Chevron 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 CHEVRON CORPORATION 2006 ANNUAL REPORT80 CHEVRON CORPORATION 2006 ANNUAL REPORT

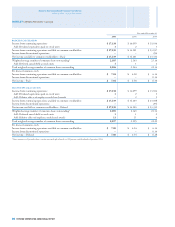

Notes to the Consolidated Financial Statements

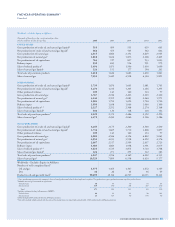

Millions of dollars, except per-share amounts

Through the end of 2006, the company paid approximately

$48 under these indemnities and continues to be obligated for

possible additional indemnifi cation payments in the future.

The company has also provided indemnities relating to

contingent environmental liabilities related to assets origi-

nally contributed by Texaco to the Equilon and Motiva joint

ventures and environmental conditions that existed prior to

the formation of Equilon and Motiva or that occurred dur-

ing the period of Texaco’s ownership interest in the joint

ventures. In general, the environmental conditions or events

that are subject to these indemnities must have arisen prior

to December 2001. Claims relating to Equilon indemnities

must be asserted either as early as February 2007, or no later

than February 2009, and claims relating to Motiva indem-

nities must be asserted either as early as February 2007,

or no later than February 2012. Under the terms of these

indemnities, there is no maximum limit on the amount of

potential future payments. The company has not recorded

any liabilities for possible claims under these indemnities.

The company posts no assets as collateral and has made no

payments under the indemnities.

The amounts payable for the indemnities described above

are to be net of amounts recovered from insurance carriers

and others and net of liabilities recorded by Equilon or Motiva

prior to September 30, 2001, for any applicable incident.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabilities associated with assets that were sold in 1997. Under

the indemnifi cation agreement, the company’s liability is

unlimited until April 2022, when the liability expires. The

acquirer shares in certain environmental remediation costs

up to a maximum obligation of $200, which had not been

reached as of December 31, 2006.

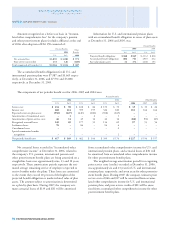

Securitization The company securitizes certain retail and

trade accounts receivable in its downstream business through

the use of qualifying Special Purpose Entities (SPEs). At

December 31, 2006, approximately $1,200, representing

about 7 percent of Chevron’s total current accounts and

notes receivables balance, were securitized. Chevron’s total

estimated fi nancial exposure under these securitizations at

December 31, 2006, was approximately $80. These arrange-

ments have the effect of accelerating Chevron’s collection of

the securitized amounts. In the event that the SPEs experience

major defaults in the collection of receivables, Chevron believes

that it would have no loss exposure connected with third-party

investments in these securitizations.

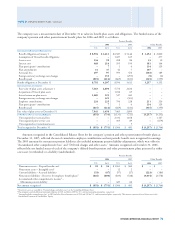

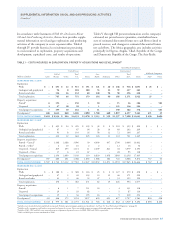

Long-Term Unconditional Purchase Obligations and Commit-

ments, Including Throughput and Take-or-Pay Agreements The

company and its subsidiaries have certain other contingent

liabilities relating to long-term unconditional purchase obli-

gations and commitments, including throughput and

take-or-pay agreements, some of which relate to suppliers’

fi nancing arrangements. The agreements typically provide

goods and services, such as pipe line and storage capacity,

drilling rigs, utilities, and petroleum products, to be used

or sold in the ordinary course of the company’s business.

The aggregate approximate amounts of required payments

under these various commitments are: 2007 – $3,200;

2008 – $1,700; 2009 – $2,100; 2010 – $1,900; 2011 –

$900; 2012 and after – $4,100. A portion of these

commitments may ultimately be shared with project part-

ners. Total payments under the agreements were

approximately $3,000 in 2006, $2,100 in 2005 and $1,600

in 2004.

Minority Interests The company has commitments of $209

related to minority interests in subsidiary companies.

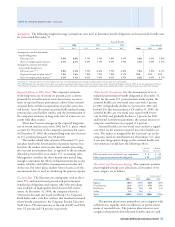

Environmental The company is subject to loss contingen-

cies pursuant to environmental laws and regulations that in

the future may require the company to take action to cor-

rect or ameliorate the effects on the environment of prior

release of chemicals or petroleum substances, including

MTBE, by the company or other parties. Such contingen-

cies may exist for various sites, including, but not limited

to, federal Superfund sites and analogous sites under state

laws, refi neries, crude oil fi elds, service stations, terminals,

land development areas, and mining operations, whether

operating, closed or divested. These future costs are not

fully determinable due to such factors as the unknown

magnitude of possible contamination, the unknown timing

and extent of the corrective actions that may be required,

the determination of the company’s liability in proportion

to other responsible parties, and the extent to which such

costs are recoverable from third parties.

Although the company has provided for known

environmental obligations that are probable and reason-

ably estimable, the amount of additional future costs

may be material to results of operations in the period in

which they are recognized. The company does not expect

these costs will have a material effect on its consolidated

fi nancial position or liquidity. Also, the company does

not believe its obligations to make such expenditures have

had, or will have, any signifi cant impact on the company’s

competitive position relative to other U.S. or international

petroleum or chemical companies.

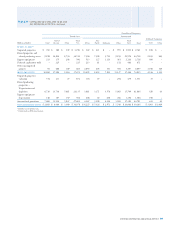

Chevron’s environmental reserve as of December

31, 2006, was $1,441. Included in this balance were

remediation activities of 242 sites for which the company

had been identifi ed as a potentially responsible party or

otherwise involved in the remediation by the U.S. Envi-

ronmental Protection Agency (EPA) or other regulatory

agencies under the provisions of the federal Superfund

law or analogous state laws. The company’s remediation

NOTE 23. OTHER CONTINGENCIES AND COMMITMENTS – Continued