Dollar General 2006 Annual Report Download - page 65

Download and view the complete annual report

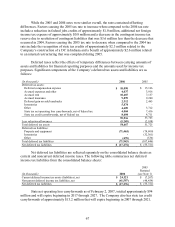

Please find page 65 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. In September 2006 the FASB issued SFAS 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans,” which will require companies to recognize the

overfunded or underfunded status of a defined benefit postretirement plan (other than a

multiemployer plan) as an asset or liability in its statement of financial position and to recognize

changes in that funded status in the year in which the changes occur through comprehensive

income. This Statement also requires a company to measure the funded status of a plan as of the

date of its year-end statement of financial position, with limited exceptions. A company with

publicly traded equity securities is required to initially recognize the funded status of a defined

benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year

ending after December 15, 2006, and the Company has complied with these provisions to the

extent material. The second phase of SFAS 158 includes a requirement to measure plan assets

and benefit obligations as of the date of the Company’ s fiscal year-end statement of financial

position, and is effective for fiscal years ending after December 15, 2008. No final determination

has yet been made regarding the timing or expected impact of adoption of the second phase of

SFAS 158 on the Company’ s consolidated financial statements, however, because the Company

currently has one supplemental executive retirement plan with one executive participant, the

impact, if any, is expected to be minimal.

Reclassifications

Certain reclassifications of the 2005 and 2004 amounts have been made to conform to the

2006 presentation.

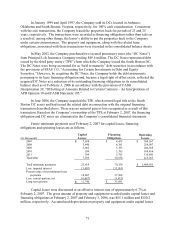

2. Strategic initiatives

In its Quarterly Report on Form 10-Q for the quarterly period ended August 4, 2006, the

Company announced it was considering modifying its historical inventory management model

and accelerating its recently enhanced real estate strategy. The outcome of these deliberations is

set forth below.

Inventory management

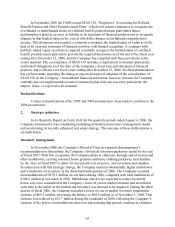

In November 2006, the Company’ s Board of Directors approved management’ s

recommendation to discontinue the Company’s historical inventory packaway model by the end

of fiscal 2007. With few exceptions, the Company plans to eliminate, through end-of-season and

other markdowns, existing seasonal, home products and basic clothing packaway merchandise

by the close of fiscal 2007 to allow for increased levels of newer, current-season merchandise.

In connection with this strategic change, the Company incurred substantially higher markdowns

and writedowns on inventory in the third and fourth quarters of 2006. The Company recorded

total markdowns of $279.1 million at cost taken during 2006, compared with total markdowns of

$106.5 million at cost taken in 2005. Markdowns which were expected to reduce inventory

below cost were considered in the Company’ s lower of cost or market estimate and recorded at

such time as the utility of the underlying inventory was deemed to be impaired. During the third

quarter of fiscal 2006, the Company recorded a lower of cost or market inventory impairment

estimate of $63.5 million, increasing the balance to $69.4 million as of November 3, 2006. This

estimate was reduced by $23.7 million during the remainder of 2006, reflecting the Company’ s

estimate of the below-cost markdowns that were taken during that period, resulting in a balance

63