Chevron 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 81CHEVRON CORPORATION 2006 ANNUAL REPORT 81

reserve for these sites at year-end 2006 was $122. The federal

Superfund law and analogous state laws provide for joint

and several liability for all responsible parties. Any future

actions by the EPA or other regulatory agencies to require

Chevron to assume other potentially responsible parties’ costs

at designated hazardous waste sites are not expected to have a

material effect on the company’s consolidated fi nancial posi-

tion or liquidity.

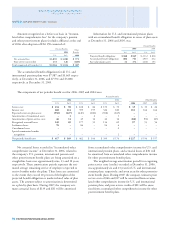

Of the remaining year-end 2006 environmental reserves

balance of $1,319, $834 related to approximately 2,250 sites

for the company’s U.S. downstream operations, including

refi neries and other plants, marketing locations (i.e., service

stations and terminals) and pipelines. The remaining $485

was associated with various sites in the international down-

stream ($117), upstream ($252), chemicals ($61) and other

($55). Liabilities at all sites, whether operating, closed or

divested, were primarily associated with the company’s plans

and activities to remediate soil or groundwater contamination

or both. These and other activities include one or more of

the following: site assessment; soil excavation; offsite disposal

of contaminants; onsite containment, remediation and/or

extraction of petroleum hydrocarbon liquid and vapor from

soil; groundwater extraction and treatment; and monitoring

of the natural attenuation of the contaminants.

The company manages environmental liabilities under

specifi c sets of regulatory requirements, which in the United

States include the Resource Conservation and Recovery Act

and various state or local regulations. No single remediation

site at year-end 2006 had a recorded liability that was mate-

rial to the company’s fi nancial position, results of operations

or liquidity.

It is likely that the company will continue to incur

additional liabilities, beyond those recorded, for environ-

mental remediation relating to past operations. These

future costs are not fully determinable due to such factors

as the unknown magnitude of possible contamination, the

unknown timing and extent of the corrective actions that

may be required, the determination of the company’s liability

in proportion to other responsible parties, and the extent to

which such costs are recoverable from third parties.

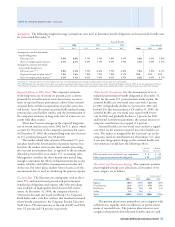

Effective January 1, 2003, the company implemented

FASB Statement No. 143, Accounting for Asset Retirement Obli-

gations (FAS 143). Under FAS 143, the fair value of a liability

for an asset retirement obligation is recorded when there is a

legal obligation associated with the retirement of long-lived

assets and the liability can be reasonably estimated. The

liability balance of approximately $5,800 for asset retirement

obligations at year-end 2006 related primarily to upstream and

mining properties. Refer to Note 24 on page 82 for a discus-

sion of the company’s Asset Retirement Obligations.

For the company’s other ongoing operating assets, such

as refi neries and chemicals facilities, no provisions are made

for exit or cleanup costs that may be required when such

assets reach the end of their useful lives unless a decision to

sell or otherwise abandon the facility has been made, as the

indeterminate settlement dates for the asset retirements prevent

estimation of the fair value of the asset retirement obligation.

Global Operations Chevron and its affi liates conduct busi-

ness activities in approximately 180 countries. Besides the

United States, the company and its affi liates have signifi cant

operations in the following countries: Angola, Argentina,

Australia, Azerbaijan, Bangladesh, Brazil, Cambodia,

Canada, Chad, China, Colombia, Democratic Republic of

the Congo, Denmark, France, India, Indonesia, Kazakhstan,

Myanmar, the Netherlands, Nigeria, Norway, the Partitioned

Neutral Zone between Kuwait and Saudi Arabia, the Phil-

ippines, Republic of the Congo, Singapore, South Africa,

South Korea, Thailand, Trinidad and Tobago, the United

Kingdom, Venezuela and Vietnam.

The company’s operations, particularly exploration and

production, can be affected by changing economic, regulatory

and political environments in the various countries in which it

operates, including the United States. As has occurred in the

past, actions could be taken by governments to increase public

ownership of the company’s partially or wholly owned busi-

nesses or assets or to impose additional taxes or royalties on the

company’s operations or both.

In certain locations, governments have imposed restric-

tions, controls and taxes, and in others, political conditions

have existed that may threaten the safety of employees and

the company’s continued presence in those countries. Internal

unrest, acts of violence or strained relations between a govern-

ment and the company or other governments may affect the

company’s operations. Those developments have at times signi-

fi cantly affected the company’s related operations and results

and are carefully considered by management when evaluating

the level of current and future activity in such countries.

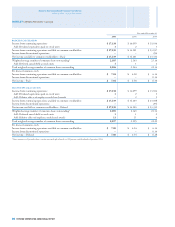

Equity Redetermination For oil and gas producing operations,

ownership agreements may provide for periodic reassess-

ments of equity interests in estimated crude oil and natural

gas reserves. These activities, individually or together, may

result in gains or losses that could be material to earnings in

any given period. One such equity redetermination process

has been under way since 1996 for Chevron’s interests in

four producing zones at the Naval Petroleum Reserve at Elk

Hills, California, for the time when the remaining inter-

ests in these zones were owned by the U.S. Department of

Energy. A wide range remains for a possible net settlement

amount for the four zones. For this range of settlement,

Chevron estimates its maximum possible net before-tax lia-

bility at approximately $200, and the possible maximum net

amount that could be owed to Chevron is estimated at about

NOTE 23. OTHER CONTINGENCIES AND COMMITMENTS – Continued