Chevron 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 CHEVRON CORPORATION 2006 ANNUAL REPORT68 CHEVRON CORPORATION 2006 ANNUAL REPORT

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

NOTE 15.

LITIGATION

MTBE Chevron and many other companies in the petroleum

industry have used methyl tertiary butyl ether (MTBE) as

a gasoline additive. Chevron is a party to approximately 75

lawsuits and claims, the majority of which involve numerous

other petroleum marketers and refi ners, related to the use of

MTBE in certain oxygenated gasolines and the alleged seepage

of MTBE into groundwater. Resolution of these actions may

ultimately require the company to correct or ameliorate the

alleged effects on the environment of prior release of MTBE

by the company or other parties. Additional lawsuits and

claims related to the use of MTBE, including personal-injury

claims, may be fi led in the future.

The company’s ultimate exposure related to these lawsuits

and claims is not currently determinable, but could be material to

net income in any one period. The company currently does not use

MTBE in the manufacture of gasoline in the United States.

RFG Patent Fourteen purported class actions were brought

by consumers of reformulated gasoline (RFG) alleging that

Unocal misled the California Air Resources Board into

adopting standards for composition of RFG that overlapped

with Unocal’s undisclosed and pending patents. Eleven

lawsuits are now consolidated in U.S. District Court for

the Central District of California and three are consoli-

dated in California State Court. Unocal is alleged to have

monopolized, conspired and engaged in unfair methods of

competition, resulting in injury to consumers of RFG. Plain-

tiffs in both consolidated actions seek unspecifi ed actual and

punitive damages, attorneys’ fees, and interest on behalf of an

alleged class of consumers who purchased “summertime” RFG

in California from January 1995 through August 2005. Unocal

believes it has valid defenses and intends to vigorously defend

against these lawsuits. The company’s potential exposure related

to these lawsuits cannot currently be estimated.

NOTE 16.

TAXES

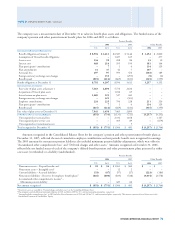

Year ended December 31

2006 2005 2004

Taxes on income*

U.S. federal

Current $ 2,828 $ 1,459 $ 2,246

Deferred 200 567 (290)

State and local 581 409 345

Total United States 3,609 2,435 2,301

International

Current 11,030 7,837 5,150

Deferred 199 826 66

Total International 11,229 8,663 5,216

Total taxes on income $ 14,838 $ 11,098 $ 7,517

* Excludes income tax expense of $100 related to discontinued operations for 2004.

In 2006, the before-tax income for U.S. operations,

including related corporate and other charges, was $9,131,

compared with a before-tax income of $6,733 and $7,776 in

2005 and 2004, respectively. For international operations,

before-tax income was $22,845, $18,464 and $12,775 in

2006, 2005 and 2004, respectively. U.S. federal income tax

expense was reduced by $116, $289 and $176 in 2006, 2005

and 2004, respectively, for business tax credits.

The reconciliation between the U.S. statutory federal

income tax rate and the company’s effective income tax rate is

explained in the table below:

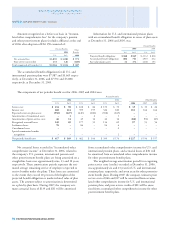

Year ended December 31

2006 2005 2004

U.S. statutory federal income tax rate 35.0% 35.0% 35.0%

Effect of income taxes from inter-

national operations at rates different

from the U.S. statutory rate 10.3 9.2 5.3

State and local taxes on income, net

of U.S. federal income tax benefi t 1.0 1.0 0.9

Prior-year tax adjustments 0.9 0.1 (1.0)

Tax credits (0.4) (1.1) (0.9)

Effects of enacted changes in tax laws 0.3 – (0.6)

Capital loss tax benefi t – (0.1) (2.1)

Other (0.7) – –

Effective tax rate 46.4% 44.1% 36.6%

The company records its deferred taxes on a tax-

jurisdiction basis and classifi es those net amounts as current

or noncurrent based on the balance sheet classifi cation of the

related assets or liabilities.

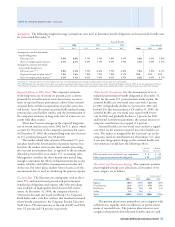

The reported deferred tax balances are composed of the

following:

At December 31

2006 2005

Deferred tax liabilities

Properties, plant and equipment $ 16,054 $ 14,220

Investments and other 2,137 1,469

Total deferred tax liabilities 18,191 15,689

Deferred tax assets

Abandonment/environmental reserves (2,925) (2,083)

Employee benefi ts (2,707) (1,250)

Tax loss carryforwards (1,509) (1,113)

Capital losses (246) (246)

Deferred credits (1,670) (1,618)

Foreign tax credits (1,916) (1,145)

Inventory (378) (182)

Other accrued liabilities (375) (240)

Miscellaneous (1,144) (1,237)

Total deferred tax assets (12,870) (9,114)

Deferred tax assets valuation allowance 4,391 3,249

Total deferred taxes, net $ 9,712 $ 9,824

In 2006, deferred tax liabilities increased by approxi-

mately $2,500 from the amount reported in 2005. The