Dollar General 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

period and a $1.1 million reduction of the original estimate, resulting in a balance of

approximately $3.6 million for inventory owned as of February 2, 2007.

All expenses associated with exit and disposal activities are included in SG&A expenses

with the exception of the below-cost inventory adjustments, which are included in cost of goods

sold in the consolidated statement of income for 2006. As noted above, the Company expects to

incur additional charges in future periods when the related expenses are incurred. The estimated

amount and timing of these future costs and charges are dependent on various factors, including

timing of the execution of the plan, the outcome of negotiations with landlords and/or potential

sublease tenants, and final inventory levels.

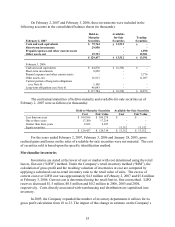

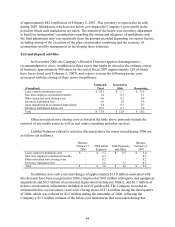

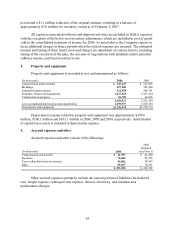

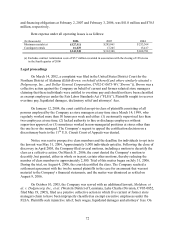

3. Property and equipment

Property and equipment is recorded at cost and summarized as follows:

(In thousands) 2006 2005

Land and land improvements $147,447 $147,039

Buildings 437,368 381,460

Leasehold improvements 212,078 209,701

Furniture, fixtures and equipment 1,617,163 1,437,324

Construction in progress 16,755 46,016

2,430,811 2,221,540

Less accumulated depreciation and amortization 1,193,937 1,029,368

Net property and equipment $1,236,874 $1,192,172

Depreciation expense related to property and equipment was approximately $199.6

million, $186.1 million and $163.1 million in 2006, 2005 and 2004, respectively. Amortization

of capital lease assets is included in depreciation expense.

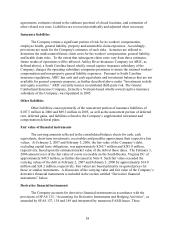

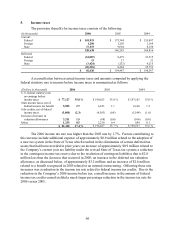

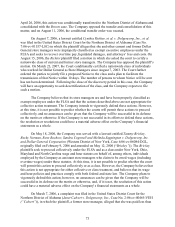

4. Accrued expenses and other

Accrued expenses and other consist of the following:

(In thousands) 2006

2005

Restated

(see Note 1)

Compensation and benefits $ 41,957 $ 41,460

Insurance 76,062 65,376

Taxes (other than taxes on income) 50,502 58,967

Other 85,037 76,551

$253,558 $242,354

Other accrued expenses primarily include the current portion of liabilities for deferred

rent, freight expense, contingent rent expense, interest, electricity, and common area

maintenance charges.

65