Chevron 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 CHEVRON CORPORATION 2006 ANNUAL REPORT62 CHEVRON CORPORATION 2006 ANNUAL REPORT

cial institutions with high credit ratings. This diversifi ed

investment policy limits the company’s exposure both to credit

risk and to concentrations of credit risk. Similar standards of

diversity and creditworthiness are applied to the company’s

counterparties in derivative instruments.

The trade receivable balances, refl ecting the company’s

diver sifi ed sources of revenue, are dispersed among the

company’s broad customer base worldwide. As a consequence,

the company believes concentrations of credit risk are limited.

The company routinely assesses the fi nancial strength of its

customers. When the fi nancial strength of a customer is not

considered sufficient, requiring Letters of Credit is a princi-

pal method used to support sales to customers.

NOTE 8.

OPERATING SEGMENTS AND GEOGRAPHIC DATA

Although each subsidiary of Chevron is responsible for its

own affairs, Chevron Corporation manages its investments

in these subsidiaries and their affi liates. For this purpose,

the investments are grouped as follows: upstream – explora-

tion and production; downstream – refi ning, marketing and

transportation; chemicals; and all other. The fi rst three of

these groupings represent the company’s “reportable segments”

and “operating segments” as defi ned in Financial Accounting

Standards Board (FASB) Statement No. 131, Disclosures About

Segments of an Enterprise and Related Information (FAS 131).

The segments are separately managed for investment

purposes under a structure that includes “segment managers”

who report to the company’s “chief operating decision maker”

(CODM) (terms as defi ned in FAS 131). The CODM is

the company’s Executive Committee, a committee of senior

offi cers that includes the Chief Executive Offi cer and that, in

turn, reports to the Board of Directors of Chevron Corporation.

The operating segments represent components of the

company as described in FAS 131 terms that engage in activ-

ities (a) from which revenues are earned and expenses are

incurred; (b) whose operating results are regularly reviewed

by the CODM, which makes decisions about resources to be

allocated to the segments and to assess their performance;

and (c) for which discrete fi nancial information is available.

Segment managers for the reportable segments are

accountable directly to and maintain regular contact with the

company’s CODM to discuss the segment’s operating activi-

ties and fi nancial performance. The CODM approves annual

capital and exploratory budgets at the reportable segment level,

as well as reviews capital and exploratory funding for major

projects and approves major changes to the annual capital

and exploratory budgets. However, business-unit managers

within the operating segments are directly responsible for deci-

sions relating to project implementation and all other matters

connected with daily operations. Company offi cers who are

members of the Executive Committee also have individual

management responsibilities and participate in other commit-

tees for purposes other than acting as the CODM.

“All Other” activities include the company’s interest in

Dynegy, mining operations, power generation businesses,

worldwide cash management and debt fi nancing activities,

corporate administrative functions, insurance operations, real

estate activities, alternative fuels, and technology companies.

The company’s primary country of operation is the

United States of America, its country of domicile. Other

components of the company’s operations are reported as

“International” (outside the United States).

Segment Earnings The company evaluates the performance of

its operating segments on an after-tax basis, without consider-

ing the effects of debt fi nancing interest expense or investment

interest income, both of which are managed by the company

on a worldwide basis. Corporate administrative costs and

assets are not allocated to the operating segments. However,

operating segments are billed for the direct use of corporate

services. Nonbillable costs remain at the corporate level in

“All Other.” After-tax segment income from continuing oper-

ations is presented in the following table:

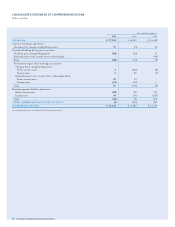

Year ended December 31

2006 2005 2004

Income From Continuing Operations

Upstream

United States $ 4,270 $ 4,168 $ 3,868

International 8,872 7,556 5,622

Total Upstream 13,142 11,724 9,490

Downstream

United States 1,938 980 1,261

International 2,035 1,786 1,989

Total Downstream 3,973 2,766 3,250

Chemicals

United States 430 240 251

International 109 58 63

Total Chemicals 539 298 314

Total Segment Income 17,654 14,788 13,054

All Other

Interest expense (312) (337) (257)

Interest income 380 266 129

Other (584) (618) 108

Income From Continuing Operations 17,138 14,099 13,034

Income From Discontinued Operations – – 294

Net Income $ 17,138 $ 14,099 $ 13,328

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

NOTE 7. FINANCIAL AND DERIVATIVE INSTRUMENTS – Continued