Dollar General 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(14) These options became or will become exercisable in installments of 25% on September 1, 2006, September 1, 2007, September 1,

2008 and September 1, 2009.

(15) Includes 10,133 RSUs that vest ratably in two installments on September 1, 2007 and September 1, 2008; and 7,600 RSUs that

vest ratably in three installments on March 16, 2007, March 16, 2008 and March 16, 2009.

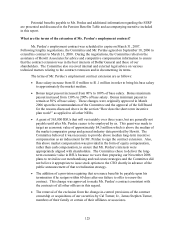

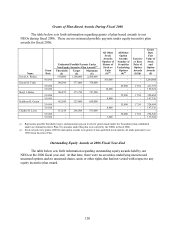

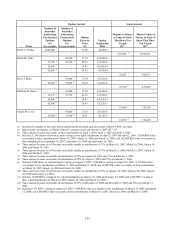

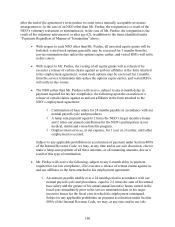

Option Exercises and Stock Vested During Fiscal 2006

The table below provides information regarding the value realized by our NEOs upon the

exercise of stock options and the vesting of stock awards during fiscal 2006.

Option Awards Stock Awards

Name

Number of Shares

Acquired on

Exercise

(#)

Value Realized

on Exercise

($)

Number of Shares

Acquired on Vesting

(#)(1)

Value Realized

on Vesting

($)(2)

David A. Perdue - - 41,000 721,183

David M. Tehle - - 9,430 133,206

Beryl J. Buley - - 8,510 146,199

Kathleen R. Guion - - 8,616 116,305

Challis M. Lowe - - 5,125 64,631

(1) Includes the number of shares underlying dividend equivalents that vested in conjunction with the vesting of

the related RSUs.

(2) The value realized is based on the closing market price of the underlying stock on the applicable vesting dates.

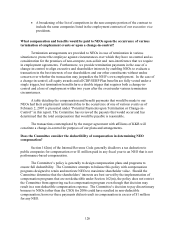

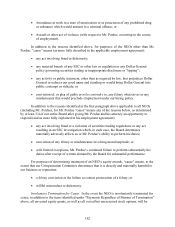

Pension Benefits

Fiscal 2006

We provide retirement benefits to Mr. Perdue under an unfunded, non-qualified defined

benefit pension plan, or SERP. The table below shows the present value of accumulated benefits

payable to Mr. Perdue, including the number of years of credited service earned by him, under

his SERP. The material terms of Mr. Perdue’ s SERP are discussed following the table.

Name Plan Name

Number of Years

Credited Service

(#)(1)

Present

Value of

Accumulated Benefit

($)(2)

Payments During

Last Fiscal Year

($)

David A. Perdue

Supplemental Executive

Retirement Plan for

David A. Perdue

6

1,848,238

-

(1) Mr. Perdue joined Dollar General on April 2, 2003 and has three actual years of employment service as of

February 2, 2007. Mr. Perdue receives two years of credited service for vesting and benefit accrual purposes

for each of his first five years of employment; thereafter, he will receive one year of credited service for

each year of employment up to a maximum of 15 years of credited service.

132