Chevron 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 71CHEVRON CORPORATION 2006 ANNUAL REPORT 71

nized tax benefi ts and associated interest and penalties as of

J anuary 1, 2007. In connection with this increase in liability,

the company estimates retained earnings at the beginning of

2007 will be reduced by $250 or less. The amount of the liabil-

ity and impact on retained earnings will depend in part on

clarifi cation expected to be issued by the FASB related to the

criteria for determining the date of ultimate settlement with a

tax authority.

FASB Statement No. 157, Fair Value Measurements (FAS

157) In September 2006, the FASB issued FAS 157, which

will become effective for the company on January 1, 2008.

This standard defi nes fair value, establishes a framework for

measuring fair value and expands disclosures about fair value

measurements. The Statement does not require any new fair

value measurements but would apply to assets and liabilities

that are required to be recorded at fair value under other

accounting standards. The impact, if any, to the company

from the adoption of FAS 157 in 2008 will depend on the

company’s assets and liabilities at that time that are required

to be measured at fair value.

FASB Statement No. 158, Employers’ Accounting for Defi ned

Benefi t Pension and Other Postretirement Plans – an Amend-

ment of FASB Statements No. 87, 88, 106 and 132(R) (FAS

158) In September 2006, the FASB issued FAS 158, which

was adopted by the company on December 31, 2006. Refer to

Note 21, beginning on page 72 for additional information.

NOTE 20.

ACCOUNTING FOR SUSPENDED EXPLORATORY WELLS

The company accounts for the cost of exploratory wells in

accordance with FASB Statement No. 19, Financial and Report-

ing by Oil and Gas Producing Companies (FAS 19), as amended

by FASB Staff Position (FSP) FAS 19-1, Accounting for Sus-

pended Well Costs, which provides that exploratory well costs

continue to be capitalized after the completion of drilling when

(a) the well has found a suffi cient quantity of reserves to justify

completion as a producing well and (b) the enterprise is making

suffi cient progress assessing the reserves and the economic and

operating viability of the project. If either condition is not met

or if an enterprise obtains information that raises substantial

doubt about the economic or operational viability of the proj-

ect, the exploratory well would be assumed to be impaired, and

its costs, net of any salvage value, would be charged to expense.

FAS 19 provides a number of indicators that can assist an entity

to demonstrate suffi cient progress is being made in assessing the

reserves and economic viability of the project.

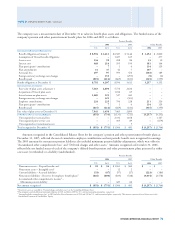

The following table indicates the changes to the com-

pany’s suspended exploratory well costs for the three years

ended December 31, 2006. No capitalized exploratory well

costs were charged to expense upon the 2005 adoption of

FSP FAS 19-1.

Year ended December 31

2006 2005 2004

Beginning balance at January 1 $ 1,109 $ 671 $ 549

Additions associated with the

acquisition of Unocal – 317 –

Additions to capitalized exploratory

well costs pending the

determination of proved reserves 446 290 252

Reclassifi cations to wells, facilities

and equipment based on the

determination of proved reserves (171) (140) (64)

Capitalized exploratory well costs

charged to expense (121) (6) (66)

Other reductions* (24) (23) –

Ending balance at December 31 $ 1,239 $ 1,109 $ 671

*Represent property sales and exchanges.

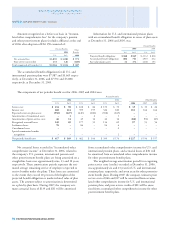

The following table provides an aging of capitalized well

costs and the number of projects for which exploratory well

costs have been capitalized for a period greater than one year

since the completion of drilling. The aging of the former

Unocal wells is based on the date the drilling was completed,

rather than Chevron’s acquisition of Unocal in 2005.

Year ended December 31

2006 2005 2004

Exploratory well costs capitalized

for a period of one year or less $ 332 $ 259 $ 222

Exploratory well costs capitalized

for a period greater than one year 907 850 449

Balance at December 31 $ 1,239 $ 1,109 $ 671

Number of projects with exploratory

well costs that have been capitalized

for a period greater than one year* 44 40 22

* Certain projects have multiple wells or fi elds or both.

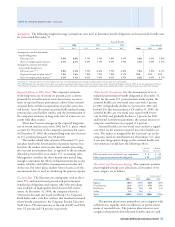

Of the $907 of exploratory well costs capitalized for a

period greater than one year at December 31, 2006, $447

(23 projects) is related to projects that had drilling activities

under way or fi rmly planned for the near future. An addi-

tional $63 (one project) had drilling activity during 2006.

The $397 balance related to 20 projects in areas requiring a

major capital expenditure before production could begin and

for which additional drilling efforts were not under way or

fi rmly planned for the near future. Additional drilling was

not deemed necessary because the presence of hydrocarbons

had already been established, and other activities were in

process to enable a future decision on project development.

The projects for the $397 referenced above had the fol-

lowing activities associated with assessing the reserves and

the projects’ economic viability: (a) $99 (two projects) –

development plans submitted to a government in early 2007;

(b) $80 (one project) – pre-FEED (front-end engineering and

design) studies are ongoing with FEED expected to com-

mence in 2007; (c) $75 (three projects) – continued to

pursue unitization opportunities on adjacent discoveries that

NOTE 19. NEW ACCOUNTING STANDARDS – Continued