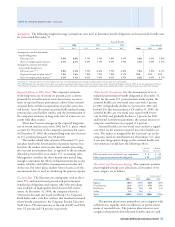

Chevron 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 CHEVRON CORPORATION 2006 ANNUAL REPORT70 CHEVRON CORPORATION 2006 ANNUAL REPORT

paper borrowings. Interest on borrowings under the terms of

specifi c agreements may be based on the London Interbank

Offered Rate or bank prime rate. No amounts were outstand-

ing under these credit agreements during 2006 or at year-end.

At December 31, 2006 and 2005, the company clas-

sifi ed $4,450 and $4,850, respectively, of short-term debt as

long-term. Settlement of these obligations is not expected to

require the use of working capital in 2007, as the company

has both the intent and the ability to refi nance this debt on

a long-term basis.

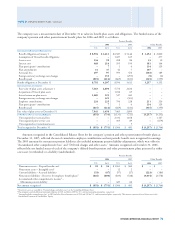

NOTE 18.

LONG-TERM DEBT

Chevron has three “shelf” registration statements on fi le

with the SEC that together would permit the issuance of

$3,800 of debt securities pursuant to Rule 415 of the Secu-

rities Act of 1933. Total long-term debt, excluding capital

leases, at December 31, 2006, was $7,405. The company’s

long-term debt outstanding at year-end 2006 and 2005 was

as follows:

At December 31

2006 2005

3.5% notes due 2007 $ 1,996 $ 1,992

3.375% notes due 2008 738 736

5.5% notes due 2009 401 406

9.75% debentures due 2020 250 250

7.327% amortizing notes due 20141 213 247

8.625% debentures due 2031 199 199

8.625% debentures due 2032 199 199

7.5% debentures due 2043 198 198

8.625% debentures due 2010 150 150

8.875% debentures due 2021 150 150

8% debentures due 2032 148 148

7.09% notes due 2007 144 144

7.5% debentures due 2029 – 475

5.05% debentures due 2012 – 412

7.35% debentures due 2009 – 347

7% debentures due 2028 – 259

Fixed and fl oating interest rate loans due

2007 to 2009 – 194

9.125% debentures due 2006 – 167

8.25% debentures due 2006 – 129

Medium-term notes, maturing from

2017 to 2043 (7.7%)2 210 210

Fixed interest rate notes, maturing from

2007 to 2011 (7.4%)2 46 241

Other foreign currency obligations (2.2%)2 23 30

Other long-term debt (7.6%)2 66 141

Total including debt due within one year 5,131 7,424

Debt due within one year (2,176) (467)

Reclassifi ed from short-term debt 4,450 4,850

Total long-term debt $ 7,405 $ 11,807

1 Guarantee of ESOP debt.

2

Less than $100 individually; weighted-average interest rate at December 31, 2006.

Long-term debt of $5,131 matures as follows: 2007 –

$2,176; 2008 – $805; 2009 – $428; 2010 – $185; 2011 – $50;

and after 2011 – $1,487.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

In the fi rst quarter of 2006, $185 of Union Oil Com-

pany bonds were retired at maturity. In the second quarter,

the company redeemed approximately $1,700 of Unocal debt

and recognized a $92 before-tax gain. In October 2006, a

$129 Texaco Capital Inc. bond matured. In November 2006,

the company retired Union Oil Company bonds of $196.

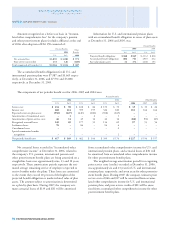

NOTE 19.

NEW ACCOUNTING STANDARDS

EITF Issue No. 04-6, Accounting for Stripping Costs Incurred

During Production in the Mining Industry (Issue 04-6) In

March 2005, the FASB ratifi ed the earlier Emerging Issues

Task Force (EITF) consensus on Issue 04-6, which was

adopted by the company on January 1, 2006. Stripping costs

are costs of removing overburden and other waste materials

to access mineral deposits. The consensus calls for strip-

ping costs incurred once a mine goes into production to be

treated as variable production costs that should be considered

a component of mineral inventory cost subject to ARB No.

43, Restatement and Revision of Accounting Research Bulletins.

Adoption of this accounting for the company’s coal, oil sands

and other mining operations resulted in a $19 reduction of

retained earnings as of January 1, 2006.

FASB Interpretation No. 48, Accounting for Uncertainty in

Income Taxes – An Interpretation of FASB Statement No. 109

(FIN 48) In July 2006, the FASB issued FIN 48, which

became effective for the company on January 1, 2007. This

interpretation clarifi es the accounting for income tax ben-

efi ts that are uncertain in nature. Under FIN 48, a company

will recognize a tax benefi t in the fi nancial statements for

an uncertain tax position only if management’s assessment is

that its position is “more likely than not” (i.e., a greater than

50 percent likelihood) to be upheld on audit based only on the

technical merits of the tax position. This accounting interpre-

tation also provides guidance on measurement methodology,

derecognition thresholds, fi nancial statement classifi cation and

disclosures, interest and penalties recognition, and accounting

for the cumulative-effect adjustment. The new interpretation

is intended to provide better fi nancial statement comparability

among companies.

Required annual disclosures include a tabular reconcilia-

tion of unrecognized tax benefi ts at the beginning and end of

the period; the amount of unrecognized tax benefi ts that, if

recognized, would affect the effective tax rate; the amounts of

interest and penalties recognized in the fi nancial statements;

any expected signifi cant impacts from unrecognized tax ben-

efi ts on the fi nancial statements over the subsequent 12-month

reporting period; and a description of the tax years remaining

to be examined in major tax jurisdictions.

As a result of the implementation of FIN 48, the company

expects to recognize an increase in the liability for unrecog-

NOTE 17. SHORT-TERM DEBT – Continued