Chevron 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 67CHEVRON CORPORATION 2006 ANNUAL REPORT 67

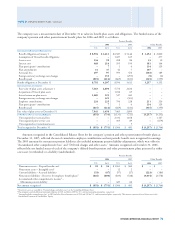

NOTE 12. INVESTMENTS AND ADVANCES – Continued

The following table provides summarized fi nancial information on a 100 percent basis for all equity affiliates as well as

Chevron’s total share, which includes Chevron loans to affi liates of $3,915 at December 31, 2006.

Affi liates Chevron Share

Year ended December 31 2006 2005 2004 2006 2005 2004

Tota l revenue s $ 73,746 $ 64,642 $ 55,152 $ 35,695 $ 31,252 $ 25,916

Income before income tax expense 10,973 7,883 5,309 5,295 4,165 3,015

Net income 7,905 6,645 4,441 4,072 3,534 2,582

At December 31

Current assets $ 19,769 $ 19,903 $ 16,506 $ 8,944 $ 8,537 $ 7,540

Noncurrent assets 49,896 46,925 38,104 18,575 17,747 15,567

Current liabilities 15,254 13,427 10,949 6,818 6,034 4,962

Noncurrent liabilities 24,059 26,579 22,261 3,902 4,906 4,520

Net equity $ 30,352 $ 26,822 $ 21,400 $ 16,799 $ 15,344 $ 13,625

NOTE 13.

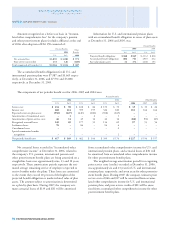

PROPERTIES, PLANT AND EQUIPMENT1

At December 31 Year ended December 31

Gross Investment at Cost Net Investment Additions at Cost2 Depreciation Expense3,4

2006 2005 2004 2006 2005 2004 2006 2005 2004 2006 2005 2004

Upstream

United States $ 46,191 $ 43,390 $ 37,329 $ 16,706 $ 15,327 $ 10,047 $ 3,739 $ 2,160 $ 1,584 $ 2,374 $ 1,869 $ 1,508

International 61,281 54,497 38,721 37,730 34,311 21,192 7,290 4,897 3,090 3,888 2,804 2,180

Total Upstream 107,472 97,887 76,050 54,436 49,638 31,239 11,029 7,057 4,674 6,262 4,673 3,688

Downstream

United States 14,553 13,832 12,826 6,741 6,169 5,611 1,109 793 482 474 461 490

International 11,036 11,235 10,843 5,233 5,529 5,443 532 453 441 551 550 572

Tota l Downstrea m 25,589 25,067 23,669 11,974 11,698 11,054 1,641 1,246 923 1,025 1,011 1,062

Chemicals

United States 645 624 615 289 282 292 25 12 12 19 19 20

International 771 721 725 431 402 392 54 43 27 24 23 26

Total Chemicals 1,416 1,345 1,340 720 684 684 79 55 39 43 42 46

All Other5

United States 3,243 3,127 2,877 1,709 1,655 1,466 270 199 314 171 186 158

International 27 20 18 19 15 15 8 4 2 5 1 3

Total All Other 3,270 3,147 2,895 1,728 1,670 1,481 278 203 316 176 187 161

Total United States 64,632 60,973 53,647 25,445 23,433 17,416 5,143 3,164 2,392 3,038 2,535 2,176

Total International 73,115 66,473 50,307 43,413 40,257 27,042 7,884 5,397 3,560 4,468 3,378 2,781

Total $ 137,747 $ 127,446 $ 103,954 $ 68,858 $ 63,690 $ 44,458 $ 13,027 $ 8,561 $ 5,952 $ 7,506 $ 5,913 $ 4,957

1 Includes assets acquired in connection with the acquisition of Unocal Corporation in August 2005. Refer to Note 2, beginning on page 58, for additional information.

2 Net of dry hole expense related to prior years’ expenditures of $120, $28 and $58 in 2006, 2005 and 2004, respectively.

3 Depreciation expense includes accretion expense of $275, $187 and $93 in 2006, 2005 and 2004, respectively.

4 Depreciation expense includes discontinued operations of $22 in 2004.

5 Primarily mining operations, power generation businesses, real estate assets and management information systems.

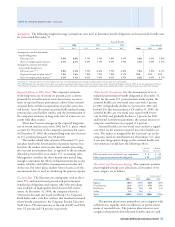

NOTE 14.

ACCOUNTING FOR BUY/SELL CONTRACTS

The company adopted the accounting prescribed by EITF

Issue No. 04-13, Accounting for Purchases and Sales of Inven-

tory with the Same Counterparty (Issue 04-13) on a prospective

basis from April 1, 2006. Issue 04-13 requires that two or

more legally separate exchange transactions with the same

counterparty, including buy/sell transactions, be combined

and considered as a single arrangement for purposes of apply-

ing the provisions of Accounting Principles Board Opinion

No. 29, Accounting for Nonmonetary Transactions, when

the transactions are entered into “in contemplation” of one

another. In prior periods, the company accounted for buy/sell

transactions in the Consolidated Statement of Income as a

monetary transaction – purchases were reported as “Purchased

crude oil and products”; sales were reported as “Sales and

other operating revenues.”

With the company’s adoption of Issue 04-13, buy/sell

transactions beginning in the second quarter 2006 are netted

against each other on the Consolidated Statement of Income,

with no effect on net income. Amounts associated with buy/

sell transactions in periods prior to the second quarter 2006

are shown as a footnote to the Consolidated Statement of

Income on page 51.