Chevron 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 CHEVRON CORPORATION 2006 ANNUAL REPORT74 CHEVRON CORPORATION 2006 ANNUAL REPORT

Notes to the Consolidated Financial Statements

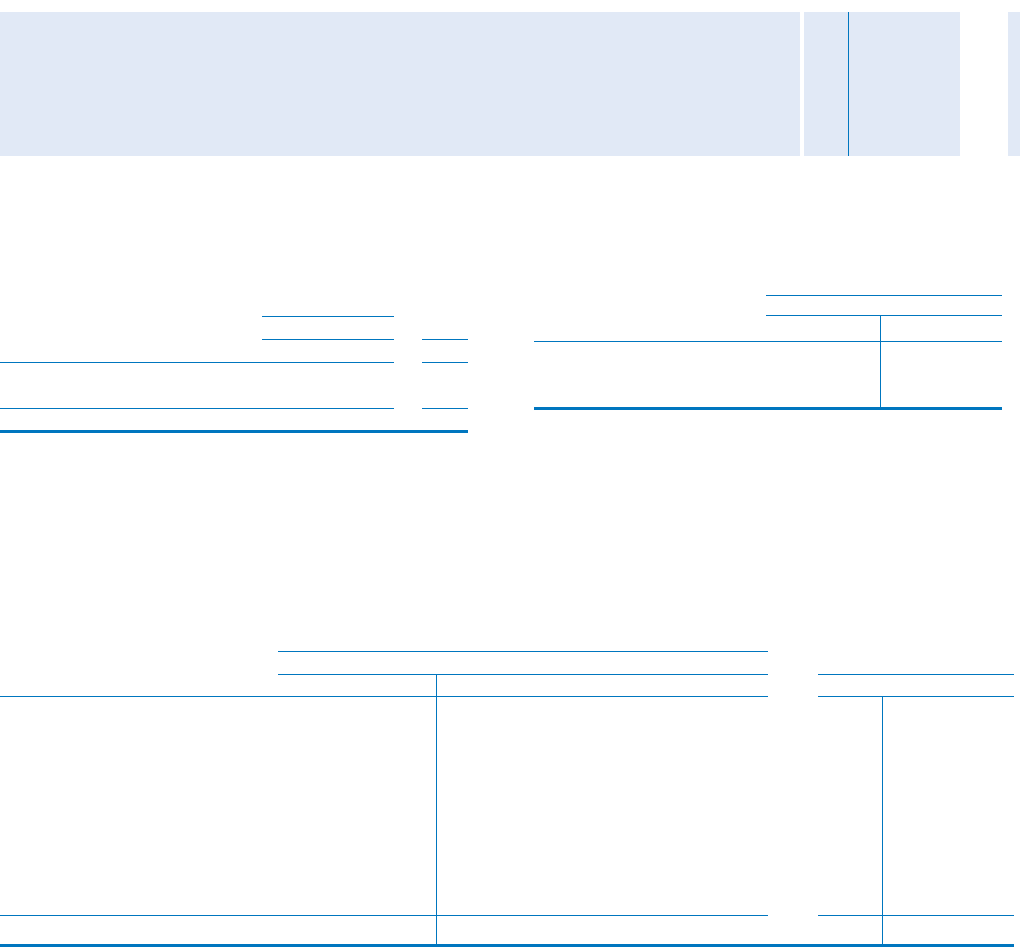

Millions of dollars, except per-share amounts

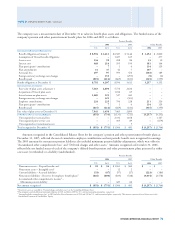

Amounts recognized on a before-tax basis in “Accumu-

lated other comprehensive loss” for the company’s pension

and other postretirement plans (excludes affi liates) at the end

of 2006 after adoption of FAS 158 consisted of:

Pension Benefi ts Other

2006 Benefi ts

U.S. Int’l. 2006

Net actuarial loss $ 1,892 $ 1,288 $ 972

Prior-service cost (credit) 272 126 (485)

Total recognized at December 31 $ 2,164 $ 1,414 $ 487

The accumulated benefi t obligations for all U.S. and

international pension plans were $7,987 and $3,669 respec-

tively, at December 31, 2006, and $7,931 and $3,080,

respectively, at December 31, 2005.

NOTE 21. EMPLOYEE BENEFIT PLANS – Continued

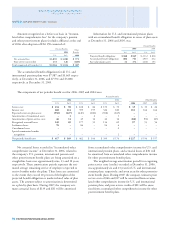

The components of net periodic benefi t cost for 2006, 2005 and 2004 were:

Pension Benefi ts

2006 2005 2004 Other Benefi ts

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2006 2005 2004

Service cost $ 234 $ 98 $ 208 $ 84 $ 170 $ 70 $ 35 $ 30 $ 26

Interest cost 468 214 395 199 326 180 181 164 164

Expected return on plan assets (550) (227) (449) (208) (358) (169) – – –

Amortization of transitional assets – 1 – 2 – 1 – – –

Amortization of prior-service costs 46 14 45 16 42 16 (86) (91) (47)

Recognized actuarial losses 149 69 177 51 114 69 97 93 54

Settlement losses 70 – 86 – 96 4 – – –

Curtailment losses – – – – – 2 – – –

Special termination benefi ts

recognition – – – – – 1 – – –

Net periodic benefi t cost $ 417 $ 169 $ 462 $ 144 $ 390 $ 174 $ 227 $ 196 $ 197

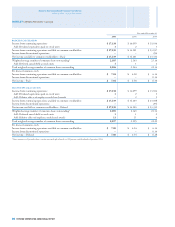

Net actuarial losses recorded in “Accumulated other

comprehensive income” at December 31, 2006, related to

the company’s U.S. pension, international pension and

other postretirement benefi t plans are being amortized on a

straight-line basis over approximately nine, 13 and 10 years,

respectively. These amortization periods represent the esti-

mated average remaining service of employees expected to

receive benefi ts under the plans. These losses are amortized

to the extent they exceed 10 percent of the higher of the

projected benefi t obligation or market-related value of plan

assets. The amount subject to amortization is determined

on a plan-by-plan basis. During 2007, the company esti-

mates actuarial losses of $139 and $81 will be amortized

from accumulated other comprehensive income for U.S. and

international pension plans, and actuarial losses of $81 will

be amortized from accumulated other comprehensive income

for other postretirement benefi t plans.

The weighted average amortization period for recognizing

prior service costs (credits) recorded at December 31, 2006,

was approximately six and 13 years for U.S. and international

pension plans, respectively, and seven years for other postretire-

ment benefi t plans. During 2007, the company estimates prior

service costs of $46 and $17 will be amortized from accumu-

lated other comprehensive income for U.S. and international

pension plans, and prior service credits of $81 will be amor-

tized from accumulated other comprehensive income for other

postretirement benefi t plans.

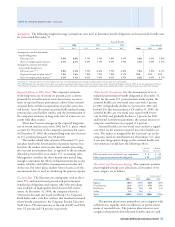

Information for U.S. and international pension plans

with an accumulated benefi t obligation in excess of plan assets

at December 31, 2006 and 2005, was:

Pension Benefi ts

2006 2005

U.S. Int’l. U.S. Int’l.

Projected benefi t obligations $ 848 $ 849 $ 2,132 $ 818

Accumulated benefi t obligations 806 741 1,993 632

Fair value of plan assets 12 172 1,206 153