Chevron 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 CHEVRON CORPORATION 2006 ANNUAL REPORT82 CHEVRON CORPORATION 2006 ANNUAL REPORT

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

$150. The timing of the settlement and the exact amount

within this range of estimates are uncertain.

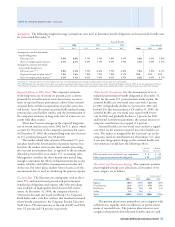

Other Contingencies Chevron receives claims from and sub-

mits claims to customers; trading partners; U.S. federal, state

and local regulatory bodies; governments; contractors; insur-

ers; and suppliers. The amounts of these claims, individually

and in the aggregate, may be signifi cant and take lengthy

periods to resolve.

The company and its affi liates also continue to review

and analyze their operations and may close, abandon, sell,

exchange, acquire or restructure assets to achieve operational

or strategic benefi ts and to improve competitiveness and prof-

itability. These activities, individually or together, may result

in gains or losses in future periods.

NOTE 24.

ASSET RETIREMENT OBLIGATIONS

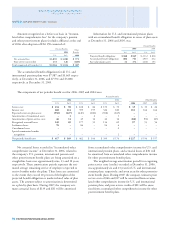

The company accounts for asset retirement obligations in

accordance with Financial Accounting Standards Board

Statement (FASB) No. 143, Accounting for Asset Retirement

Obligations (FAS 143). This accounting standard applies to

the fair value of a liability for an asset retirement obligation

(ARO) that is recorded when there is a legal obligation associ-

ated with the retirement of a tangible long-lived asset and

the liability can be reasonably estimated. Obligations associ-

ated with the retirement of these assets require recognition

in certain circumstances: (1) the present value of a liability

and offsetting asset for an ARO, (2) the subsequent accretion

of that liability and depreciation of the asset, and (3) the

periodic review of the ARO liability estimates and discount

rates. In 2005, the FASB issued FASB Interpretation No. 47,

Accounting for Conditional Asset Retirement Obligations – An

Interpretation of FASB Statement No. 143 (FIN 47), which

was effective for the company on December 31, 2005. FIN

47 clarifi es that the phrase “conditional asset retirement

obligation,” as used in FAS 143, refers to a legal obligation to

perform asset retirement activity for which the timing and/or

method of settlement are conditional on a future event that

may or may not be within the control of the company. The

obligation to perform the asset retirement activity is uncon-

ditional even though uncertainty exists about the timing

and/or method of settlement. Uncertainty about the timing

and/or method of settlement of a conditional ARO should be

factored into the measurement of the liability when suffi cient

information exists. FAS 143 acknowledges that in some cases,

suffi cient information may not be available to reasonably

estimate the fair value of an ARO. FIN 47 also clarifi es when

an entity would have suffi cient information to reasonably

estimate the fair value of an ARO. In adopting FIN 47, the

company did not recognize any additional liabilities for con-

ditional AROs due to an inability to reasonably estimate the

fair value of those obligations because of their indeterminate

settlement dates.

FAS 143 and FIN 47 primarily affect the company’s

accounting for crude oil and natural gas producing assets.

No signifi cant AROs associated with any legal obligations to

retire refi ning, marketing and transportation (downstream)

and chemical long-lived assets have been recognized, as inde-

terminate settlement dates for the asset retirements prevented

estimation of the fair value of the associated ARO. The com-

pany performs periodic reviews of its downstream and chemical

long-lived assets for any changes in facts and circumstances that

might require recognition of a retirement obligation.

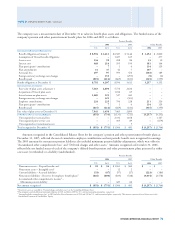

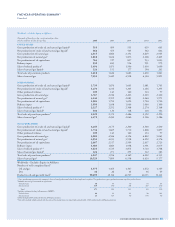

The following table indicates the changes to the com-

pany’s before-tax asset retirement obligations in 2006, 2005

and 2004:

2006 2005 2004

Balance at January 1 $ 4,304 $ 2,878 $ 2,856

Liabilities assumed in the

Unocal acquisition – 1,216 –

Liabilities incurred 153 90 37

Liabilities settled (387) (172) (426)

Accretion expense 275 187 93

Revisions in estimated cash fl ows 1,428* 105 318

Balance at December 31 $ 5,773 $ 4,304 $ 2,878

* Includes $1,128 associated with estimated costs to dismantle and abandon wells and facili-

ties damaged by the 2005 hurricanes in the Gulf of Mexico.

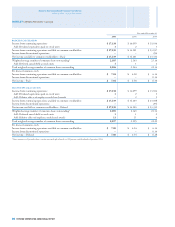

NOTE 25.

COMMON STOCK SPLIT

In September 2004, the company effected a two-for-one stock

split in the form of a stock dividend. The total number of

authorized common stock shares and associated par value

were unchanged by this action. All per-share amounts in the

fi nancial statements refl ect the stock split for all periods pre-

sented. The effect of the common stock split is refl ected on the

Consolidated Balance Sheet in “Common stock” and “Capital

in excess of par value.”

NOTE 23. OTHER CONTINGENCIES AND COMMITMENTS – Continued