Chevron 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 CHEVRON CORPORATION 2006 ANNUAL REPORT

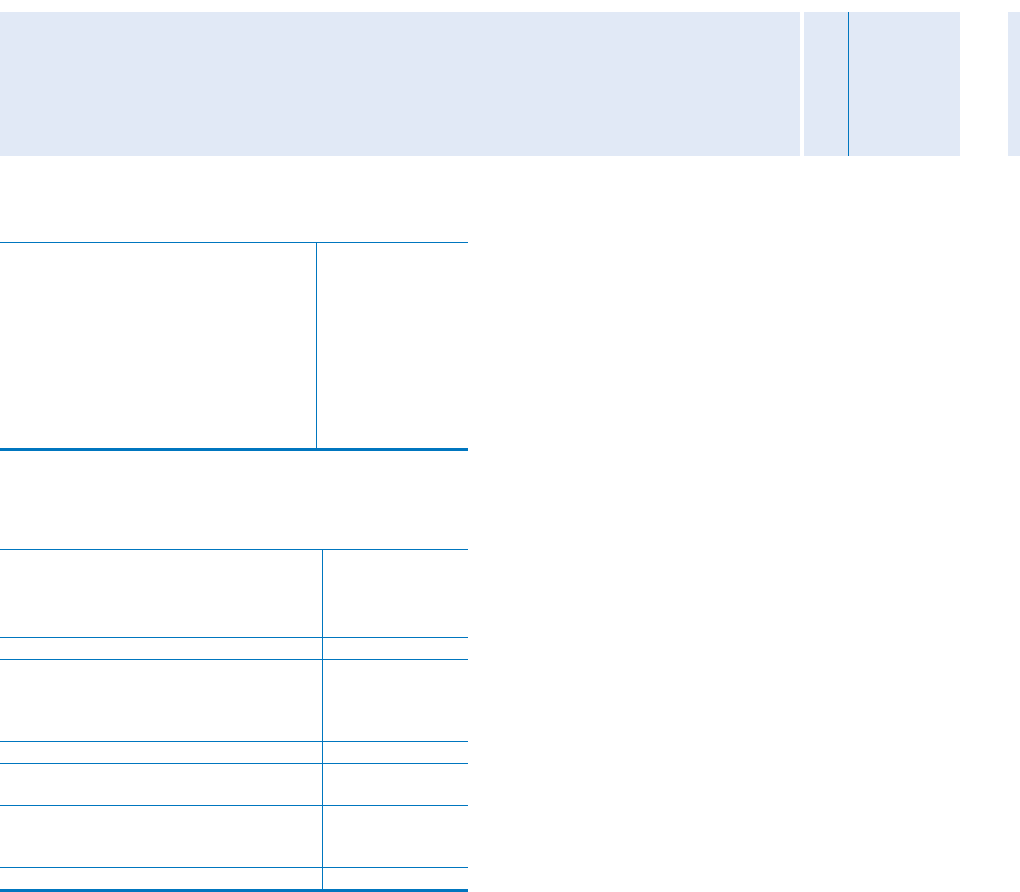

KEY FINANCIAL RESULTS

Millions of dollars, except per-share amounts 2006 2005 2004

Net Income $ 17,138 $ 14,099 $ 13,328

Per Share Amounts:

Net Income – Basic $ 7.84 $ 6.58 $ 6.30

– Diluted $ 7.80 $ 6.54 $ 6.28

Dividends $ 2.01 $ 1.75 $ 1.53

Sales and Other

Operating Revenues $ 204,892 $ 193,641 $ 150,865

Return on:

Average Capital Employed 22.6% 21.9% 25.8%

Average Stockholders’ Equity 26.0% 26.1% 32.7%

INCOME FROM CONTINUING OPERATIONS BY MAJOR

OPERATING AREA

Millions of dollars 2006 2005 2004

Income From Continuing Operations

Upstream – Exploration and Production

United States $ 4,270 $ 4,168 $ 3,868

International 8,872 7,556 5,622

Total Upstream 13,142 11,724 9,490

Downstream – Refi ning, Marketing

and Transportation

United States 1,938 980 1,261

International 2,035 1,786 1,989

Total Downstream 3,973 2,766 3,250

Chemicals 539 298 314

All Other (516) (689) (20)

