Chevron 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 39

not recorded a liability for these guarantees. Approximately

50 percent of the amounts guaranteed will expire within

the 2007 through 2011 period, with the guarantees of the

remaining amounts expiring by 2019.

Indemnifi cations The company provided certain indem-

nities of contingent liabilities of Equilon and Motiva to Shell

and Saudi Refi ning, Inc., in connection with the February

2002 sale of the company’s interests in those investments.

The company would be required to perform if the indemni-

fi ed liabilities become actual losses. Were that to occur, the

company could be required to make future payments up to

$300 million. Through the end of 2006, the company paid

approximately $48 million under these indemnities and con-

tinues to be obligated for possible additional indemnifi cation

payments in the future.

The company has also provided indemnities relating to

contingent environmental liabilities related to assets origi-

nally contributed by Texaco to the Equilon and Motiva joint

ventures and environmental conditions that existed prior to

the formation of Equilon and Motiva or that occurred dur-

ing the period of Texaco’s ownership interest in the joint

ventures. In general, the environmental conditions or events

that are subject to these indemnities must have arisen prior

to December 2001. Claims relating to Equilon indemni-

ties must be asserted either as early as February 2007 or

no later than February 2009, and claims relating to Motiva

indemnities must be asserted either as early as February 2007

or no later than February 2012. Under the terms of these

indemnities, there is no maximum limit on the amount of

potential future payments. The company has not recorded

any liabilities for possible claims under these indemnities.

The company posts no assets as collateral and has made no

payments under the indemnities.

The amounts payable for the indemnities described above

are to be net of amounts recovered from insurance carriers

and others and net of liabilities recorded by Equilon or Motiva

prior to September 30, 2001, for any applicable incident.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabilities associated with assets that were sold in 1997. Under

the indemnifi cation agreement, the company’s liability is

unlimited until April 2022, when the liability expires. The

acquirer shares in certain environmental remediation costs

up to a maximum obligation of $200 million, which had not

been reached as of December 31, 2006.

Securitization The company securitizes certain retail and

trade accounts receivable in its downstream business through

the use of qualifying Special Purpose Entities (SPEs). At

December 31, 2006, approximately $1.2 billion, represent-

ing about 7 percent of Chevron’s total current accounts and

notes receivable balance, were securitized. Chevron’s total

estimated fi nancial exposure under these securitizations at

December 31, 2006, was approximately $80 million. These

arrangements have the effect of accelerating Chevron’s collec-

tion of the securitized amounts. In the event that the SPEs

experience major defaults in the collection of receivables,

Chevron believes that it would have no loss exposure con-

nected with third-party investments in these securitizations.

Long-Term Unconditional Purchase Obligations and

Commitments, Including Throughput and Take-or-Pay Agree-

ments The company and its subsidiaries have certain other

contingent liabilities relating to long-term unconditional pur-

chase obligations and commitments, including throughput

and take-or-pay agreements, some of which relate to suppliers’

fi nancing arrangements. The agreements typically provide

goods and services, such as pipeline and storage capacity,

drilling rigs, utilities, and petroleum products, to be used or

sold in the ordinary course of the company’s business. The

aggregate approximate amounts of required payments under

these various commitments are: 2007 – $3.2 billion; 2008

– $1.7 billion; 2009 – $2.1 billion; 2010 – $1.9 billion; 2011

– $0.9 billion; 2012 and after – $4.1 billion. A portion of

these commitments may ultimately be shared with project

partners. Total payments under the agreements were approxi-

mately $3.0 billion in 2006, $2.1 billion in 2005 and $1.6

billion in 2004.

Minority Interests The company has commitments of $209

million related to minority interests in subsidiary companies.

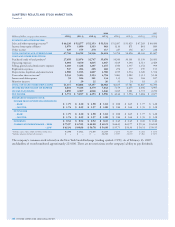

The following table summarizes the company’s signifi cant

contractual obligations:

Contractual Obligations

Millions of dollars Payments Due by Period

2008– After

Total 2007 2010 2011 2011

On Balance Sheet:

Short-Term Debt1 $ 2,159 $ 2,159 $ – $ – $ –

Long-Term Debt1,2 7,405 – 5,868 50 1,487

Noncancelable Capital

Lease Obligations 274 – 138 40 96

Interest 5,269 491 1,173 366 3,239

Off-Balance-Sheet:

Noncancelable Operating

Lease Obligations 3,058 509 1,374 311 864

Throughput and

Take-or-Pay Agreements 9,796 2,765 3,027 475 3,529

Other Unconditional

Purchase Obligations 4,072 383 2,696 427 566

1 $4.5 billion of short-term debt that the company expects to refi nance is included in

long-term debt. The repayment schedule above refl ects the projected repayment of the

entire amounts in the 2008–2010 period.

2 Includes guarantees of $213 of ESOP (employee stock ownership plan) debt due after

2007. The 2007 amount of $20, which was scheduled for payment on the fi rst business

day of January 2007, was paid in late December 2006.

FINANCIAL AND DERIVATIVE INSTRUMENTS

Commodity Derivative Instruments Chevron is exposed to

market risks related to the price volatility of crude oil, refi ned

products, natural gas, natural gas liquids, liquefi ed natural gas

and refi nery feedstocks.

The company uses derivative commodity instruments to

manage these exposures on a portion of its activity, includ-

ing: fi rm commitments and anticipated transactions for the

purchase, sale and storage of crude oil, refi ned products,

natural gas, natural gas liquids and feedstock for company

refi neries. The company also uses derivative commodity

instruments for limited trading purposes. The results of this

activity were not material to the company’s fi nancial position,

net income or cash fl ows in 2006.

The company’s market exposure positions are moni-

tored and managed on a daily basis by an internal Risk