Chevron 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 65CHEVRON CORPORATION 2006 ANNUAL REPORT 65

signing of the sales agreement and obtaining necessary regula-

tory approvals.

NOTE 12.

INVESTMENTS AND ADVANCES

Equity in earnings, together with investments in and

advances to companies accounted for using the equity

method and other investments accounted for at or below

cost, are shown in the table below. For certain equity affi li-

ates, Chevron pays its share of some income taxes directly.

For such affi liates, the equity in earnings do not include

these taxes, which are reported on the Consolidated State-

ment of Income as “Income tax expense.”

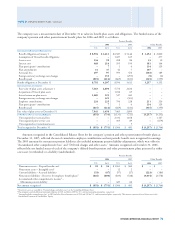

Investments and Advances Equity in Earnings

At December 31 Year ended December 31

2006 2005 2006 2005 2004

Upstream

Tengizchevroil $ 5,507 $ 5,007

$ 1,817 $ 1,514 $ 950

Hamaca 928 1,189 319 390 98

Petroboscan 712 – 31 – –

Other 682 679 123 139 148

Tota l Upstrea m 7,829 6,875 2,290 2,043 1,196

Downstream

GS Caltex Corporation 2,176 1,984 316 320 296

Caspian Pipeline Consortium 990 1,014 117 101 140

Star Petroleum Refi ning

Company Ltd. 787 709 116 81 207

Caltex Australia Ltd. 559 435 186 214 173

Colonial Pipeline Company 555 565 34 13 –

Other 1,839 1,562 358 273 143

Tota l Downst rea m 6,906 6,269 1,127 1,002 959

Chemicals

Chevron Phillips Chemical

Company LLC 2,044 1,908 697 449 334

Other 22 20 5 3 2

Total Chemicals 2,066 1,928 702 452 336

All Other

Dynegy Inc. 254 682 68 189 86

Other 586 740 68 45 5

Tot al equit y method $ 17,641 $ 16,494 $ 4,255 $ 3,731 $ 2,582

Other at or below cost 911 563

Total investments and

advances $ 18,552 $ 17,057

Total United States $ 4,191 $ 4,624 $ 955 $ 833 $ 588

Total International $ 14,361 $ 12,433 $ 3,300 $ 2,898 $ 1,994

Descriptions of major affiliates are as follows:

Tengizchevroil Chevron has a 50 percent equity ownership

interest in Tengizchevroil (TCO), a joint venture formed in

1993 to develop the Tengiz and Korolev crude oil fi elds in

Kazakhstan over a 40-year period.

Hamaca Chevron has a 30 percent interest in the Hamaca

heavy oil production and upgrading project located in Vene-

zuela’s Orinoco Belt.

An accrual of $106 was established as part of the

purchase-price allocation for Unocal. The $11 balance at

year-end 2006 was classifi ed as a current liability on the

Consolidated Balance Sheet. Activity for this accrual is

shown in the table below.

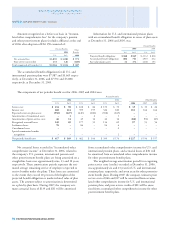

Amounts before tax 2006 2005

Balance at January 1 $ 44 $ –

Additions/adjustments (14) 106

Payments (19) (62)

Balance at December 31 $ 11 $ 44

Shown in the table below is the activity for the com-

pany’s liability related to various other reorganizations and

restructurings across several businesses and corporate depart-

ments. The $17 balance at year-end 2006 was also classifi ed as

a current liability on the Consolidated Balance Sheet. The asso-

ciated charges or credits during the periods were categorized as

“Operating expenses” or “Selling, general and administrative

expenses” on the Consolidated Statement of Income.

Activity for the company’s liability related to other various

reorganizations and restructurings is summarized in the fol-

lowing table:

Amounts before tax 2006 2005

Balance at January 1 $ 47 $ 119

Additions/adjustments (7) (10)

Payments (23) (62)

Balance at December 31 $ 17 $ 47

NOTE 11.

ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONS

At December 31, 2004, the company classifi ed $162 of net

properties, plant and equipment as “Assets held for sale” on

the Consolidated Balance Sheet. Assets in this category related

to a group of service stations outside the United States.

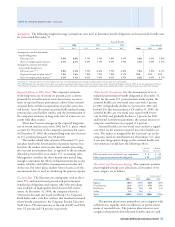

Summarized income statement information relating to

discontinued operations is as follows:

Year ended December 31

2006 2005 2004

Revenues and other income $ – $ – $ 635

Income from discontinued operations

before income tax expense – – 394

Income from discontinued operations,

net of tax – – 294

Not all assets sold or to be disposed of are classifi ed as dis-

continued operations, mainly because the cash fl ows from the

assets were not, or will not be, eliminated from the ongoing

operations of the company.

Subsequent to December 31, 2006, approximately $300

of the company’s refi ning assets in the Netherlands met the

criteria for classifying the assets as held for sale. The company

expects to record a gain upon close of sale, which is subject to

NOTE 10. RESTRUCTURING AND REORGANIZATION COSTS – Continued