Income From Continuing Operations $ 17,138 $ 14,099 $ 13,034

Income From Discontinued

Operations – Upstream – – 294

Net Income* $ 17,138 $ 14,099 $ 13,328

*Includes Foreign Currency Effects: $ (219) $ (61) $ (81)

Refer to the “Results of Operations” section beginning on

page 30 for a detailed discussion of fi nancial results by major

operating area for the three years ending December 31, 2006.

BUSINESS ENVIRONMENT AND OUTLOOK

Chevron’s current and future earnings depend largely on the

profi tability of its upstream (exploration and production)

and downstream (refi ning, marketing and transportation)

business segments. The single biggest factor that affects the

results of operations for both segments is movement in the

price of crude oil. In the downstream business, crude oil is

the largest cost component of refi ned products. The overall

trend in earnings is typically less affected by results from the

company’s chemicals business and other activities and invest-

ments. Earnings for the company in any period may also be

infl uenced by events or transactions that are infrequent and/

or unusual in nature. Chevron and the oil and gas industry

at large are currently experiencing an increase in certain costs

that exceeds the general trend of infl ation in many areas of

the world. This increase in costs is affecting the company’s

operating expenses for all business segments and capital

expenditures, particularly for the upstream business.

To sustain its long-term competitive position in the

upstream business, the company must develop and replenish

an inventory of projects that offer adequate fi nancial returns

for the investment required. Identifying promising areas for

exploration, acquiring the necessary rights to explore for and

to produce crude oil and natural gas, drilling successfully,

and handling the many technical and operational details in

a safe and cost-effective manner are all important factors in

this effort. Projects often require long lead times and large

capital commitments. Changes in economic, legal or political

circumstances can have signifi cant effects on the profi tability

of a project over its expected life. In the current environ-

ment of higher commodity prices, certain governments have

sought to renegotiate contracts or impose additional costs

on the company. Other governments may attempt to do so

in the future. The company will continue to monitor these

developments, take them into account in evaluating future

investment opportunities, and otherwise seek to mitigate any

risks to the company’s current operations or future prospects.

In late February 2007, the President of Venezuela issued a

decree announcing the government’s intention for the state-

owned company, Petróleos de Venezuela S.A., to increase

its ownership later this year in all Orinoco Heavy Oil Asso-

ciations, including Chevron’s 30 percent-owned Hamaca

project, to a minimum of 60 percent. The impact on

Chevron from such an action is uncertain but is not expected

to have a material effect on the company’s results of opera-

tions, consolidated fi nancial position or liquidity.

The company also continually evaluates opportunities to

dispose of assets that are not key to providing suffi cient long-

term value, or to acquire assets or operations complementary

to its asset base to help augment the company’s growth. Dur-

ing the fi rst quarter 2007, the company authorized the sale

of its 31 percent ownership interest in the Nerefco Refi nery

and the associated TEAM Terminal in the Netherlands.

The transaction is subject to signing of the sales agreement

and obtaining necessary regulatory approvals. The company

expects to record a gain upon close of the sale. In early 2007,

the company was also in discussions regarding the possible sale

of its fuels marketing operations in the Netherlands, Belgium

and Luxembourg. Neither the refi ning nor marketing assets

were classifi ed as held-for-sale as of December 31, 2006,

in accordance with the held-for-sale criteria of Financial

Accounting Standards Board (FASB) Statement No. 144,

Impairment or Disposal of Long-Lived Assets. Other asset dis-

positions and restructurings may occur in future periods and

could result in signifi cant gains or losses.

Comments related to earnings trends for the company’s

major business areas are as follows:

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS