Chevron 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 59CHEVRON CORPORATION 2006 ANNUAL REPORT 59

NOTE 2. ACQUISITION OF UNOCAL CORPORATION – Continued

NOTE 3.

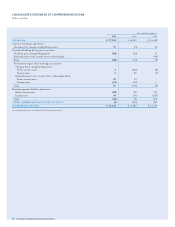

INFORMATION RELATING TO THE CONSOLIDATED STATEMENT

OF CASH FLOWS

Year ended December 31

2006 2005 2004

Net decrease (increase) in operating working

capital was composed of the following:

Decrease (increase) in accounts and

notes receivable $ 17 $ (3,164) $ (2,515)

Increase in inventories (536) (968) (298)

Increase in prepaid expenses and

other current assets (31) (54) (76)

Increase in accounts payable and

accrued liabilities 1,246 3,851 2,175

Increase in income and other

taxes payable 348 281 1,144

Net decrease (increase) in operating

working capital $ 1,044 $ (54) $ 430

Net cash provided by operating

activities includes the following

cash payments for interest and

income taxes:

Interest paid on debt

(net of capitalized interest) $ 470 $ 455 $ 422

Income taxes $ 13,806 $ 8,875 $ 6,679

Net (purchases) sales of

marketable securities consisted

of the following gross amounts:

Marketable securities purchased $ (1,271) $ (918) $ (1,951)

Marketable securities sold 1,413 1,254 1,501

Net sales (purchases) of

marketable securities $ 142 $ 336 $ (450)

The Consolidated Statement of Cash Flows excludes the

effects of noncash transactions. In October 2006, operating

service agreements in Venezuela were converted to joint stock

companies. Upon conversion, the company reclassifi ed $441

of long-term receivables, $132 of accounts receivable and $45

of properties, plant and equipment to investments in equity

affi liates. Refer also to Note 21 on page 72 for the noncash

effects associated with the implementation of FASB State-

ment No. 158, Employers’ Accounting for Defi ned Pension and

Other Postretirement Plans.

In accordance with the cash-fl ow classifi cation require-

ments of FAS 123R, Share-Based Payment, the “Net decrease

(increase) in operating working capital” includes reductions

of $94 and $20 for excess income tax benefi ts associated with

stock options exercised during 2006 and 2005, respectively.

These amounts are offset by “Net purchases of treasury shares.”

The “Net purchases of treasury shares” represents the cost

of common shares acquired in the open market less the cost

of shares issued for share-based compensation plans. Open-

market purchases totaled $5,033, $3,029 and $2,122 in 2006,

2005 and 2004, respectively.

