Dollar General 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

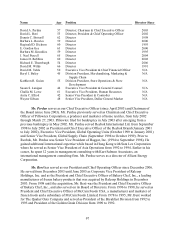

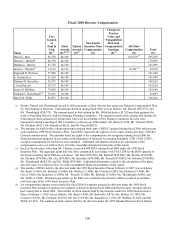

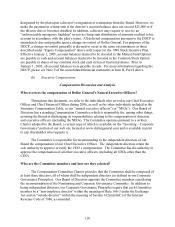

Fiscal 2006 Director Compensation

Name

Fees

Earned

or

Paid in

Cash

($) (1)

Stock

Awards

($)(2)(3)(4)

Option

Awards

($)(5)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)(6)

All Other

Compensation

($)

Total

($)

David L. Beré 48,750 84,149 - - - 162,359 (7) 295,258

Dennis C. Bottorff 86,750 84,149 - - - - 170,899

Barbara L. Bowles 81,750 84,149 - - - - 165,899

James L. Clayton(8) 13,125 34,163 - - - 15,382 (9) 62,670

Reginald D. Dickson 57,500 84,149 - - - - 141,649

E. Gordon Gee 61,250 84,149 - - - - 145,399

Barbara M. Knuckles 56,375 84,149 - - - - 140,524

J. Neal Purcell 59,375 84,149 - - - - 143,524

James D. Robbins 79,500 84,149 - - - - 163,649

Richard E. Thornburgh(10) 35,625 30,268 - - - - 65,893

David M. Wilds 81,875 84,149 - - - - 166,024

(1) Messrs. Purcell and Thornburgh elected to defer payments of their director fees under our Deferred Compensation Plan

for Non-Employee Directors. Cash amounts deferred during fiscal 2006 were as follows: Mr. Purcell ($59,375); and

Mr. Thornburgh ($34,375). The amount noted in this column for Mr. Wilds includes a $1,250 per diem payment for

work as Presiding Director with our Strategic Planning Committee. The amounts noted in this column also include the

following per diem amounts for all directors who were not members of the Finance Committee but who were

requested to attend a meeting of that Committee to discuss our 2006 budget: Mr. Beré ($1,250); Mr. Clayton ($625);

Mr. Dickson ($625); Ms. Knuckles ($625); and Mr. Purcell ($625).

(2) The amounts set forth in this column represent restricted stock units (“RSUs”) granted during fiscal 2006 and previous

years under the 1998 Stock Incentive Plan. Each RSU represents the right to receive upon vesting one share of Dollar

General common stock. The amounts listed are equal to the compensation cost recognized during fiscal 2006 for

financial statement purposes in accordance with Statement of Financial Accounting Standards 123R (“FAS 123R”),

except no assumptions for forfeitures were included. Additional information related to the calculation of the

compensation cost is set forth in Note 10 of the consolidated financial statements of this report.

(3) Each of the directors, other than Mr. Clayton, received 4,600 RSUs during fiscal 2006 under the 1998 Stock

Incentive Plan. The aggregate grant date fair value computed in accordance with FAS 123R for the RSUs granted to

the directors during fiscal 2006 are as follows: Mr. Beré ($74,980); Mr. Bottorff ($74,980); Ms. Bowles ($74,980);

Mr. Dickson ($74,980); Mr. Gee ($74,980); Ms. Knuckles ($74,980); Mr. Purcell ($74,980); Mr. Robbins ($74,980);

Mr. Thornburgh ($60,536); and Mr. Wilds ($74,980). Additional information related to the calculation of the grant

date fair value is set forth in Note 10 of the consolidated financial statements of this report.

(4) The number of RSUs held by the directors under the 1998 Stock Incentive Plan at February 2, 2007 was as follows:

Mr. Beré (13,800); Mr. Bottorff (13,800); Ms. Bowles (13,800); Mr. Clayton (9,200); Mr. Dickson (13,800); Mr.

Gee (13,800); Ms. Knuckles (13,800); Mr. Purcell (13,800); Mr. Robbins (13,800); Mr. Thornburgh (4,600); and

Mr. Wilds (13,800). Dividend equivalents on the RSUs are credited to the director’s RSU account in accordance

with the terms of the 1998 Stock Incentive Plan.

(5) No compensation expense was recorded for fiscal 2006 for options awarded to directors under the 1998 Stock

Incentive Plan because no options were granted to directors during fiscal 2006 and all previously awarded options

had vested prior to fiscal 2006. The number of stock options held by the directors under the 1998 Stock Incentive

Plan at February 2, 2007 was as follows: Mr. Beré (9,444); Mr. Bottorff (16,876); Ms. Bowles (12,780); Mr.

Clayton (16,876); Mr. Dickson (16,876); Mr. Gee (15,938); Ms. Knuckles (11,150); Mr. Robbins (9,345); and Mr.

Wilds (16,876). The number of stock options held by the directors under the 1995 Outside Directors Stock Option

103