Chevron 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 CHEVRON CORPORATION 2006 ANNUAL REPORT

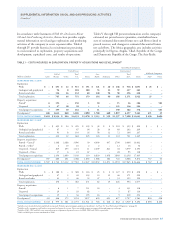

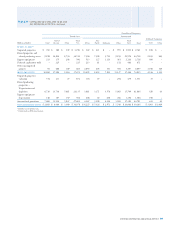

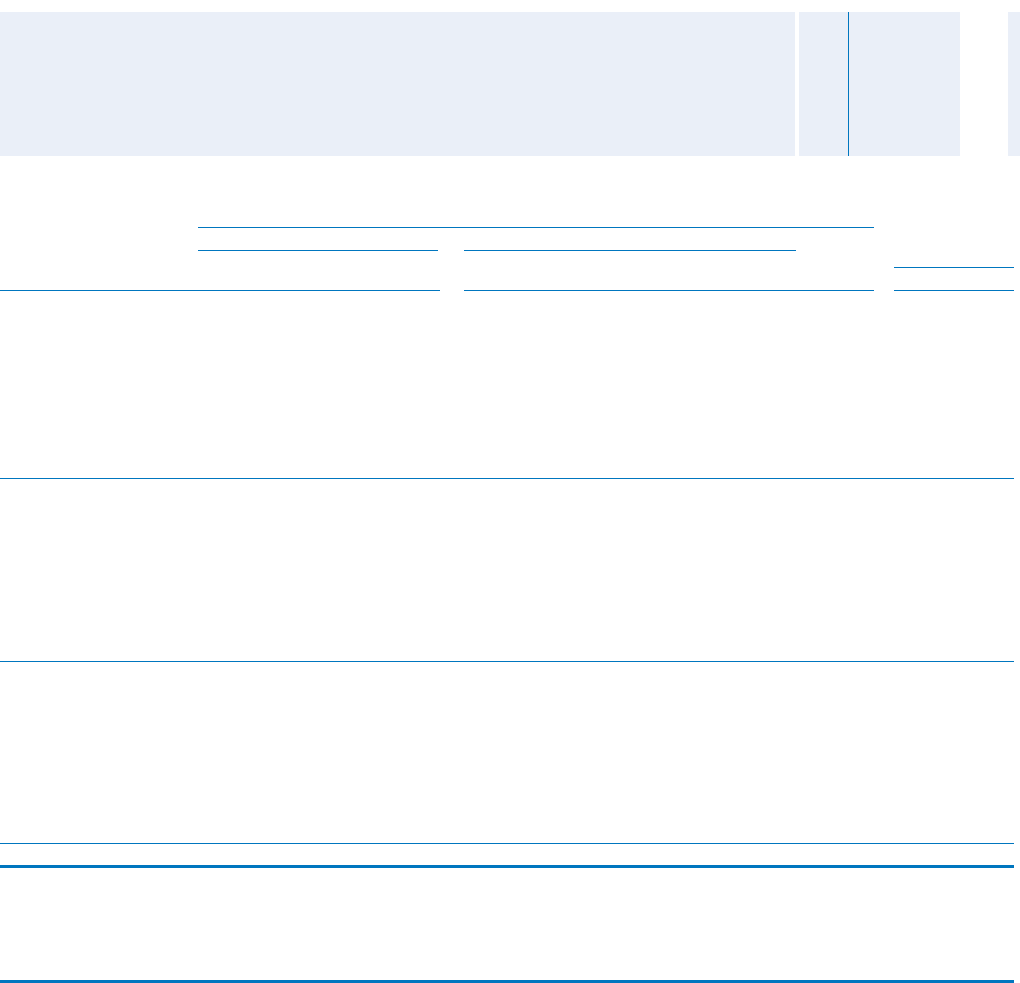

NET PROVED RESERVES OF NATURAL GAS

Consolidated Companies

United States

International

Gulf of Total A sia- Tot a l Affi liated Companies

Billions of cubic feet Calif. Mexico Other U.S. Africa Pacifi c Indonesia Other Int’l. Total TCO Other

RESERVES AT JAN. 1, 2004 323 1,841 3,189 5,353 2,642 5,373 520 3,665 12,200 17,553 2,526 112

Changes attributable to:

Revisions 27 (391) (316) (680) 346 236 21 325 928 248 963 23

Improved recovery 2 – 1 3 7 – 13 – 20 23 – –

Extensions and

discoveries 1 54 89 144 16 39 2 13 70 214 – –

Purchases1 – 5 – 5 – 4 – – 4 9 – –

Sales2 – (147) (289) (436) – – – (111) (111) (547) – –

Production (39) (298) (348) (685) (32) (247) (54) (354) (687) (1,372) (76) (1)

