Dollar General 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

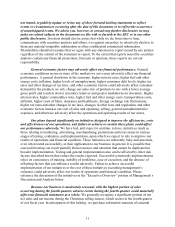

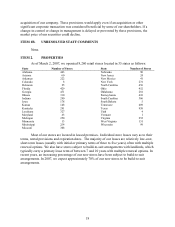

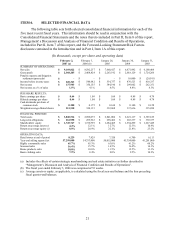

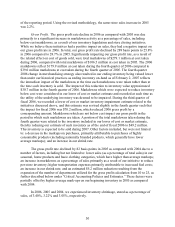

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected consolidated financial information for each of the

five most recent fiscal years. This information should be read in conjunction with the

Consolidated Financial Statements and the notes thereto included in Part II, Item 8 of this report,

Management’ s Discussion and Analysis of Financial Condition and Results of Operations,

included in Part II, Item 7 of this report, and the Forward-Looking Statement/Risk Factors

disclosure contained in the Introduction and in Part I, Item 1A of this report.

(In thousands, except per share and operating data)

February 2,

2007 (a)

February 3,

2006 (b)

January 28,

2005

January 30,

2004

January 31,

2003

SUMMARY OF OPERATIONS:

Net sales $ 9,169,822

$ 8,582,237 $ 7,660,927 $ 6,871,992 $ 6,100,404

Gross profit $ 2,368,205

$ 2,464,824 $ 2,263,192 $ 2,018,129 $ 1,724,266

Penalty expense and litigation

settlement (proceeds) $ – $ –

$ –

$ 10,000

$ (29,541)

Income before income taxes $ 220,363

$ 544,642

$ 534,757

$ 476,523

$ 410,337

Net income $ 137,943

$ 350,155 $ 344,190 $ 299,002 $ 262,351

Net income as a % of sales 1.5%

4.1% 4.5% 4.4% 4.3%

PER SHARE RESULTS:

Basic earnings per share $ 0.44

$ 1.09 $ 1.04 $ 0.89 $ 0.79

Diluted earnings per share $ 0.44

$ 1.08 $ 1.04 $ 0.89 $ 0.78

Cash dividends per share of

common stock $ 0.200

$ 0.175

$ 0.160

$ 0.140

$ 0.128

Weighted average diluted shares 313,510

324,133 332,068 337,636 335,050

FINANCIAL POSITION:

Total assets $ 3,040,514

$ 2,980,275 $ 2,841,004 $ 2,621,117 $ 2,303,619

Long-term obligations $ 261,958

$ 269,962 $ 258,462 $ 265,337 $ 330,337

Shareholders’ equity $ 1,745,747

$ 1,720,795 $ 1,684,465 $ 1,554,299 $ 1,267,445

Return on average assets (c) 4.4%

12.1% 12.7% 12.3% 10.9%

Return on average equity (c) 8.0%

20.9% 22.1% 21.4% 23.2%

OPERATING DATA:

Retail stores at end of period 8,229

7,929 7,320 6,700 6,113

Year-end selling square feet 57,299,000

54,753,000 50,015,000 45,354,000 41,201,000

Highly consumable sales 65.7%

65.3% 63.0% 61.2% 60.2%

Seasonal sales 16.4%

15.7% 16.5% 16.8% 16.3%

Home products sales 10.0%

10.6% 11.5% 12.5% 13.3%

Basic clothing sales 7.9%

8.4% 9.0% 9.5% 10.2%

(a) Includes the effects of certain strategic merchandising and real estate initiatives as further described in

“Management’ s Discussion and Analysis of Financial Condition and Results of Operations”.

(b) The fiscal year ended February 3, 2006 was comprised of 53 weeks.

(c) Average assets or equity, as applicable, is calculated using the fiscal year-end balance and the four preceding

fiscal quarter-end balances.

21