Dollar General 2006 Annual Report Download - page 28

Download and view the complete annual report

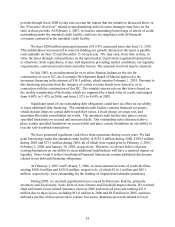

Please find page 28 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.portion of which can be attributed to the inventory liquidation and store closing initiatives.

Additionally, administrative salaries, incentive bonuses and related payroll taxes (excluding

benefits) increased by $25.0 million resulting from the approval of a $9.6 million discretionary

bonus to approximately 7,000 administrative and DC employees and the addition of executives

and staff to support our strategic efforts, particularly in merchandising and real estate. Partially

offsetting these amounts were insurance proceeds of $13.0 million received during 2006 related

to losses we experienced due to Hurricane Katrina.

Readers should refer to the detailed discussion of operating results below for additional

comments on financial performance in the 2006 fiscal year as compared with the prior year.

While we are disappointed with our 2006 financial results, we are excited about and confident in

our strategic decisions to accelerate our real estate strategies and the elimination of our packaway

inventory model. We believe these actions will allow us to sharpen our focus on serving the

demands of our customers and will ultimately result in improved financial performance.

While we provide no assurance that we will be successful or continue to be successful, as

applicable, in executing any or all of these initiatives, and do not guarantee that their successful

implementation would result in improved financial performance, management continues to

believe that they are appropriate initiatives to consider for the long-term success of the business.

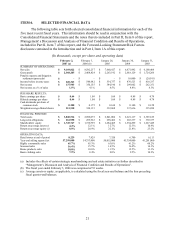

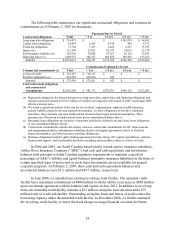

Company Performance Measures. Management uses a number of metrics, including

those indicated on the table included in “Results of Operations” below, to assess its performance.

The following are the more frequently discussed metrics:

• Earnings per share (“EPS”) growth is an indicator of the increased returns generated

for our shareholders. EPS of $0.44 in 2006 reflected a decrease of 59% from EPS of

$1.08 in 2005. Significant elements of this decrease were discussed above.

• Total net sales growth indicates, among other things, the success of our selection of

new store locations and merchandising strategies. Total net sales increased 6.8% in

2006. Note that fiscal 2005 included a 53rd week.

• Same-store sales growth indicates whether our merchandising strategies, store

execution and customer service in existing stores have been successful in generating

increased sales. Same-store sales increased 3.3% in 2006, with stronger same-store

sales in the latter half of the year than the first half as a result of our promotional and

strategic initiatives.

• Operating margin rate (operating profit divided by net sales), which is an indicator of

our success in leveraging our fixed costs and managing our variable costs, declined to

2.7% in 2006 versus 6.5% in 2005. The various components impacting this metric are

fully discussed in “Results of Operations” below.

• Inventory turns (cost of goods sold for the year divided by average inventory

balances, at cost, measured at the end of the latest five fiscal quarters) is an indicator

of how well we are managing the largest asset on our balance sheet. Inventory turns

were 4.3 times in 2006 compared to 4.2 times in 2005, including the 53rd week.

• Return on average assets (net income for the year divided by average total assets,

measured at the end of the latest five fiscal quarters) is an overall indicator of our

26