RESERVES AT DEC. 31, 20043 314 1,064 2,326 3,704 2,979 5,405 502 3,538 12,424 16,128 3,413 134

Changes attributable to:

Revisions 21 (15) (15) (9) 211 (428) (31) 243 (5) (14) (547) 49

Improved recovery 8 – – 8 13 – – 31 44 52 – –

Extensions and

discoveries – 68 99 167 25 118 5 55 203 370 – –

Purchases1 – 269 899 1,168 5 3,962 247 274 4,488 5,656 – –

Sales2 – – (6) (6) – – – (248) (248) (254) – –

Production (39) (215) (350) (604) (42) (434) (77) (315) (868) (1,472) (79) (2)

RESERVES AT DEC. 31, 20053 304 1,171 2,953 4,428 3,191 8,623 646 3,578 16,038 20,466 2,787 181

Changes attributable to:

Revisions 32 40 (102) (30) 34 400 38 39 511 481 26 –

Improved recovery 5 – – 5 3 – – 5 8 13 – –

Extensions and

discoveries – 111 157 268 11 510 – 10 531 799 – –

Purchases1 6 13 – 19 – 16 – – 16 35 – 54

Sales2 – – (1) (1) – – – (148) (148) (149) – –

Production (37) (241) (383) (661) (33) (629) (110) (302) (1,074) (1,735) (70) (4)

RESERVES AT DEC. 31, 20063,4 310 1,094 2,624 4,028 3,206 8,920 574 3,182 15,882 19,910 2,743 231

DEVELOPED RESERVES5

At Jan. 1, 2004 265 1,572 2,964 4,801 954 3,627 223 3,043 7,847 12,648 1,789 52

At Dec. 31, 2004 252 937 2,191 3,380 1,108 3,701 271 2,273 7,353 10,733 2,584 63

At Dec. 31, 2005 251 977 2,794 4,022 1,346 4,819 449 2,453 9,067 13,089 2,314 85

At Dec. 31, 2006 250 873 2,434 3,557 1,306 4,751 377 1,912 8,346 11,903 1,412 144

1 Includes reserves acquired through property exchanges.

2 Includes reserves disposed of through property exchanges.

3 Included are year-end reserve quantities related to production-sharing contracts (PSC) (refer to page 24 for the defi nition of a PSC). PSC-related reserve quantities are 47 percent, 44 percent

and 33 percent for consolidated companies for 2006, 2005 and 2004, respectively, and 100 percent for TCO for each year.

4 Net reserve changes (excluding production) in 2006 consist of 549 billion cubic feet of developed reserves and 630 billion cubic feet of undeveloped reserves for consolidated companies

and (769) billion cubic feet of developed reserves and 849 billion cubic feet of undeveloped reserves for affi liated companies.

5 During 2005, the percentages of undeveloped reserves at December 31, 2004, transferred to developed reserves were 5 percent and 2 percent for consolidated companies and affi liated

companies, respectively.

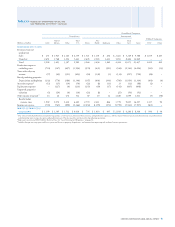

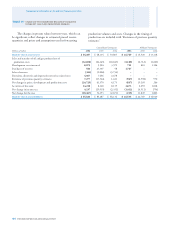

Noteworthy amounts in the categories of proved-reserve

changes for 2004 through 2006 in the table above are dis-

cussed below:

Revisions In 2004, revisions increased reserves for con-

solidated companies by a net 248 billion cubic feet (BCF),

composed of increases of 928 BCF internationally and

decreases of 680 BCF in the United States. Internationally,

about half of the 346 BCF increase in Africa related to prop-

erties in Nigeria, for which changes were associated with well

performance reviews, development drilling and lease fuel cal-

culations. The 236 BCF addition in the Asia-Pacifi c region

was related primarily to reservoir analysis for a single fi eld.

Most of the 325 BCF in the “Other” international area was

related to a new gas sales contract in Trinidad and Tobago.

In the United States, the net 391 BCF downward revision in

the Gulf of Mexico was related to well-performance reviews

and technical analyses in several fi elds. Most of the net 316

BCF negative revision in the “Other” U.S. area related to two

coal bed methane fi elds in the Mid-Continent region and

their associated wells’ performance. The 963 BCF increase

for TCO was connected with updated analyses of reservoir

performance and processing plant yields.

In 2005, reserves were revised downward by 14 BCF for

consolidated companies and 498 BCF for equity affi liates.

For consolidated companies, negative revisions were 428 BCF

in the Asia-Pacifi c region. Most of the decrease was attribut-

TABLE V – RESERVE QUANTITY INFORMATION – Continued

Supplemental Information on Oil and Gas Producing Activities