Chevron 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

38 CHEVRON CORPORATION 2006 ANNUAL REPORT

Pension Obligations In 2006, the company’s pension

plan contributions totaled approximately $450 million.

Approximately $225 million of the total was contributed to

U.S. plans. In 2007, the company estimates total contribu-

tions will be $500 million. Actual amounts are dependent

upon plan-investment results, changes in pension obliga-

tions, regulatory requirements and other economic factors.

Additional funding may be required if investment returns are

insuffi cient to offset increases in plan obligations. Refer also

to the discussion of pension accounting in “Critical Account-

ing Estimates and Assumptions,” beginning on page 44.

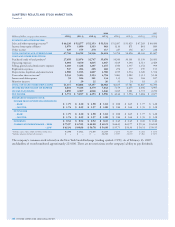

FINANCIAL RATIOS

Financial Ratios

At December 31

2006 2005 2004

Current Ratio 1.3 1.4 1.5

Interest Coverage Ratio 53.5 47.5 47.6

Total Debt/Total Debt-Plus-Equity 12.5% 17.0% 19.9%

Current Ratio – current assets divided by current liabili-

ties. The current ratio in all periods was adversely affected by

the fact that Chevron’s inventories are valued on a Last-In-

First-Out basis. At year-end 2006, the book value of inventory

was lower than replacement costs, based on average acquisi-

tion costs during the year, by approximately $6 billion.

Interest Coverage Ratio – income before income tax

expense, plus interest and debt expense and amortization of

capitalized interest, divided by before-tax interest costs. The

interest coverage ratio was higher in 2006 compared with

2005, primarily due to higher before-tax income and lower

average debt balances. The

company’s interest cover-

age ratio was essentially

unchanged between 2005

and 2004.

Debt Ratio – total debt

as a percentage of total debt

plus equity. The decrease

between 2005 and 2006

was due to lower average

debt levels and an increase

in stockholders’ equity.

Although total debt was

slightly higher at the end of

2005 than a year earlier due

to the assumption of debt

associated with the Unocal

acquisition, the debt ratio

declined as a result of higher

stockholders’ equity bal-

ances for retained earnings

and the capital stock that was issued in connection with the

Unocal acquisition.

GUARANTEES, OFF-BALANCE-SHEET

ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS,

AND OTHER CONTINGENCIES

Direct or Indirect Guarantees*

Millions of dollars Commitment Expiration by Period

2008– After

Total 2007 2010 2011 2011

Guarantees of non-

consolidated affi liates or

joint-venture obligations $ 296 $ 21 $ 253 $ 9 $ 13

Guarantees of obligations

of third parties 131 4 113 3 11

Guarantees of Equilon debt

and leases 119 14 38 11 56

* The amounts exclude indemnifi cations of contingencies associated with the sale of the

company’s interest in Equilon and Motiva in 2002, as discussed in the “Indemnifi cations”

section on page 39.

At December 31, 2006, the company and its subsid-

iaries provided guarantees, either directly or indirectly, of

$296 million for notes and other contractual obligations of

affi liated companies and $131 million for third parties, as

described by major category below. There are no amounts

being carried as liabilities for the company’s obligations

under these guarantees.

The $296 million in guarantees provided to affi liates

related to borrowings for capital projects. These guarantees

were undertaken to achieve lower interest rates and generally

cover the construction periods of the capital projects. Included

in these amounts are the company’s guarantees of $214 mil-

lion associated with a construction completion guarantee for

the debt fi nancing of the company’s equity interest in the

BTC crude oil pipeline project. Substantially all of the $296

million guaranteed will expire between 2007 and 2011, with

the remaining expiring by the end of 2015. Under the terms

of the guarantees, the company would be required to fulfi ll

the guarantee should an affi liate be in default of its loan

terms, generally for the full amounts disclosed.

The $131 million in guarantees provided on behalf of

third parties relate to construction loans to governments of

certain of the company’s international upstream operations.

Substantially all of the $131 million in guarantees expire by

2011, with the remainder expiring by 2015. The company

would be required to perform under the terms of the guar-

antees should an entity be in default of its loan or contract

terms, generally for the full amounts disclosed.

At December 31, 2006, Chevron also had outstanding

guarantees for about $120 million of Equilon debt and leases.

