Chevron 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 CHEVRON CORPORATION 2006 ANNUAL REPORT76 CHEVRON CORPORATION 2006 ANNUAL REPORT

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

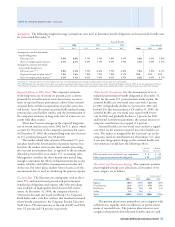

measured. To assess the plans’ investment performance, long-

term asset allocation policy benchmarks have been established.

For the primary U.S. pension plan, the Chevron Board

of Directors has established the following approved asset allo-

cation ranges: Equities 40–70 percent, Fixed Income 20–60

percent, Real Estate 0–15 percent and Other 0–5 percent.

The signifi cant international pension plans also have estab-

lished maximum and minimum asset allocation ranges that

vary by each plan. Actual asset allocation within approved

ranges is based on a variety of current economic and market

conditions and consideration of specifi c asset category risk.

Equities include investments in the company’s common

stock in the amount of $17 and $13 at December 31, 2006

and 2005, respectively. The “Other” asset category includes

minimal investments in private-equity limited partnerships.

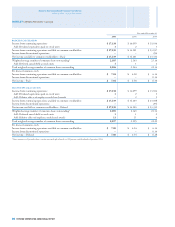

Cash Contributions and Benefi t Payments In 2006, the

company contributed $224 and $225 to its U.S. and inter-

national pension plans, respectively. In 2007, the company

expects contributions to be approximately $300 and $200 to

its U.S. and international pension plans, respectively. Actual

contribution amounts are dependent upon plan-investment

returns, changes in pension obligations, regulatory environ-

ments and other economic factors. Additional funding may

ultimately be required if investment returns are insuffi cient

to offset increases in plan obligations.

The company anticipates paying other postretirement

benefi ts of approximately $223 in 2007, as compared with

$211 paid in 2006.

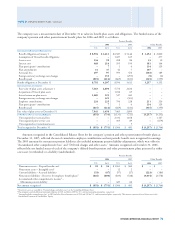

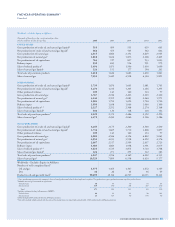

The following benefi t payments, which include estimated

future service, are expected to be paid in the next 10 years:

Pension Benefi ts Other

U.S. Int’l. Benefi ts

2007 $ 775 $ 206 $ 223

2008 $ 755 $ 228 $ 226

2009 $ 786 $ 237 $ 228

2010 $ 821 $ 253 $ 233

2011 $ 865 $ 249 $ 239

2012–2016 $ 4,522 $ 1,475 $ 1,252

Employee Savings Investment Plan Eligible employees of

Chevron and certain of its subsidiaries participate in the

Chevron Employee Savings Investment Plan (ESIP).

Charges to expense for the ESIP represent the company’s

contributions to the plan, which are funded either through

the purchase of shares of common stock on the open market

or through the release of common stock held in the leveraged

employee stock ownership plan (LESOP), which is discussed

below. Total company matching contributions to employee

accounts within the ESIP were $169, $145 and $139 in 2006,

2005 and 2004, respectively. This cost was reduced by the value

of shares released from the LESOP totaling $6, $4 and $138 in

2006, 2005 and 2004, respectively. The remaining amounts,

totaling $163, $141 and $1 in 2006, 2005 and 2004, respec-

tively, represent open market purchases.

Employee Stock Ownership Plan Within the Chevron ESIP is

an employee stock ownership plan (ESOP). In 1989, Chevron

established a LESOP as a constituent part of the ESOP. The

LESOP provides partial prefunding of the company’s future

commitments to the ESIP.

As permitted by American Institute of Certifi ed Public

Accountants (AICPA) Statement of Position 93-6, Employers’

Accounting for Employee Stock Ownership Plans, the company

has elected to continue its practices, which are based on

AICPA Statement of Position 76-3, Accounting Practices for

Certain Employee Stock Ownership Plans, and subsequent con-

sensus of the EITF of the FASB. The debt of the LESOP is

recorded as debt, and shares pledged as collateral are reported

as “Deferred compensation and benefi t plan trust” on the

Consolidated Balance Sheet and the Consolidated Statement

of Stockholders’ Equity.

The company reports compensation expense equal to

LESOP debt principal repayments less dividends received

and used by the LESOP for debt service. Interest accrued

on LESOP debt is recorded as interest expense. Dividends

paid on LESOP shares are refl ected as a reduction of retained

earnings. All LESOP shares are considered outstanding for

earnings-per-share computations.

Total (credits) expenses recorded for the LESOP were

$(1), $94 and $(29) in 2006, 2005 and 2004, respectively,

including $17, $18 and $23 of interest expense related to

LESOP debt and a (credit) charge to compensation expense

of $(18), $76 and $(52).

Of the dividends paid on the LESOP shares, $59, $55

and $52 were used in 2006, 2005 and 2004, respectively,

to service LESOP debt. The amount in 2006 included $28

of LESOP debt service that was scheduled for payment

on the fi rst business day of January 2007 and was paid in

late December 2006. Included in the 2004 amount was a

repayment of debt entered into in 1999 to pay interest on the

ESOP debt. Interest expense on this debt was recognized and

reported as LESOP interest expense in 1999. In addition,

the company made contributions in 2005 of $98 to satisfy

LESOP debt service in excess of dividends received by the

LESOP. No contributions were required in 2006 or 2004 as

dividends received by the LESOP were suffi cient to satisfy

LESOP debt service.

Shares held in the LESOP are released and allocated

to the accounts of plan participants based on debt service

deemed to be paid in the year in proportion to the total of

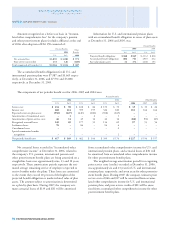

current year and remaining debt service. LESOP shares as

of December 31, 2006 and 2005, were as follows:

NOTE 21. EMPLOYEE BENEFIT PLANS – Continued