Chevron 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

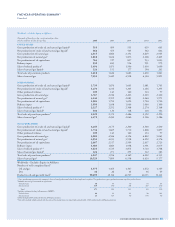

CHEVRON CORPORATION 2006 ANNUAL REPORT 79CHEVRON CORPORATION 2006 ANNUAL REPORT 79

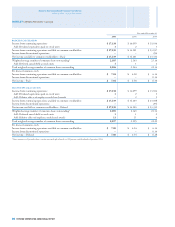

ing period for retirement-eligible employees in accordance with

vesting provisions of the company’s share-based compensation

programs for awards issued after adoption of FAS 123R. As

of December 31, 2006, there was $99 of total unrecognized

before-tax compensation cost related to nonvested share-based

compensation arrangements granted or restored under the

plans. That cost is expected to be recognized over a weighted-

average period of 2.0 years.

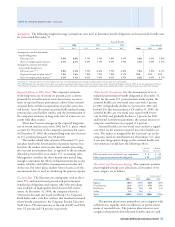

At January 1, 2006, the number of LTIP performance

units outstanding was equivalent to 2,346,016 shares. Dur-

ing 2006, 709,200 units were granted, 827,450 units vested

with cash proceeds distributed to recipients, and 117,570 units

were forfeited. At December 31, 2006, units outstanding were

2,110,196, and the fair value of the liability recorded for these

instruments was $113. In addition, outstanding stock apprecia-

tion rights that were awarded under various LTIP and former

Texaco and Unocal programs totaled approximately 700,000

equivalent shares as of December 31, 2006. A liability of $16

was recorded for these awards.

Broad-Based Employee Stock Options In addition to the plans

described above, Chevron granted all eligible employees stock

options or equivalents in 1998. The options vested after two

years, in February 2000, and expire after 10 years, in Febru-

ary 2008. A total of 9,641,600 options were awarded with an

exercise price of $38.16 per share.

The fair value of each option on the date of grant was

estimated at $9.54 using the Black-Scholes model for the

preceding 10 years. The assumptions used in the model,

based on a 10-year average, were: a risk-free interest rate of

7 percent, a dividend yield of 4.2 percent, an expected life

of seven years and a volatility of 24.7 percent.

At January 1, 2006, the number of broad-based

employee stock options outstanding was 1,682,904. Dur-

ing 2006, exercises of 354,845 shares and forfeitures of

22,000 shares reduced outstanding options to 1,306,059. As

of December 31, 2006, these instruments had an aggregate

intrinsic value of $46 and the remaining contractual term of

these options was 1.1 years. The total intrinsic value of these

options exercised during 2006, 2005 and 2004 was $10, $9

and $16, respectively.

NOTE 23.

OTHER CONTINGENCIES AND COMMITMENTS

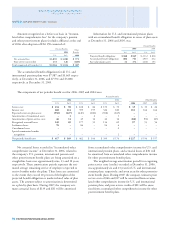

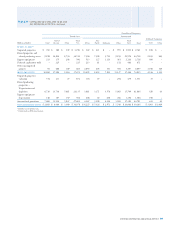

Income Taxes The company calculates its income tax expense

and liabilities quarterly. These liabilities generally are not fi nal-

ized with the individual taxing authorities until several years

after the end of the annual period for which income taxes have

been calculated. The U.S. federal income tax liabilities have

been settled through 1996 for Chevron Corporation, 1997 for

Unocal Corporation (Unocal) and 2001 for Texaco Corpora-

tion (Texaco). California franchise tax liabilities have been

settled through 1991 for Chevron, 1998 for Unocal and 1987

for Texaco. Settlement of open tax years, as well as tax issues

in other countries where the company conducts its busi-

nesses, is not expected to have a material effect on the

consolidated fi nancial position or liquidity of the company

and, in the opinion of management, adequate provision has

been made for income and franchise taxes for all years under

examination or subject to future examination.

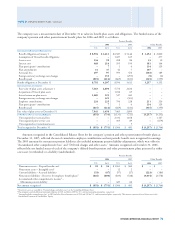

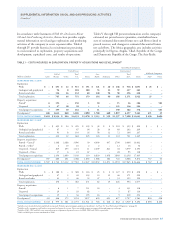

Guarantees At December 31, 2006, the company and its sub-

sidiaries provided guarantees, either directly or indirectly, of

$296 for notes and other contractual obligations of affi liated

companies and $131 for third parties, as described by major

category below. There are no amounts being carried as liabili-

ties for the company’s obligations under these guarantees.

The $296 in guarantees provided to affi liates related

to borrowings for capital projects. These guarantees were

undertaken to achieve lower interest rates and generally cover

the construction periods of the capital projects. Included in

these amounts are the company’s guarantees of $214 associ-

ated with a construction completion guarantee for the debt

fi nancing of the company’s equity interest in the Baku-Tbilisi-

Ceyhan (BTC) crude oil pipeline project. Substantially all

of the $296 guaranteed will expire between 2007 and 2011,

with the remaining expiring by the end of 2015. Under the

terms of the guarantees, the company would be required to

fulfi ll the guarantee should an affi liate be in default of its

loan terms, generally for the full amounts disclosed.

The $131 in guarantees provided on behalf of third

parties related to construction loans to governments of cer-

tain of the company’s international upstream operations.

Substantially all of the $131 in guarantees expire by 2011,

with the remainder expiring by 2015. The company would be

required to perform under the terms of the guarantees should

an entity be in default of its loan or contract terms, generally

for the full amounts disclosed.

At December 31, 2006, Chevron also had outstanding

guarantees for about $120 of Equilon debt and leases. Follow-

ing the February 2002 disposition of its interest in Equilon,

the company received an indemnifi cation from Shell for any

claims arising from the guarantees. The company has not

recorded a liability for these guarantees. Approximately 50

percent of the amounts guaranteed will expire within the 2007

through 2011 period, with the guarantees of the remaining

amounts expiring by 2019.

Indemnifi cations The company provided certain indemnities

of contingent liabilities of Equilon and Motiva to Shell and

Saudi Refi ning, Inc., in connection with the February 2002

sale of the company’s interests in those investments. The

company would be required to perform if the indemnifi ed

liabilities become actual losses. Were that to occur, the com-

pany could be required to make future payments up to $300.

NOTE 22. STOCK OPTIONS AND OTHER SHARE-BASED

COMPENSATION – Continued