Dollar General 2006 Annual Report Download - page 33

Download and view the complete annual report

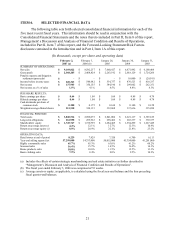

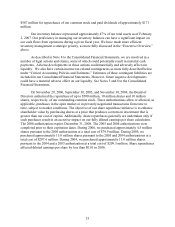

Please find page 33 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, General and Administrative (“SG&A”) Expense. The increase in SG&A

expense as a percentage of sales in 2006 as compared with 2005 was due to a number of factors,

including but not limited to increases in the following expense categories: impairment charges

on leasehold improvements and store fixtures totaling $9.4 million, including $8.0 million

related to the planned closings of approximately 400 underperforming stores, 128 of which

closed in 2006 and the remainder of which are scheduled to close in 2007, as further discussed

above in the “Executive Overview”; lease contract terminations totaling $5.7 million related to

these stores; higher store occupancy costs (increased 12.1%) due to higher average monthly

rentals associated with our leased store locations; higher debit and credit card fees (increased

40.6%) due to the increased customer usage of debit cards and the acceptance of VISA credit and

check cards at all locations; higher administrative labor costs (increased 29.9%) primarily related

to recent additions to our executive team, particularly in merchandising and real estate, and the

expensing of stock options; higher advertising costs (increased 198.3%) related primarily to the

distribution of several advertising circulars in the current year period and to promotional

activities related to the inventory clearance and store closing activities discussed above; and

higher incentive compensation primarily related to the $9.6 million discretionary bonus

authorized by the Board of Directors for the current fiscal year. These increases were partially

offset by insurance proceeds of $13.0 million received during the current year period related to

losses incurred due to Hurricane Katrina, and depreciation and amortization expenses that

remained relatively constant in fiscal 2006 as compared to fiscal 2005.

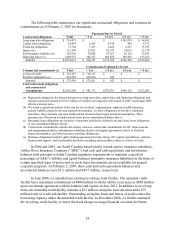

The decrease in SG&A expense as a percentage of sales in 2005 as compared with 2004

was due to a number of factors, including but not limited to the following expense categories that

either declined or increased less than the 12.0% increase in sales: employee incentive

compensation expense (decreased 37.8%), based upon our fiscal 2005 financial performance;

professional fees (decreased 32.3%), primarily due to the reduction of consulting fees associated

with the EZstore project and 2004 fees associated with our initial Sarbanes-Oxley compliance

effort; and employee health benefits (decreased 10.0%), due in part to a downward revision in

claim lag assumptions based upon review and recommendation by our outside actuary and

decreased claims costs as a percentage of sales. Partially offsetting these reductions in SG&A

were current year increases in store occupancy costs (increased 17.6%), primarily due to rising

average monthly rentals associated with our leased store locations, and store utilities costs

(increased 22.7%) primarily related to increased electricity and gas expense.

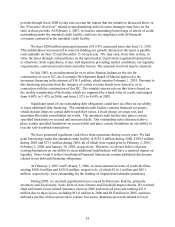

Interest Income. The decline in interest income in 2006 compared to 2005 is due

primarily to the acquisition of the entity which held legal title to the South Boston DC in June

2006 and the related elimination of the notes receivable which represented debt issued by this

entity from which we formerly leased the South Boston DC. The increase in interest income in

2005 compared to 2004 is due primarily to earnings on short-term investments due to increased

interest rates on these investments.

Interest Expense. The increase in interest expense in 2006 is primarily attributable to

increased interest expense of $6.5 million under our revolving credit agreement primarily due to

increased borrowings, an increase in tax-related interest of $4.1 million principally due to the

non-recurrence in 2006 of a 2005 reduction in accrued interest related to contingent tax

liabilities, offset by a reduction in interest expense associated with the elimination of the

financing obligation associated with the June 2006 acquisition of the entity which held legal title

31