Chevron 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 CHEVRON CORPORATION 2006 ANNUAL REPORT54 CHEVRON CORPORATION 2006 ANNUAL REPORT

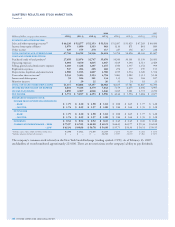

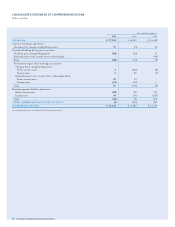

Year ended December 31

2006 2005 2004

OPERATING ACTIVITIES

Net income $ 17,138 $ 14,099 $ 13,328

Adjustments

Depreciation, depletion and amortization 7,506 5,913 4,935

Dry hole expense 520 226 286

Distributions less than income from equity affiliates (979) (1,304) (1,422)

Net before-tax gains on asset retirements and sales (229) (134) (1,882)

Net foreign currency effects 259 62 60

Deferred income tax provision 614 1,393 (224)

Net decrease (increase) in operating working capital 1,044 (54) 430

Minority interest in net income 70 96 85

Increase in long-term receivables (900) (191) (60)

Decrease (increase) in other deferred charges 232 668 (69)

Cash contributions to employee pension plans (449) (1,022) (1,643)

Other (503) 353 866

NET CASH PROVIDED BY OPERATING ACTIVITIES 24,323 20,105 14,690

INVESTING ACTIVITIES

Cash portion of Unocal acquisition, net of Unocal cash received – (5,934) –

Capital expenditures (13,813) (8,701) (6,310)

Repayment of loans by equity affi liates 463 57 1,790

Proceeds from asset sales 989 2,681 3,671

Net sales (purchases) of marketable securities 142 336 (450)

Advances to equity affi liate – – (2,200)

NET CASH USED FOR INVESTING ACTIVITIES (12,219) (11,561) (3,499)

FINANCING ACTIVITIES

Net (payments) borrowings of short-term obligations (677) (109) 114

Repayments of long-term debt and other financing obligations (2,224) (966) (1,398)

Cash dividends – common stock (4,396) (3,778) (3,236)

Dividends paid to minority interests (60) (98) (41)

Net purchases of treasury shares (4,491) (2,597) (1,645)

Redemption of preferred stock of subsidiaries – (140) (18)

Proceeds from issuances of long-term debt – 20 –

NET CASH USED FOR FINANCING ACTIVITIES (11,848) (7,668) (6,224)

EFFECT OF EXCHANGE RATE CHANGES

ON CASH AND CASH EQUIVALENTS 194 (124) 58

NET CHANGE IN CASH AND CASH EQUIVALENTS 450 752 5,025

CASH AND CASH EQUIVALENTS AT JANUARY 1 10,043 9,291 4,266

CASH AND CASH EQUIVALENTS AT DECEMBER 31 $ 10,493 $ 10,043 $ 9,291

See accompanying Notes to the Consolidated Financial Statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

Millions of dollars