Chevron 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2006 ANNUAL REPORT 99

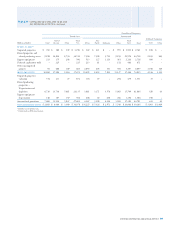

TABLE VI – STANDARDIZED MEASURE OF DISCOUNTED FUTURE NET CASH

FLOWS RELATED TO PROVED OIL AND GAS RESERVES – Continued

Consolidated Companies

United States International

Gulf of Total Asia- Total Affi liated Companies

Millions of dollars Calif. Mexico Other U.S. Africa Pacifi c Indonesia Other Int’l. Total TCO Other

AT DECEMBER 31, 2006

Future cash infl ows

from production $ 48,828 $ 23,768 $ 38,727 $ 111,323 $ 97,571 $ 70,288 $ 30,538 $ 36,272 $ 234,669 $ 345,992 $ 104,069 $ 20,644

Future production costs (14,791) (6,750) (12,845) (34,386) (12,523) (13,398) (16,281) (10,777) (52,979) (87,365) (7,796) (2,348)

Future devel. costs (3,999) (2,947) (1,399) (8,345) (9,648) (6,963) (2,284) (3,082) (21,977) (30,322) (7,026) (1,732)

Future income taxes (10,171) (4,764) (8,290) (23,225) (53,214) (20,633) (5,448) (11,164) (90,459) (113,684) (25,212) (8,282)

Undiscounted future

net cash fl ows 19,867 9,307 16,193 45,367 22,186 29,294 6,525 11,249 69,254 114,621 64,035 8,282

10 percent midyear annual

discount for timing of

estimated cash fl ows (9,779) (3,256) (7,210) (20,245) (10,065) (12,457) (2,426) (3,608) (28,556) (48,801) (40,597) (5,185)

STANDARDIZED MEASURE

NET CASH FLOWS $ 10,088 $ 6,051 $ 8,983 $ 25,122 $ 12,121 $ 16,837 $ 4,099 $ 7,641 $ 40,698 $ 65,820 $ 23,438 $ 3,097

AT DECEMBER 31, 2005

Future cash infl ows

from production $ 50,771 $ 29,422 $ 50,039 $ 130,232 $ 101,912 $ 73,612 $ 32,538 $ 44,680 $ 252,742 $ 382,974 $ 97,707 $ 20,616

Future production costs (15,719) (5,758) (12,767) (34,244) (11,366) (12,459) (18,260) (11,908) (53,993) (88,237) (7,399) (2,101)

Future devel. costs (2,274) (2,467) (873) (5,614) (8,197) (5,840) (1,730) (2,439) (18,206) (23,820) (5,996) (762)

Future income taxes (11,092) (7,173) (12,317) (30,582) (50,894) (21,509) (5,709) (13,917) (92,029) (122,611) (23,818) (6,036)

Undiscounted future

net cash fl ows 21,686 14,024 24,082 59,792 31,455 33,804 6,839 16,416 88,514 148,306 60,494 11,717

10 percent midyear annual

discount for timing of

estimated cash fl ows (10,947) (4,520) (10,838) (26,305) (14,881) (14,929) (2,269) (5,635) (37,714) (64,019) (37,674) (7,768)

STANDARDIZED MEASURE

NET CASH FLOWS $ 10,739 $ 9,504 $ 13,244 $ 33,487 $ 16,574 $ 18,875 $ 4,570 $ 10,781 $ 50,800 $ 84,287 $ 22,820 $ 3,949

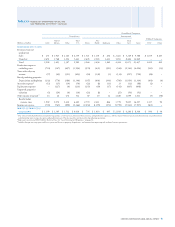

AT DECEMBER 31, 2004

Future cash infl ows

from production $ 32,793 $ 19,043 $ 28,676 $ 80,512 $ 64,628 $ 35,960 $ 25,313 $ 30,061 $ 155,962 $ 236,474 $ 61,875 $ 12,769

Future production costs (11,245) (3,840) (7,343) (22,428) (10,662) (8,604) (12,830) (7,884) (39,980) (62,408) (7,322) (3,734)

Future devel. costs (1,731) (2,389) (667) (4,787) (6,355) (2,531) (717) (1,593) (11,196) (15,983) (5,366) (407)

Future income taxes (6,706) (4,336) (6,991) (18,033) (29,519) (9,731) (5,354) (9,914) (54,518) (72,551) (13,895) (2,934)

Undiscounted future

net cash fl ows 13,111 8,478 13,675 35,264 18,092 15,094 6,412 10,670 50,268 85,532 35,292 5,694

10 percent midyear annual

discount for timing of

estimated cash fl ows (6,656) (2,715) (6,110) (15,481) (9,035) (6,966) (2,465) (3,451) (21,917) (37,398) (22,249) (3,817)

STANDARDIZED MEASURE

NET CASH FLOWS $ 6,455 $ 5,763 $ 7,565 $ 19,783 $ 9,057 $ 8,128 $ 3,947 $ 7,219 $ 28,351 $ 48,134 $ 13,043 $ 1,877