Chevron 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 CHEVRON CORPORATION 2006 ANNUAL REPORT64 CHEVRON CORPORATION 2006 ANNUAL REPORT

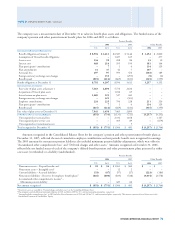

Segment Income Taxes Segment income tax expenses for the

years 2006, 2005 and 2004 are as follows:

Year ended December 31

2006 2005 2004

Upstream

United States $ 2,668 $ 2,330 $ 2,308

International 10,987 8,440 5,041

Total Upstream 13,655 10,770 7,349

Downstream

United States 1,162 575 739

International 586 576 442

Total Downstream 1,748 1,151 1,181

Chemicals

United States 213 99 47

International 30 25 17

Total Chemicals 243 124 64

All Other (808) (947) (1,077)

Income Tax Expense From

Continuing Operations* $ 14,838 $ 11,098 $ 7,517

*Income tax expense of $100 related to discontinued operations for 2004 is not included.

Other Segment Information Additional information for the

segmentation of major equity affiliates is contained in Note

12, beginning on page 65. Information related to properties,

plant and equipment by segment is contained in Note 13, on

page 67.

NOTE 9.

LEASE COMMITMENTS

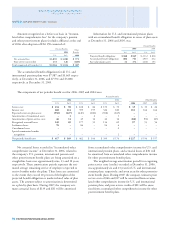

Certain noncancelable leases are classifi ed as capital leases,

and the leased assets are included as part of “Properties, plant

and equipment, at cost.” Such leasing arrangements involve

tanker charters, crude oil production and processing equip-

ment, service stations, and other facilities. Other leases are

classifi ed as operating leases and are not capitalized. The

payments on such leases are recorded as expense. Details of

the capitalized leased assets are as follows:

At December 31

2006 2005

Upstream $ 461

$ 442

Downstream 896 837

Total 1,357 1,279

Less: Accumulated amortization 813 745

Net capitalized leased assets $ 544 $ 534

Rental expenses incurred for operating leases during

2006, 2005 and 2004 were as follows:

Year ended December 31

2006 2005 2004

Minimum rentals $ 2,326 $ 2,102 $ 2,093

Contingent rentals 6 6 7

Tota l 2,332 2,108 2,100

Less: Sublease rental income 33 43 40

Net rental expense $ 2,299 $ 2,065 $ 2,060

Contingent rentals are based on factors other than the

passage of time, principally sales volumes at leased service

stations. Certain leases include escalation clauses for adjusting

rentals to refl ect changes in price indices, renewal options

ranging up to 25 years, and options to purchase the leased

property during or at the end of the initial or renewal lease

period for the fair market value or other specifi ed amount at

that time.

At December 31, 2006, the estimated future minimum

lease payments (net of noncancelable sublease rentals) under

operating and capital leases, which at inception had a non-

cancelable term of more than one year, were as follows:

At December 31

Operating Capital

Leases Leases

Year: 2007 $ 509 $ 91

2008 507 80

2009 477 81

2010 390 59

2011 311 57

Thereafter 864 520

Total $ 3,058 $ 888

Less: Amounts representing interest

and executory costs (262)

Net present values 626

Less: Capital lease obligations

included in short-term debt (352)

Long-term capital lease obligations $ 274

NOTE 10.

RESTRUCTURING AND REORGANIZATION COSTS

In connection with the Unocal acquisition, the company imple-

mented a restructuring and reorganization program as part of

the effort to capture the synergies of the combined companies

by eliminating redundant operations, consolidating offi ces and

facilities, and sharing common services and functions.

As part of the restructuring and reorganization, approxi-

mately 600 employees were eligible for severance payments.

Most of the associated positions are in the United States and

relate primarily to corporate and upstream executive and

administrative functions. By year-end 2006, the program

was substantially complete.

NOTE 8. OPERATING SEGMENTS AND GEOGRAPHIC DATA – Continued

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts