Dollar General 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of approximately $45.6 million as of February 2, 2007. This inventory is expected to be sold

during 2007. Markdowns which are not below cost impact the Company’ s gross profit in the

period in which such markdowns are taken. The amount of the below-cost inventory adjustment

is based on management’ s assumptions regarding the timing and adequacy of markdowns and

the final adjustment may vary materially from the amount recorded depending on various factors,

including timing of the execution of the plan, retail market conditions and the accuracy of

assumptions used by management in developing these estimates.

Exit and disposal activities

In November 2006, the Company’ s Board of Directors approved management’ s

recommendation to close, in addition to those stores that might be closed in the ordinary course

of business, approximately 400 stores by the end of fiscal 2007 (approximately 128 of which

have been closed as of February 2, 2007), and expects to incur the following pretax costs

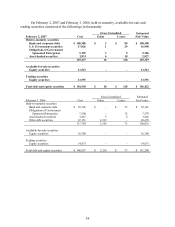

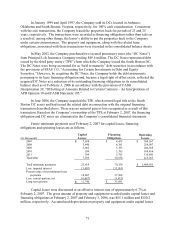

associated with the closing of these stores (in millions):

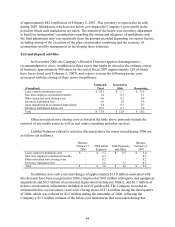

(Unaudited)

Estimated

Total

Incurred in

2006 Remaining

Lease contract termination costs $ 38.1 $ 5.7 $ 32.4

One-time employee termination benefits 1.4 0.3 1.1

Other associated store closing costs 9.0 0.2 8.8

Inventory liquidation fees 5.0 1.6 3.4

Asset impairment & accelerated depreciation 9.0 8.3 0.7

Inventory markdowns below cost 10.5 6.7 3.8

Total $ 73.0 $ 22.8 $ 50.2

Other associated store closing costs as listed in the table above primarily include the

removal of any usable assets as well as real estate consulting and other services.

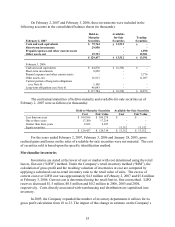

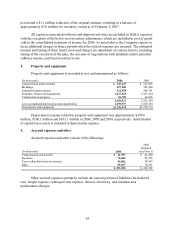

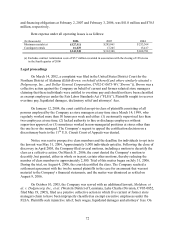

Liability balances related to activities discussed above for stores closed during 2006 are

as follows (in millions):

Balance,

February 3,

2006

2006 Initial

Expenses

2006 Payments

and Other

Balance,

February 2,

2007

Lease contract termination costs $ - $ 5.7 $ 0.7 $ 5.0

One-time employee termination benefits - 0.3 - 0.3

Other associated store closing costs - 0.2 - 0.2

Inventory liquidation fees - 1.6 1.3 0.3

Total $ - $ 7.8 $ 2.0 $ 5.8

In addition, non-cash costs and charges of approximately $15.0 million associated with

this decision have been recognized in 2006, comprised of $8.0 million of property and equipment

impairment and $0.3 million of accelerated depreciation included in SG&A, and $6.7 million of

below-cost inventory adjustments included in cost of goods sold. The Company recorded an

estimated below-cost inventory reserve for closing stores of $7.8 million during the third quarter

of 2006, which was reduced by $4.2 million during the remainder of 2006, reflecting the

Company’ s $3.1 million estimate of the below-cost markdowns that were taken during that

64