Chevron 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 CHEVRON CORPORATION 2006 ANNUAL REPORT60 CHEVRON CORPORATION 2006 ANNUAL REPORT

In May 2006, the company’s investment in Dynegy

Series C preferred stock was redeemed at its face value of

$400. Upon redemption of the preferred stock, the company

recorded a before-tax gain of $130 ($87 after tax). The $130

gain is included in the Consolidated Statement of Income as

“Income from equity affi liates.”

The 2005 “cash portion of Unocal acquisition, net of

Unocal cash received” represents the purchase price, net of

$1,600 of cash received. The aggregate purchase price of

Unocal was approximately $17,288. Refer to Note 2, start-

ing on page 58, for additional discussion of the Unocal

acquisition.

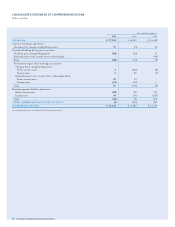

The major components of “Capital expenditures” and

the reconciliation of this amount to the reported capital and

exploratory expenditures, including equity affiliates, presented

in Management’s Discussion and Analysis, beginning on

page 26, are presented in the following table:

Year ended December 31

2006 2005 2004

Additions to properties, plant

and equipment* $ 12,80 0 $ 8,154 $ 5,798

Additions to investments 880 459 303

Current-year dry hole expenditures 400 198 228

Payments for other liabilities

and assets, net (267) (110) (19)

Capital expenditures 13,813 8,701 6,310

Expensed exploration expenditures 844 517 412

Assets acquired through capital

lease obligations and other

fi nancing obligations 35 164 31

Capital and exploratory expenditures,

excluding equity affi liates 14,692 9,382 6,753

Equity in affi liates’ expenditures 1,919 1,681 1,562

Capital and exploratory expenditures,

including equity affi liates $ 16,611 $ 11,063 $ 8,315

*Net of noncash additions of $440 in 2006, $435 in 2005 and $212 in 2004.

NOTE 4.

SUMMARIZED FINANCIAL DATA — CHEVRON U.S.A. INC.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of

Chevron Corporation. CUSA and its subsidiaries manage

and operate most of Chevron’s U.S. businesses. Assets include

those related to the exploration and production of crude oil,

natural gas and natural gas liquids and those associated with

the refi ning, marketing, supply and distribution of products

derived from petroleum, other than natural gas liquids,

excluding most of the regulated pipeline operations of

Chevron. CUSA also holds Chevron’s investments in the

Chevron Phillips Chemical Company LLC (CPChem) joint

venture and Dynegy Inc. (Dynegy), which are accounted for

using the equity method.

Year ended December 31

2006 2005 2004

Sales and other operating

revenues $ 146,447 $ 138,296 $ 108,351

Total costs and other deductions 138,494 132,180 102,180

Net income 5,399 4,693 4,773

At December 31

2006 2005

Current assets $ 26,356 $ 27,878

Other assets 23,200 20,611

Current liabilities 17,250 20,286

Other liabilities 11,501 12,897

Net equity 20,805 15,306

Memo: Total debt $ 6,020 $ 8,353

NOTE 5.

SUMMARIZED FINANCIAL DATA — CHEVRON TRANSPORT

CORPORATION LTD.

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s

international tanker fl eet and is engaged in the marine

transportation of crude oil and refi ned petroleum products.

Most of CTC’s shipping revenue is derived from provid-

ing transportation services to other Chevron companies.

Chevron Corporation has fully and unconditionally guaran-

teed this subsidiary’s obligations in connection with certain

debt securities issued by a third party. Summarized fi nancial

information for CTC and its consolidated subsidiaries is pre-

sented in the following table:

Year ended December 31

2006 2005 2004

Sales and other operating revenues $ 692 $ 640 $ 660

Total costs and other deductions 602 509 495

Net income 119 113 160

At December 31

2006 2005

Current assets $ 413 $ 358

Other assets 345 283

Current liabilities 92 119

Other liabilities 250 243

Net equity 416 279

There were no restrictions on CTC’s ability to pay divi-

dends or make loans or advances at December 31, 2006.

NOTE 6.

STOCKHOLDERS’ EQUITY

Retained earnings at December 31, 2006 and 2005, included

approximately $5,580 and $5,000, respectively, for the com-

pany’s share of undistributed earnings of equity affiliates.

At December 31, 2006, about 134 million shares of

Chevron’s common stock remained available for issuance from

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

NOTE 3. INFORMATION RELATING TO THE CONSOLIDATED

STATEMENT OF CASH FLOWS – Continued