral plan) of the Company. Account balances deemed to be invested in the Mutual

Funds Option are payable in cash and account balances deemed to be invested in the Common

Stock Option are payable in shares of Dollar General common stock and cash in lieu of fractional

shares.

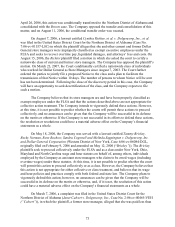

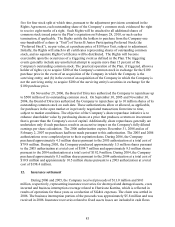

10. Share-based payments

The Company has a shareholder-approved stock incentive plan under which stock

options, nonvested shares in the form of restricted stock and restricted stock units (which

represent the right to receive one share of common stock for each unit upon vesting), and other

equity-based awards may be granted to certain officers, directors and key employees. The plan

authorizes the issuance of up to 29.375 million shares of the Company’s common stock, up to 4

million of which may be issued in the form of restricted stock or restricted stock units. As of

February 2, 2007, there were approximately 6.4 million shares available for future grant,

approximately 3.0 million of which may be issued as restricted stock or restricted stock units.

77