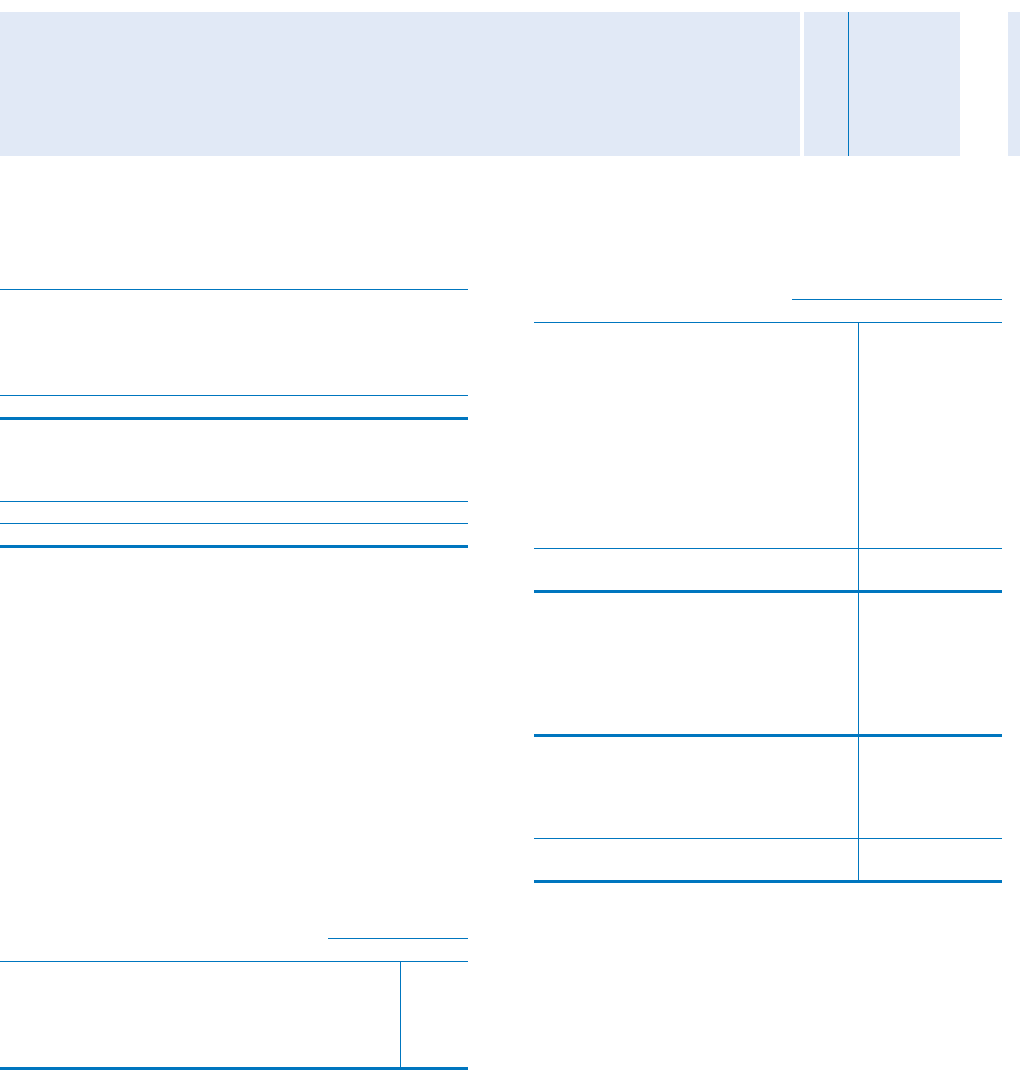

The acquisition was accounted for under the rules of

FASB Statement No. 141, Business Combinations. The follow-

ing table summarizes the fi nal purchase-price allocation:

Current assets $ 3,573

Investments and long-term receivables 1,695

Properties 17,285

Goodwill 4,820

Other assets 2,174

Total assets acquired 29,547

Current liabilities (2,364)

Long-term debt and capital leases (2,392)

Deferred income taxes (4,009)

Other liabilities (3,494)

Total liabilities assumed (12,259)

Net assets acquired $ 17,288

The $4,820 of goodwill, which represents benefi ts of

the acquisition that are additional to the fair values of the

other net assets acquired, was assigned to the upstream seg-

ment. The goodwill is not deductible for tax purposes. The

goodwill balance was reviewed for possible impairment as of

June 30, 2006, according to the requirements of FASB State-

ment No. 142, Goodwill and Other Intangible Assets, to test

goodwill for impairment on an annual basis. Goodwill was

determined not to be impaired at that time, and no events

have occurred subsequently that would necessitate an addi-

tional impairment review.

The following unaudited pro forma summary presents

the results of operations as if the acquisition of Unocal had

occurred at the beginning of each period:

Year ended December 31

2005 2004

Sales and other operating revenues $ 198,762 $ 158,471

Net income 14,967 14,164

Net income per share of common stock

Basic $ 6.68 $ 6.22

Diluted $ 6.64 $ 6.19

The pro forma summary uses estimates and assumptions

based on information available at the time. Management

believes the estimates and assumptions to be reasonable;

however, actual results may differ signifi cantly from this pro

forma fi nancial information. The pro forma information does

not refl ect any synergistic savings that might be achieved from

combining the operations and is not intended to refl ect the

actual results that would have occurred had the companies

actually been combined during the periods presented.