Dollar General 2006 Annual Report Download - page 58

Download and view the complete annual report

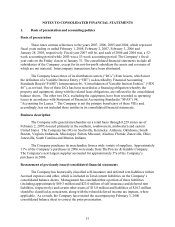

Please find page 58 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.consolidated 2005 results of operations was an estimated reduction of gross profit and a

corresponding decrease to inventory, at cost, of $5.2 million.

Store pre-opening costs

Pre-opening costs related to new store openings and the construction periods are

expensed as incurred.

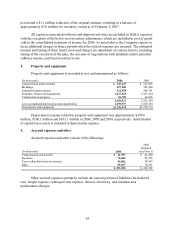

Property and equipment

Property and equipment are recorded at cost. The Company provides for depreciation

and amortization on a straight-line basis over the following estimated useful lives:

Land improvements 20

Buildings 39-40

Furniture, fixtures and equipment 3-10

Improvements of leased properties are amortized over the shorter of the life of the

applicable lease term or the estimated useful life of the asset.

Impairment of long-lived assets

When indicators of impairment are present, the Company evaluates the carrying value of

long-lived assets, other than goodwill, in relation to the operating performance and future cash

flows or the appraised values of the underlying assets. In accordance with SFAS 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets,” the Company reviews for

impairment stores open more than two years for which current cash flows from operations are

negative. Impairment results when the carrying value of the assets exceeds the undiscounted

future cash flows over the life of the lease. The Company’ s estimate of undiscounted future cash

flows over the lease term is based upon historical operations of the stores and estimates of future

store profitability which encompasses many factors that are subject to variability and difficult to

predict. If a long-lived asset is found to be impaired, the amount recognized for impairment is

equal to the difference between the carrying value and the asset’s fair value. The fair value is

estimated based primarily upon future cash flows (discounted at the Company’ s credit adjusted

risk-free rate) or other reasonable estimates of fair market value. Assets to be disposed of are

adjusted to the fair value less the cost to sell if less than the book value.

The Company recorded impairment charges, included in SG&A expense, of

approximately $9.4 million in 2006, $0.6 million in 2005 and $0.2 million in 2004 to reduce the

carrying value of certain of its stores’ assets as deemed necessary due to negative sales trends

and cash flows at these locations. The majority of the 2006 charges were recorded pursuant to

certain strategic initiatives discussed in Note 2.

Other assets

Other assets consist primarily of long-term investments, qualifying prepaid expenses,

debt issuance costs which are amortized over the life of the related obligations, utility and

security deposits, life insurance policies and goodwill.

56