Chevron 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 95

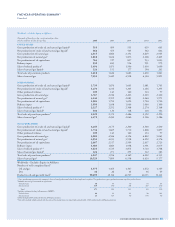

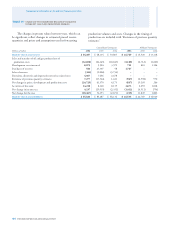

TABLE V – RESERVE QUANTITY INFORMATION – Continued

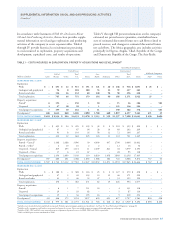

Mexico area was across several fi elds and based mainly on

reservoir analyses and assessments of well performance.

For affi liated companies, the 206 million-barrel increase

for TCO was based on an updated assessment of reservoir

performance for the Tengiz Field. Partially offsetting this

increase was a downward effect of higher year-end prices on

the variable royalty-rate calculation. Downward revisions also

occurred in other geographic areas because of the effect of

higher year-end prices on various production-sharing terms

and variable royalty calculations.

In 2005, net revisions reduced reserves by 239 million

and 24 million barrels for worldwide consolidated com-

panies and equity affi liates, respectively. For consolidated

companies, the net decrease was 199 million barrels in the

international areas and 40 million barrels in the United

States. The largest downward net revisions internationally

were 108 million barrels in Indonesia and 53 million barrels

in Kazakhstan, due primarily to the effect of higher year-end

prices on the calculation of reserves associated with production-

sharing and variable-royalty contracts. In the United States,

the 40 million-barrel reduction was across many fi elds in each

of the geographic sections. Most of the downward revision

for affi liated companies was a 19 million-barrel reduction in

Hamaca, attributable to revised government royalty provisions.

For TCO, the downward effect of higher year-end prices was

partially offset by increased reservoir performance.

In 2006, net revisions increased reserves by 39 million

and 84 million barrels for worldwide consolidated companies

and equity affi liates, respectively. International consolidated

companies accounted for the net increase of 39 million bar-

rels. The largest upward net revisions were 61 million barrels

in Indonesia and 27 million barrels in Thailand. In Indonesia,

the increase was the result of infi ll drilling and improved

steamfl ood performance. The upward revision in Thailand

refl ected additional drilling and development activity dur-

ing the year. These upward revisions were partially offset by

reductions in reservoir performance in Nigeria and the United

Kingdom, which decreased reserves by 43 million barrels and

by 32 million barrels, respectively. Most of the upward revi-

sion for affi liated companies was related to a 60 million barrel

increase in TCO as a result of improved reservoir performance.

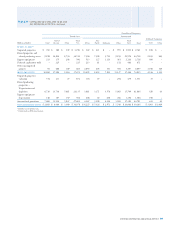

Improved Recovery In 2006, improved recovery increased

liquids volumes worldwide by 83 million barrels for consoli-

dated companies. Reserves in the United States increased

52 million barrels, with California representing 49 million

barrels of the total increase due to steamfl ood expansion and

revised modeling activities. Internationally, improved recovery

increased reserves by 31 million barrels, with no single country

accounting for an increase of more than 10 million barrels.

Extensions and Discoveries In 2006, extensions and dis-

coveries increased liquids volumes worldwide by 107 million

barrels for consolidated companies. Reserves in Nigeria

increased by 27 million barrels due in part to the initial book-

ing of reserves for the Aparo Field. Additional drilling activities

contributed 19 million barrels in the United Kingdom and

14 million barrels in Argentina. In the United States, the

Gulf of Mexico added 25 million barrels, mainly the result of

the initial booking of the Great White Field in the deepwater

Perdido Fold Belt area.

Purchases In 2005, the acquisition of 572 million barrels

of liquids related solely to the acquisition of Unocal in August.

About three-fourths of the 376 million barrels acquired in

the international areas were represented by volumes in

Azerbaijan and Thailand. Most volumes acquired in the

United States were in Texas and Alaska.

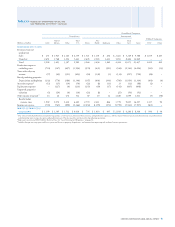

In 2006, acquisitions increased liquids volumes world-

wide by 21 million barrels for consolidated companies and

119 million barrels for equity affi liates. For consolidated

companies, the amount was mainly the result of new agree-

ments in Nigeria, which added 13 million barrels of reserves.

The other-equity-affi liates quantity refl ects the result of the

conversion of Boscan and LL-652 operations to joint stock

companies in Venezuela.

Sales In 2004, sales of liquids volumes reduced reserves

of consolidated companies by 179 million barrels. Sales

totaled 130 million barrels in the United States and 33 mil-

lion barrels in the “Other” international region. Sales in the

“Other” region of the United States totaled 103 million bar-

rels, with two fi elds accounting for approximately one-half

of the volume. The 27 million barrels sold in the Gulf of

Mexico refl ect the sale of a number of Shelf properties. The

“Other” international sales include the disposal of western

Canada properties and several fi elds in the United Kingdom.

All the sales were associated with the company’s program to

dispose of assets deemed nonstrategic to the portfolio of pro-

ducing properties.

In 2005, sales of 58 million barrels in the “Other” inter-

national area related to the disposition of the former Unocal

operations onshore in Canada.

In 2006, sales decreased reserves by 15 million barrels

due to the conversion of the LL-652 risked service agreement

to a joint stock company in Venezuela.