Chevron 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 93

During the year, the RAC is represented in meetings

with each of the company’s upstream business units to review

and discuss reserve changes recommended by the various

asset teams. Major changes are also reviewed with the com-

pany’s Strategy and Planning Committee and the Executive

Committee, whose members include the Chief Executive

Offi cer and the Chief Financial Offi cer. The company’s annual

reserve activity is also reviewed with the Board of Directors.

If major changes to reserves were to occur between the annual

reviews, those matters would also be discussed with the Board.

RAC subteams also conduct in-depth reviews during

the year of many of the fi elds that have the largest proved

reserves quantities. These reviews include an examination of

the proved-reserve records and documentation of their align-

ment with the Corporate Reserves Manual.

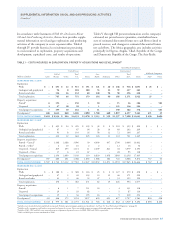

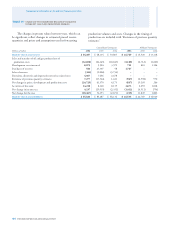

Reserve Quantities At December 31, 2006, oil-equivalent

reserves for the company’s consolidated operations were 8.6

billion barrels. (Refer to page 24 for the defi nition of oil-equiv-

alent reserves.) Approximately 28 percent of the total reserves

were in the United States. For the company’s interests in equity

affi liates, oil-equivalent reserves were 3 billion barrels, 80 per-

cent of which were associated with the company’s 50 percent

ownership in TCO. During the year, the company’s Boscan

and LL-652 contracts in Venezuela were converted to

Empresas Mixtas (i.e., joint stock contractual structures). The

company had not previously recorded any reserves for its

Boscan operations, but did so this year as a result of the con-

version. The conversion of LL-652 reserves was treated as the

sale of consolidated company reserves and the acquisition of

equity affi liate reserves.

Aside from the TCO operations, no single property

accounted for more than 5 percent of company’s total oil-

equivalent proved reserves. Fewer than 20 other individual

properties in the company’s portfolio of assets each contained

between 1 percent and 5 percent of the company’s oil-equiva-

lent proved reserves, which in the aggregate accounted for

about 36 percent of the company’s proved reserves total.

These properties were geographically dispersed, located in the

United States, South America, West Africa, the Middle East

and the Asia-Pacifi c region.

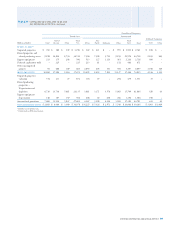

In the United States, total oil-equivalent reserves at

year-end 2006 were 2.4 billion barrels. Of this amount, 40

percent, 21 percent and 39 percent were located in California,

the Gulf of Mexico and other U.S. areas, respectively.

In California, liquids reserves represented 95 percent of

the total, with most classifi ed as heavy oil. Because of heavy

oil’s high viscosity and the need to employ enhanced recovery

methods, the producing operations are capital intensive in

nature. Most of the company’s heavy-oil fi elds in California

employ a continuous steamfl ooding process.

In the Gulf of Mexico region, liquids represented approx-

imately 64 percent of total oil-equivalent reserves. Production

operations are mostly offshore and, as a result, are also capital

intensive. Costs include investments in wells, production plat-

forms and other facilities, such as gathering lines and storage

facilities.

In other U.S. areas, the reserves were split about equally

between liquids and natural gas. For production of crude oil,

some fi elds utilize enhanced recovery methods, including

waterfl ood and CO2 injection.

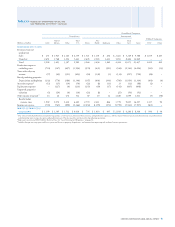

The pattern of net reserve changes shown in the follow-

ing tables, for the three years ending December 31, 2006, is

not necessarily indicative of future trends. Apart from acquisi-

tions, the company’s ability to add proved reserves is affected

by, among other things, events and circumstances that are

outside the company’s control, such as delays in government

permitting, partner approvals of development plans, declines

in oil and gas prices, OPEC constraints, geopolitical uncer-

tainties, and civil unrest.

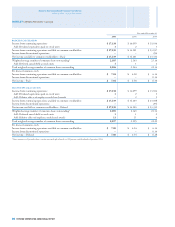

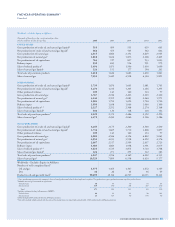

The company’s estimated net proved underground oil

and natural gas reserves and changes thereto for the years

2004, 2005 and 2006 are shown in the tables on pages 94

and 96.

TABLE V – RESERVE QUANTITY INFORMATION – Continued