Dollar General 2006 Annual Report Download - page 88

Download and view the complete annual report

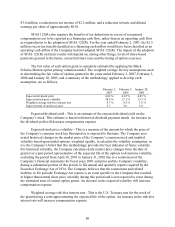

Please find page 88 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.packaway merchandise by the close of fiscal 2007. As a result, in the third quarter of 2006, the

Company recorded SG&A charges and a lower of cost or market inventory impairment, which

reduced the Company’ s net income and related per share amounts. Also, the fourth quarter 2006

change in merchandising strategy resulted in substantially higher markdowns on inventory in the

fourth quarter of 2006 ($179.9 million at cost) and the Company’ s ending inventory being valued

lower than under historical practices as ending inventory on-hand as of February 2, 2007 reflects

the immediate impact of the markdowns at the time such markdowns were taken rather than at

the time such inventory is sold. The impact of this reduction to inventory value approximated

$30.7 million in the fourth quarter of 2006.

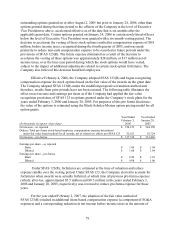

In 2005, the Company expanded the number of departments it utilizes for its gross profit

calculation from 10 to 23. The estimated impact of this change was a reduction of the

Company’ s net income and related per share amounts above of $2.1 million ($0.01 per diluted

share), $2.2 million ($0.01 per diluted share) and $6.8 million ($0.02 per diluted share) in the

first, second and third quarters of 2005, respectively, and a $7.7 million ($0.02 per diluted share)

increase in the Company’ s fourth quarter 2005 net income and related per share amounts.

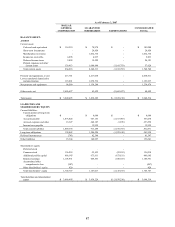

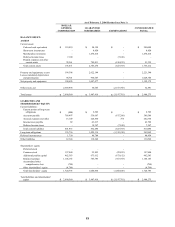

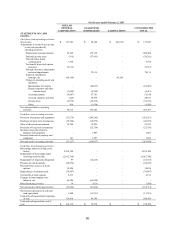

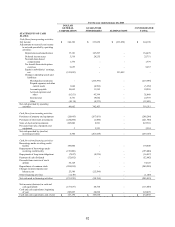

16. Guarantor subsidiaries

All of the Company’ s subsidiaries except for its not-for-profit subsidiary for which the

assets and revenues are not material (the “Guarantors”) have fully and unconditionally

guaranteed on a joint and several basis the Company’ s obligations under certain outstanding debt

obligations. Each of the Guarantors is a direct or indirect wholly owned subsidiary of the

Company.

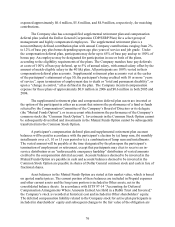

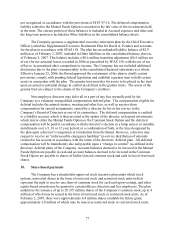

The following consolidating schedules present condensed financial information on a

combined basis. Dollar amounts are in thousands.

86