Dollar General 2006 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

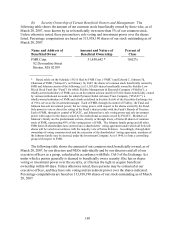

any member of his or her immediate family (“related parties”), have a direct or indirect material

interest. Our Legal Department then screens those relationships and transactions to determine

which fall below the related-party transaction disclosure threshold in, or are otherwise exempt

from disclosure under, Item 404 of Regulation S-K of the Exchange Act or which fall within a

Board-adopted categorical independence standard (as discussed above under “Director

Independence”). Our Legal Department ensures that any identified relationship or transaction

that is not exempt from disclosure under Item 404 or that does not fall within a categorical

independence standard is submitted to the Board of Directors or an appropriate Board committee

for consideration under our conflict of interest or other policy as further described below.

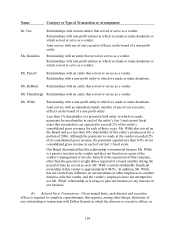

Pursuant to our Code of Business Conduct and Ethics, the Nominating and Corporate

Governance Committee reviews and resolves any conflict of interest involving directors or

executive officers. In addition, if a director’ s relationship or transaction falls within any of the

previously discussed Board-adopted categorical standards for independence, then the director’ s

interest in the relationship or transaction will be deemed immaterial in the absence of other

factors for purposes of both independence and related-party transaction disclosure. Finally, our

Compensation Committee reviews and approves and/or ratifies all material components of

executive officer compensation per its Charter and as further discussed in “Compensation

Discussion and Analysis”. In fulfilling its responsibilities under its Charter to discuss with the

independent auditors related-party transactions, our Audit Committee also reviews any draft

disclosure in our proxy statement or Form 10-K to ensure it is consistent with the information

contained in our audited financial statements.

No related parties had a material direct or indirect interest in a financial or other

transaction, arrangement or relationship with us or in which we were a participant since the

beginning of fiscal 2006 or which is currently planned that would require disclosure under

applicable SEC regulations.

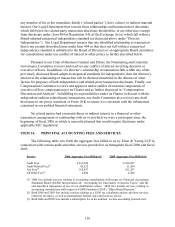

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

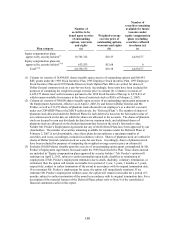

The following table sets forth the aggregate fees billed to us by Ernst & Young LLP in

connection with various audit and other services provided to us throughout fiscal 2006 and fiscal

2005:

Service 2006 Aggregate Fees Billed ($) 2005 Aggregate Fees Billed ($)

Audit Fees 2,521,920 2,410,287

Audit-Related Fees(1) 45,225 11,200

Tax Fees(2) 182,937 161,207

All Other Fees(3) 6,000 4,500

(1) 2006 fees include services relating to accounting consultations with respect to Financial Accounting

Standards Board (FASB) Interpretation 48, “Accounting for Uncertainty in Income Taxes,” and the

sale-leaseback transaction of one of our distribution centers. 2005 fees include services relating to

accounting consultations with respect to FASB Statement 123(R), “Share-Based Payment.”

(2) Both 2006 and 2005 fees include services relating to a LIFO tax calculation and tax advisory services

related to inventory, as well as international, federal, state and local tax advice.

(3) Both 2006 and 2005 fees include a subscription fee to the auditors’ on-line accounting research tool.

155