Following the February 2002 disposition of its interest in

Equilon, the company received an indemnifi cation from Shell

for any claims arising from the guarantees. The company has

'%'

(''%'

)'%'

-'%'

/'%'

+'%'

'

,'

+'

*'

)'

('

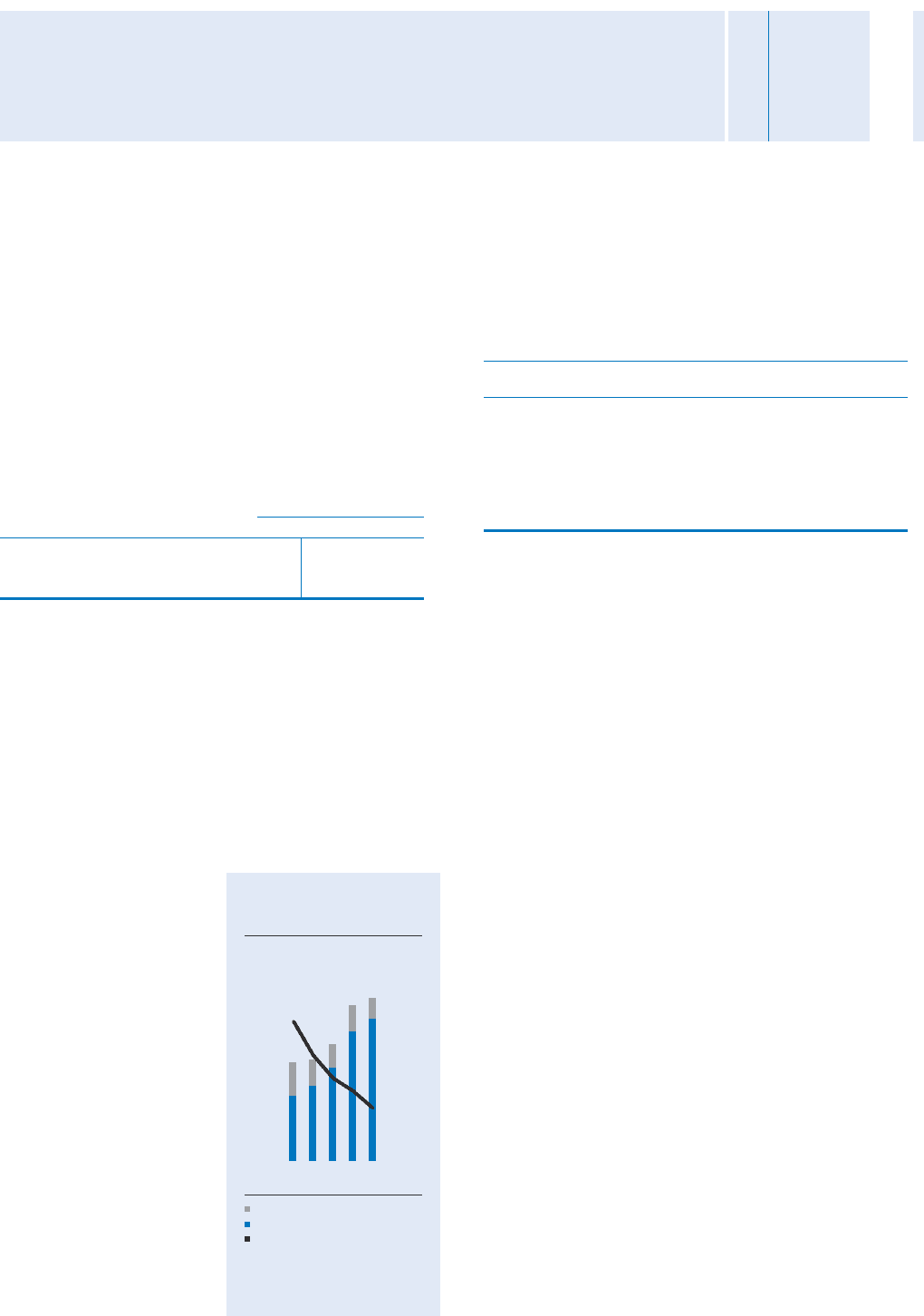

KFK8C;<9KKFKFK8C

;<9K$GCLJ$<HL@KPI8K@F

9`cc`fejf][fccXij&G\iZ\ek

;\Ykc\]kjZXc\

JkfZb_fc[\ijË<hl`kpc\]kjZXc\

IXk`fi`^_kjZXc\

:_\mifeËjiXk`ff]kfkXc[\YkkfkfkXc

[\Yk$gclj$\hl`kp]\cckf()%,g\iZ\ek

Xkp\Xi$\e[[l\kfcfn\i[\YkXe[

_`^_\ijkfZb_fc[\ijË\hl`kp%

'*') '+ ', '-

./%/